Strong year so far, ready for next phase

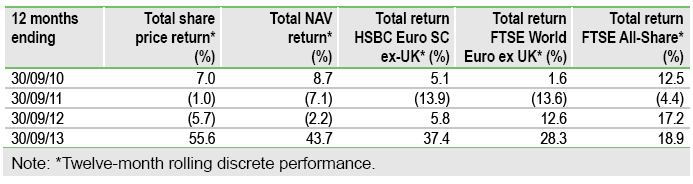

JPMorgan European Smaller Companies Trust, (JESC.L) invests in small-cap Continental European equities. Within the portfolio there are four investment themes: secular growth, quality financials, cyclically sensitive stocks and restructuring plays. A combination of screening and stock picking based on fundamental research and the managers’ substantial combined experience have allowed the trust to outperform its benchmark over one, three, five and 10 years, to the end of August.

Investment strategy: Awaiting next trend

JESC invests in small-cap Continental European equities, primarily in the €100m-2.5bn range. The two fund managers, Jim Campbell and Francesco Conte, have worked together for over 15 years and apply their knowledge and judgement aided by a proprietary screening tool developed by JPMorgan Asset Management. Although the portfolio is not constrained in terms of sector or country exposure, the NAV correlation with the fund benchmark has been relatively high and the tracking error low so, based on past performance, the fund provides reasonably representative exposure to the European small-cap universe. The managers have been increasing the cyclical exposure of the portfolio, but have recently reduced gearing from 15% to 3%, waiting for new market trends to emerge before re-gearing.

Sector outlook: Sentiment improving

While European economic growth remains lacklustre, the European equity market and small-cap stocks within it have enjoyed a strong period (the trust’s benchmark is up 27% year to date). Nevertheless, valuation metrics do not appear obviously stretched compared with long-term averages or the world average. There has also been a definite improvement in collected sentiment surveys in Europe, pointing to the potential for a gradual improvement in the economic background. This raises the possibility of further expansion of multiples and eventual positive earnings surprises. JESC seeks high quality stocks and has a broadly neutral sensitivity to market movements, with a beta close to 1.0, allowing investors to benefit from such an improving scenario through an actively managed portfolio.

Valuation: Narrower discount warranted

The current ex-income discount of 10.5% is below the three-year average of c 15%. Improved sentiment towards Europe and the trust’s performance have probably acted as catalysts and underpin the move.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

JPMorgan European Smaller Comp: Sentiment Improving

Published 10/10/2013, 07:42 AM

JPMorgan European Smaller Comp: Sentiment Improving

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.