JPMorgan Global Convertibles Income Fund (LON:JGCI) is the only UK-listed closed-end fund focusing on convertible bonds. While its primary aim is to provide investors with an income, the fund has recently moved to a more total return-orientated approach to meeting its objective, taking advantage of attractive risk/reward opportunities in the balanced segment of the market.

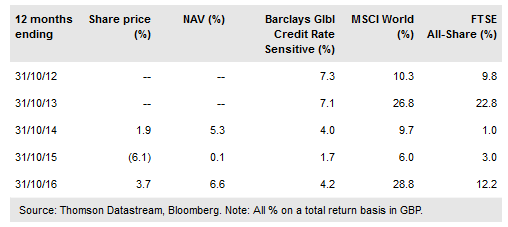

Although fundamentally a bond portfolio, the equity participation offered by convertibles could prove defensive for JGCI investors if the recent fixed income sell-off becomes protracted. The NAV performance of the sterling-hedged fund has been steady while funds with unhedged overseas portfolios have seen material gains post-Brexit; JGCI’s managers note that currency volatility is a two-edged sword.

Investment strategy: Globally diversified approach

JGCI aims to generate income for investors, with potential for some capital appreciation, by investing in the bond-like to balanced segments of the global convertible bond market (see diagram, Exhibit 2).

The fund is run by the convertible bond team at J.P. Morgan Asset Management, led by Antony Vallée, which manages more than $4bn of assets invested across the convertibles universe. The team combines strategic market views with bottom-up security analysis to build a portfolio diversified by geography, industry sector and issuer size.

To read the entire report Please click on the pdf File Below