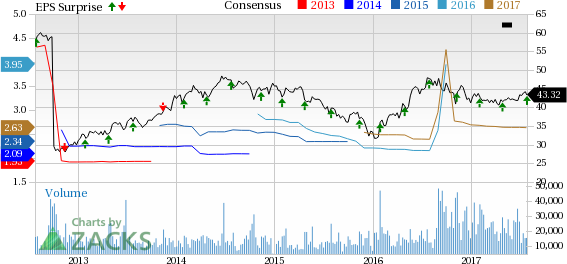

Johnson Controls International plc (NYSE:JCI) posted adjusted earnings of 71 cents per share in third-quarter fiscal 2017 (ended Jun 30, 2017), which came in line with the Zacks Consensus Estimate. Moreover, earnings increased 16% from 61 cents recorded in third-quarter fiscal 2016.

Operational Update

Johnson Controls reported revenues of $7.67 billion, up 1% year over year. Revenues too were almost in line with the Zacks Consensus Estimate.

Cost of sales increased to $7.68 billion from $5.15 billion in the year-ago quarter. Gross profit increased to $2.4 billion from $1.4 billion in the year-ago quarter.

Selling, general and administrative expenses in the fiscal third quarter totaled $1.61 billion, increasing from the prior-year quarter figure of $895 million.

Segment Results

Building Efficiency: This segment’s revenues came in at $6.06 billion, almost unchanged from the year-ago level. Excluding net M&A and foreign currency impact, organic sales increased 2%, driven by growth in field businesses product sales.

Quarter-end backlog increased 3% year over year. Orders, excluding M&A and adjusted for foreign exchange were up 1% year over year, led by an increase in product orders.

Segment EBITA rose 7% year over year to $908 million.

Power Solutions: Revenues at the Power Solutions segment increased 6% to $1.61 billion. Excluding the impact of foreign exchange and higher lead pass-through costs, organic sales declined 2%. Segment EBITA came in at $304 million, reflecting an increase of 8% from the year-ago quarter on favorable product mix, as well as productivity savings, partly offset by lower volumes.

Financial Position

Johnson Controls had cash and cash equivalents of $458 million as of Jun 30, 2017, reflecting a decline from $579 million as of Sep 30, 2016. Long-term debt escalated to $11.8 billion in the quarter from $11.1 billion as of Sep 30, 2016.

During the quarter, the company repurchased 7.3 million shares for $307 million. Johnson Controls now expects to complete $650–$750 million of share repurchases during fiscal 2017.

Guidance

Johnson Controls guided fourth quarter 2017 adjusted EPS from continuing operations in the range of 86–88 cents, an increase of 13–16% year-over-year.

Zacks Rank & Key Picks

Johnson Controls currently carries a Zacks Rank #4 (Sell).

Some better-ranked companies from the same space are Allison Transmission Holdings (NYSE:ALSN) , Volkswagen (DE:VOWG_p) AG (OTC:VLKAY) and Daimler AG (OTC:DDAIF) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Allison Transmission has expected long-term growth rate of 11%.

Volkswagen has expected growth rate of around 17.3% over the long term.

Daimler has expected long-term growth rate of 2.8%.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Daimler AG (DDAIF): Free Stock Analysis Report

Volkswagen AG (VLKAY): Free Stock Analysis Report

Johnson Controls International PLC (JCI): Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN): Free Stock Analysis Report

Original post

Zacks Investment Research