Active small cap European play

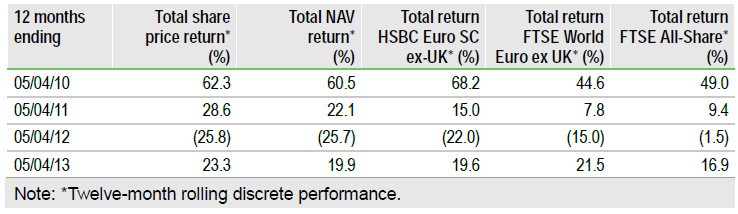

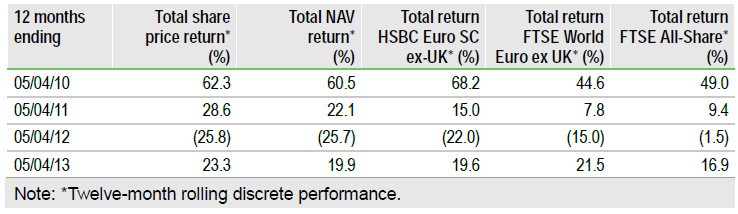

JP Morgan Smaller Companies (JESC) is an investment trust that invests in small cap Continental European equities. Within the portfolio there are three investment themes: secular growth, quality financials and cyclically sensitive stocks. A combination of screening and stock picking based on fundamental research and the managers’ substantial combined experience have allowed the trust to outperform its benchmark over three, five and 10 years, to the end of February.

Investment strategy: Screen and pick

JESC invests in small cap Continental European equities primarily in the €100m-3bn range. The two fund managers, Jim Campbell and Francesco Conte, have worked together for over 15 years and apply their knowledge and judgement aided by a proprietary screening tool developed by JP Morgan Asset Management. Although the portfolio is not constrained in terms of sector or country exposure, the NAV correlation with the fund benchmark has been relatively high and the tracking error low so, based on past performance, the fund provides reasonably representative exposure to the European small cap universe. The managers currently have three growth themes running through the portfolio: secular growth companies, quality financials and cyclically sensitive stocks.

Sector outlook: Uncertainty but opportunity

While the macroeconomic background in Continental Europe is lacklustre and events in Cyprus raised further concerns, the relatively modest reaction of markets to the handling of the bailout signals the positive change in expectations since Draghi’s speech last July. Smaller cap stocks would benefit from a gradual improvement in backdrop while the JESC managers continue to find attractive opportunities for investment within a large and diverse universe. Investors may also be attracted by the potential for a recurrence of the small firm effect, something the experienced managers should be well-placed to capitalise on.

Valuation: Discount modestly below five-year average

The current ex-income discount of 13.0% is modestly below the five-year average of 15.9% and as such is hardly stretched. JESC’s yield of 2.0% is mid-range for all European trusts with the dividend policy being to pay out nearly all revenue. Repetition of previous share buybacks/tenders and/or improved European sentiment could see the discount contract noticeably.

To Read the Entire Report Please Click on the pdf File Below.

JP Morgan Smaller Companies (JESC) is an investment trust that invests in small cap Continental European equities. Within the portfolio there are three investment themes: secular growth, quality financials and cyclically sensitive stocks. A combination of screening and stock picking based on fundamental research and the managers’ substantial combined experience have allowed the trust to outperform its benchmark over three, five and 10 years, to the end of February.

Investment strategy: Screen and pick

JESC invests in small cap Continental European equities primarily in the €100m-3bn range. The two fund managers, Jim Campbell and Francesco Conte, have worked together for over 15 years and apply their knowledge and judgement aided by a proprietary screening tool developed by JP Morgan Asset Management. Although the portfolio is not constrained in terms of sector or country exposure, the NAV correlation with the fund benchmark has been relatively high and the tracking error low so, based on past performance, the fund provides reasonably representative exposure to the European small cap universe. The managers currently have three growth themes running through the portfolio: secular growth companies, quality financials and cyclically sensitive stocks.

Sector outlook: Uncertainty but opportunity

While the macroeconomic background in Continental Europe is lacklustre and events in Cyprus raised further concerns, the relatively modest reaction of markets to the handling of the bailout signals the positive change in expectations since Draghi’s speech last July. Smaller cap stocks would benefit from a gradual improvement in backdrop while the JESC managers continue to find attractive opportunities for investment within a large and diverse universe. Investors may also be attracted by the potential for a recurrence of the small firm effect, something the experienced managers should be well-placed to capitalise on.

Valuation: Discount modestly below five-year average

The current ex-income discount of 13.0% is modestly below the five-year average of 15.9% and as such is hardly stretched. JESC’s yield of 2.0% is mid-range for all European trusts with the dividend policy being to pay out nearly all revenue. Repetition of previous share buybacks/tenders and/or improved European sentiment could see the discount contract noticeably.

To Read the Entire Report Please Click on the pdf File Below.