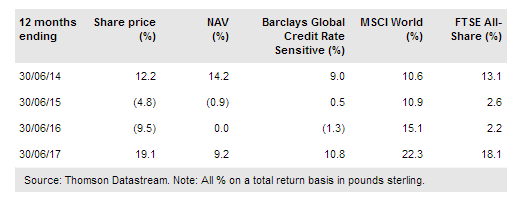

JPMorgan 's (NYSE:JPM) Global Convertibles Income Fund (LON:JGCI) is the only UK-listed closed-end fund specializing in convertible bonds, aiming to generate income along with the possibility of capital growth. Increased investment flexibility granted to the managers in late 2015 means the fund can now invest more in the balanced to equity-like segments of the convertible bond market. NAV performance since launch in 2013 has been fairly steady, in spite of an environment of falling yields and tighter spreads on high-yield bonds. However, share price performance has been volatile at times, so the board has introduced a new discount control policy and has stepped up the pace of share buybacks. There has been a recovery in the share price since the policy was put in place in May 2017, yet JGCI still offers an attractive yield of 4.5%.

Investment strategy: Income-tilted convertibles fund

JGCI is managed by J.P. Morgan Asset Management’s dedicated convertible bonds team, who run a range of mandates and thus have broad coverage of the whole convertible bond market. The fund invests mainly in the bond-like and balanced parts of the market (see Exhibit 2). Security selection is largely bottom-up, but the process also allows for an assessment of industry dynamics and more top-down factors such as economic strength. The portfolio is diversified by geography, sector, credit quality and issuer size, and is currently spread across c 80 issuers. Gearing may be used tactically, and currency exposure is hedged back to sterling.

To read the entire report Please click on the pdf File Below: