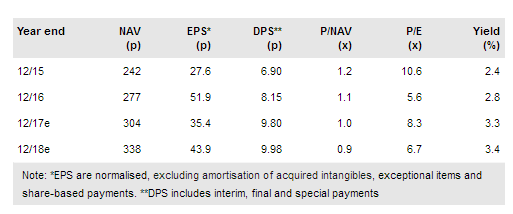

John Laing Group Plc (LON:JLG) has an established and impressive track record of growth and is well paced to benefit from the strong market that exists for global infrastructure and renewable energy investment. We believe it can deliver a CAGR of 11.1% in NAV per share and 5.2% in DPS in 2016-21e. The combination of NAV per share and DPS growth should continue to provide attractive returns for shareholders and further close the valuation gap to its peers.

H117 results extend JLG’s record of growth

In the period 2011-16 JLG achieved a c 17% CAGR in total portfolio value and a c 20% CAGR in the NAV (13.1% CAGR in NAV per share in 2014-16). H117 results show that the NAV per share increased by a further 2.3% (to 284p/share) in the first six months of the year, despite a £25.5m (c 7p/share) reduction in the carrying value of its investment in the Manchester Waste project and the payment of last year’s final and special dividends (£23.1m, c 6p/share). The interim DPS was increased by 3% (vs H116) and further increases over time should be sustained by a growing cash yield on an expanding secondary portfolio.

To read the entire report Please click on the pdf File Below: