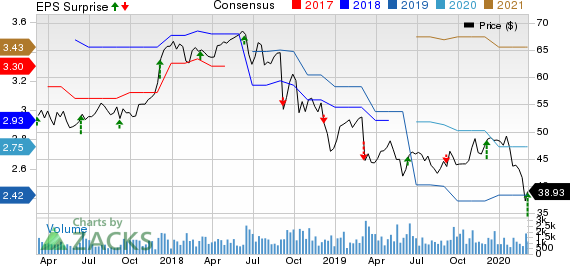

Shares of John Wiley & Sons, Inc. JW.A jumped 5.4% on Mar 4, as it posted solid third-quarter fiscal 2020 results, with the top and the bottom line rising year over year. Moreover, earnings comfortably beat the Zacks Consensus Estimate. Further, management raised adjusted earnings per share (EPS) guidance for fiscal 2020.

Q3 in Detail

John Wiley’s adjusted earnings of 68 cents per share rose 11.5% year over year. Also, at constant-currency (cc) the metric increased by 10%. The upside can be attributable to reduced effective tax rate. Moreover, the bottom line surpassed the Zacks Consensus Estimate of 52 cents.

Revenues of $467.1 million advanced 4% year over year (also at cc), The Zacks Consensus Estimate was pegged at $467.2 million. Strength in the Research Publishing & Platforms, Education Services and Academic & Professional Learning division fueled the top line. Excluding the impact of acquisitions, organic revenues rose 2% at cc in the quarter.

Adjusted operating income increased 4% year over year to $51.8 million, owing to growth in revenues. Adjusted EBITDA rose 6% (7% at cc) to $95.5 million.

Segmental Details

The Research Publishing & Platforms segment consists of Research Publishing and Research Platforms businesses. In the third quarter, revenues rose 3% year over year (also at cc) to $233.6 million on higher open access publishing volumes. Research Publishing grew 2% and Research Platforms increased 12%. The segment’s adjusted contribution to profit rose 5% at cc.

The Academic & Professional Learning segment includes the Education Publishing and Professional Learning businesses. Revenues in the segment inched up 1% on a reported basis and 2% at cc to $178.3 million on the back of higher contribution from zyBooks and Knewton acquisitions as well as humble organic growth in Higher Education publishing. Further, excluding contributions from the acquisitions of zyBooks and Knewton, organic revenues declined 2% at cc. Adjusted contribution to profit slumped 18% at cc during the quarter under review.

The Education Services revenues segment increased 20% on a reported basis and 19% at cc to $55.3 million. The upside was backed by gains from mthree buyout as well as a 10% rise in organic revenues. Also, adjusted contribution to profit from the segment rallied 30% at cc in the quarter.

Other Financial Update

John Wiley ended the quarter with cash and cash equivalents of $117.4 million, long-term debt of $789.6 million and total shareholders’ equity of $1,197.2 million.

The company generated $88.9 million of cash from operating activities in the nine months ended

Jan 31, 2020. Further, it provided free cash flow (net of Product Development Spending) of nearly $5 million year to date. For fiscal 2020, the company still anticipates free cash flow in the range of $210-$230 million.

During the third quarter, John Wiley bought back 205,370 shares for $10 million and paid out cash dividends of $19 million.

Guidance

Management raised its adjusted EPS guidance to $2.45-$2.55. The company had earlier envisioned the metric in the rage of $2.35-$2.45. Further, management reiterated fiscal 2020 view for revenues and EBITDA. The company anticipates revenues for fiscal 2020 in the range of $1,855-$1,885 million. John Wiley still expects adjusted EBITDA in the band of $357-$372 million.

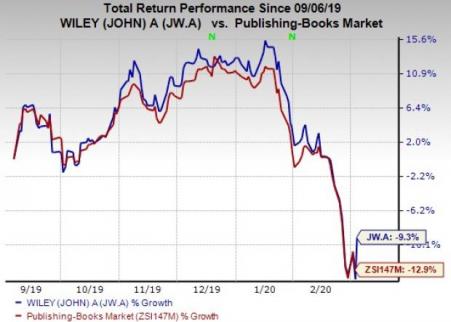

Price Performance & Zacks Rank

We note that this Zacks Rank #3 (Hold) stock has dropped 9.3% in the past six months compared with the industry’s decline of 12.9%.

Don’t Miss These Solid Consumer Staple Bets

Lamb Weston (NYSE:LW) , with a Zacks Rank #2 (Buy), has long-term EPS growth rate of 8.8%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Hershey Company (NYSE:HSY) , which carries a Zacks Rank #2, has a long-term earnings growth rate of 7.7%.

e.l.f. Beauty Inc. (NYSE:ELF) , which carries a Zacks Rank #2, has a long-term earnings growth rate of 3.8%.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our latest Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

See 5 Stocks Set to Double>>

Hershey Company (The) (HSY): Free Stock Analysis Report

John Wiley & Sons, Inc. (JW.A): Free Stock Analysis Report

e.l.f. Beauty Inc. (ELF): Free Stock Analysis Report

Lamb Weston Holdings Inc. (LW): Free Stock Analysis Report

Original post

Zacks Investment Research