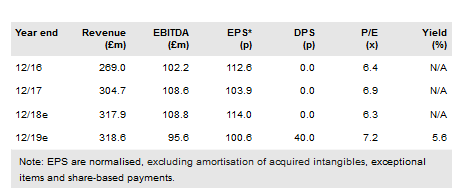

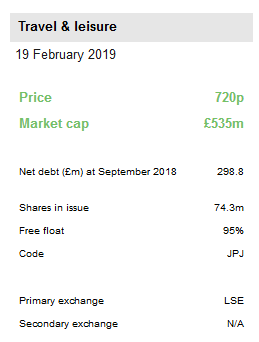

Jackpotjoy PLC (LON:JPJ) has announced a definitive agreement to sell its Mandalay subsidiary to 888 Holdings for £18m cash. During FY18, Mandalay reported revenues of c £11m and PBT of c £3.7m, which represents a deal value of c 5.0x EV/EBITDA. This subsidiary has significantly underperformed the rest of JPJ’s business and was particularly affected by the additional bonus tax in 2017. We therefore believe this asset sale is a net positive and should enable the company to better focus on its market-leading brands. The stock continues to trade at the low end of the peer group, at only 8.7x EV/EBITDA, 7.2x P/E and 11.9% free cash flow yield for FY19e.

A bonus-reliant business

The Mandalay subsidiary comprises a number of online bingo brands, including Costa Bingo, which all operate on 888’s Dragonfish platform. These bingo brands have historically been heavily reliant on bonusing and were particularly affected by the introduction of bonuses into the point of consumption tax in 2017. We note that 2018 revenues of c £11.0m and PBT of c £3.7m were in line with our estimates, but materially below FY17 levels. Our forecasts had assumed a modest decline going forward, although performance was expected to stabilise as the business lapped easier comps in H219. Completion is expected by end Q119, following the conclusion of an employee consultation process. The deal value of £18m equates to c 5.0x EV/EBITDA, with £12m to be paid on completion and £6m by end Q319.

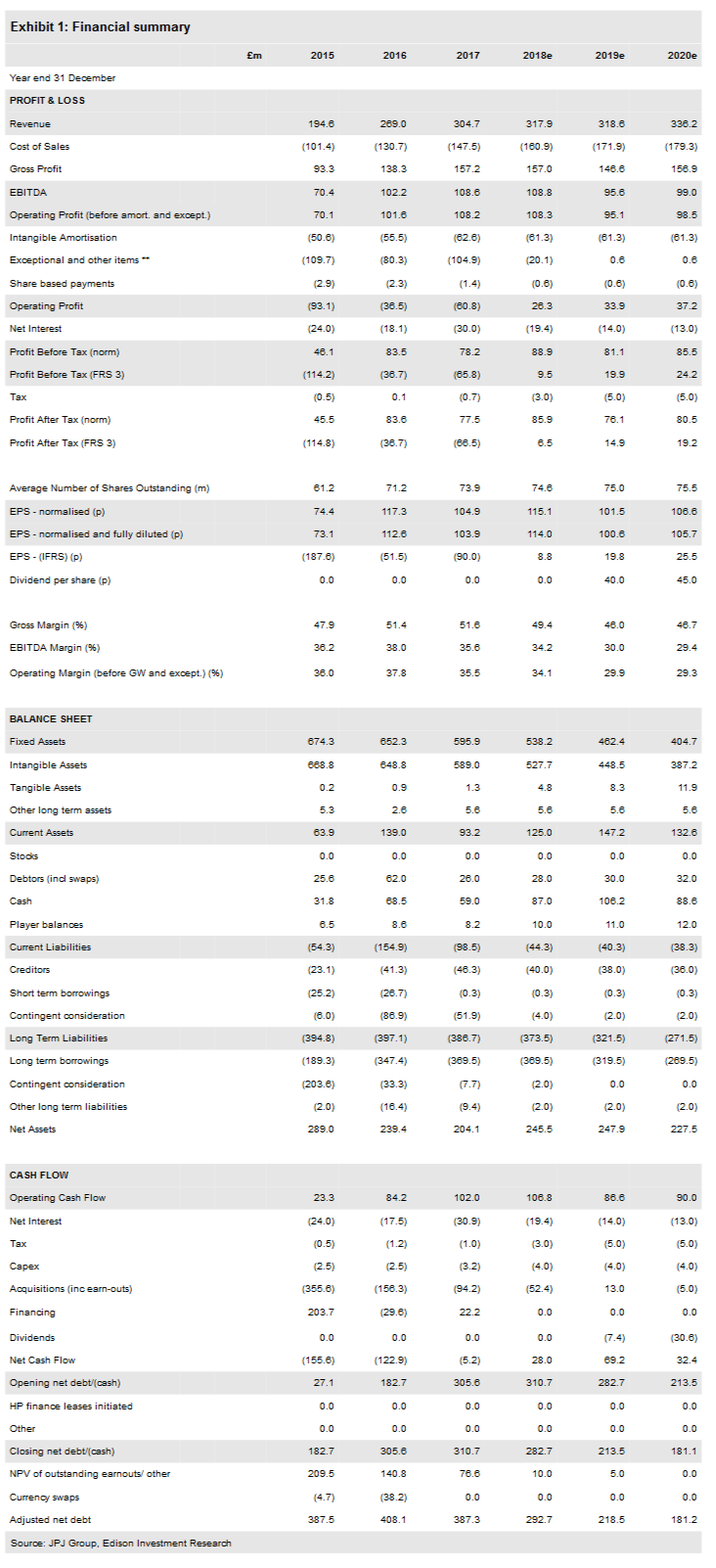

Mandalay equates to c 3.5% of revenues and EBITDA

Mandalay currently represents c 3.5% of total revenues and EBITDA and we have adjusted our forecasts to completely exclude Mandalay from our FY19 estimates. We have also raised our cash balance by £18m, which is helpful for the continued debt reduction programme. Following the pre-close trading update in January, we are also increasing our FY18 revenue and EBITDA forecasts by c 2.5%. The increase is driven by continued positive momentum in the international business and we expect further information at FY18 results in March.

Valuation: 7.2x FY19e P/E

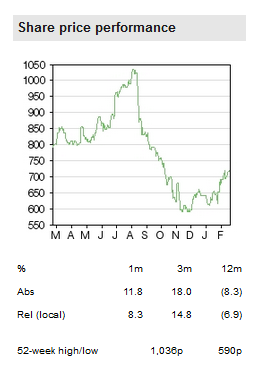

JPJ’s shares fell by c 23% in 2018, but have since rebounded by c 13% ytd, helped by a positive trading statement in January. Nonetheless, the stock still trades at only 8.7x EV/EBITDA, 7.2x P/E and 11.9% FCF yield for FY19e. The business model remains highly cash generative and we expect annual operating cash flow of c £90m. Continual debt reduction should lead to a 2.5x net debt to EBITDA ratio during 2019 (vs 3.0x at Q318).

Business description

JPJ Group plc is a leading online gaming operator mainly focused on bingo-led gaming targeted towards female audiences. At September 2018, 56% of revenues were generated in the UK.