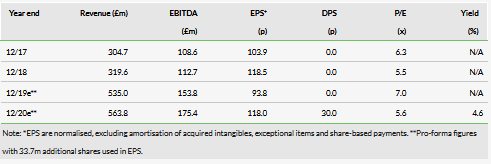

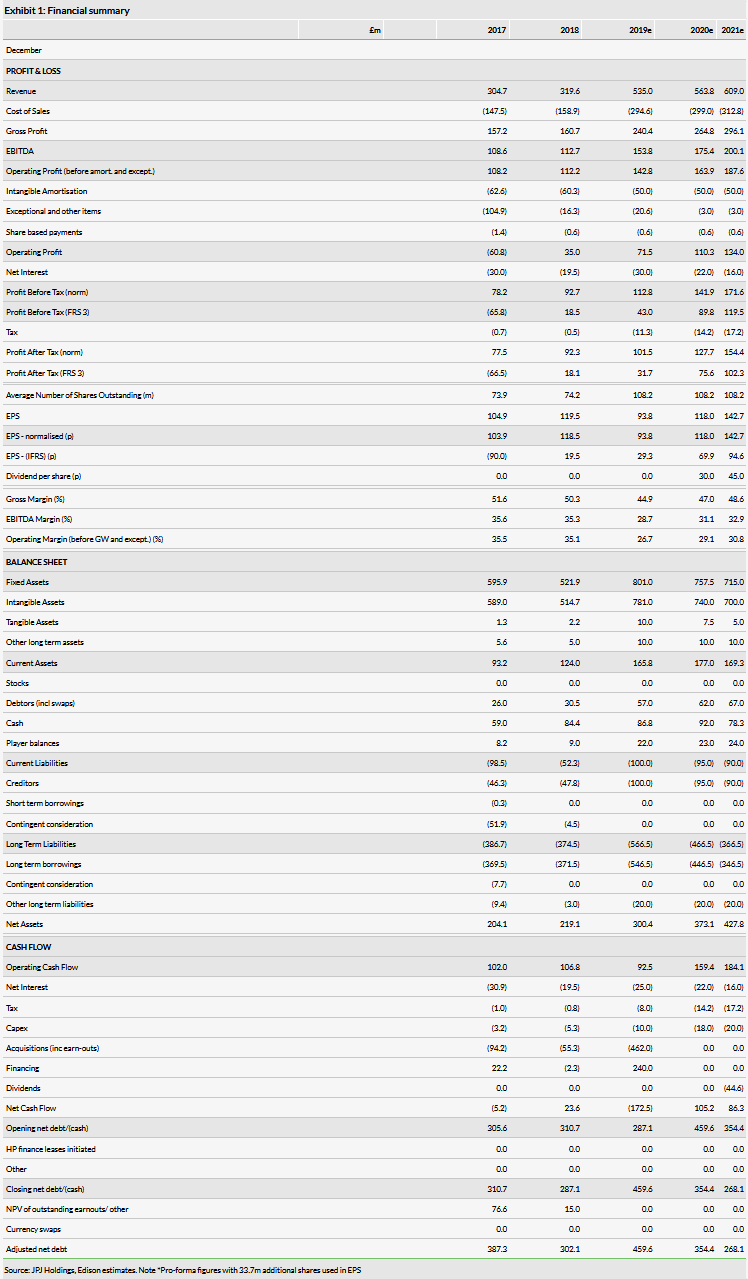

Jackpotjoy PLC (LON:JPJ) standalone H119 revenues increased by 14% to £169.5m, with an adjusted EBITDA of £54.0m. Including Gamesys, pro-forma H119 revenues were £265.6m. This was above our expectations due to another exceptional performance in the Vera&John division, which grew revenues by 58%. As expected, the UK (both JPJ and Gamesys) and Sweden continue to suffer the impact of rising taxes and restrictive regulations. The Gamesys acquisition is due for completion in Q319 and we raise our FY19 pro-forma forecasts by c 3%. Our FY20 and FY21 forecasts remain broadly unchanged. JPJ trades at 7.0x EV/EBITDA and 5.6x P/E for FY20, at the low end of the peer group.

Stand out performance from Vera&John

JPJ reported a 14% increase in standalone H119 revenues to £169.5m with an EBITDA of £54.0m. This was above our forecasts, due to an exceptional 58% revenue growth in Vera&John (42% of standalone revenues). During H119, international revenues comprised 53% of JPJ’s standalone revenues. As a result of higher than expected Vera&John growth, we are raising our standalone JPJ forecasts by c 5% and our pro-forma FY19 forecasts by c 3% (pro-forma includes a full year of Gamesys). Our FY20 and FY21 figures remain broadly unchanged and although we believe there could be upside to our international forecasts, we note that grey markets (particularly Japan) are far more lumpy and volatile.

UK trading in line; Gamesys completion in Q319

As expected, the Jackpotjoy division (mostly UK) declined by 6% in H119, largely due to enhanced responsible gambling measures and the impact of rising gaming taxes. As discussed previously, management continues to expect the negative impact of regulation to be lapped in H219 and we leave our UK forecasts broadly unchanged. Gamesys reported an 8% increase in revenues to £96.1m for H119, with an EBITDA margin of 30.8%, which is in line with our forecasts. Completion of the acquisition is expected in Q319 – please see our June 2019 update.

Valuation: 5.6x P/E for FY20e

At H119, adjusted net debt was £269.9m, which equates to 2.5x net debt/EBITDA. Including the Gamesys acquisition, pro-forma net debt would be £519.1m and we forecast 3.0x net debt/ EBITDA for FY19 and 2.0x at FY20 for the enlarged group. Based on our pro-forma forecasts, JPJ trades at 7.0x EV/EBITDA and 5.6x P/E for FY20. This remains at the lower end of the peer group and, as the company rapidly deleverages, we expect value to shift from debt to equity.

Business description

JPJ Group is a leading online gaming operator mainly focused on bingo-led gaming. It has announced the £490m acquisition of Gamesys Group and completion is expected in Q319. The enlarged group will be renamed Gamesys Group.