Looking back, the Federal Reserve believed the decline in oil prices was good for the economy - and would provide a stimulus as consumers could spend the money saved on lower oil prices on other items.

Follow up:

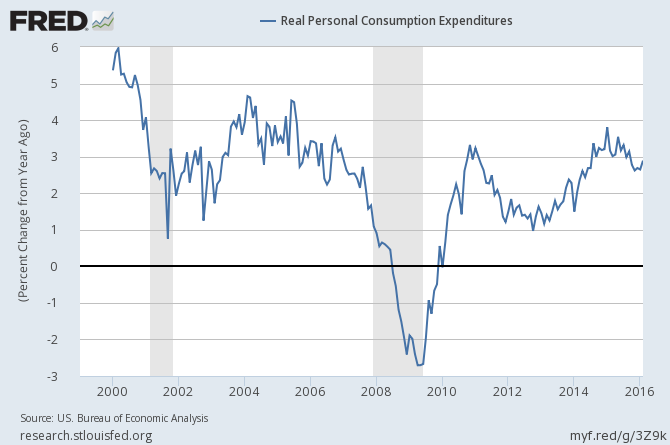

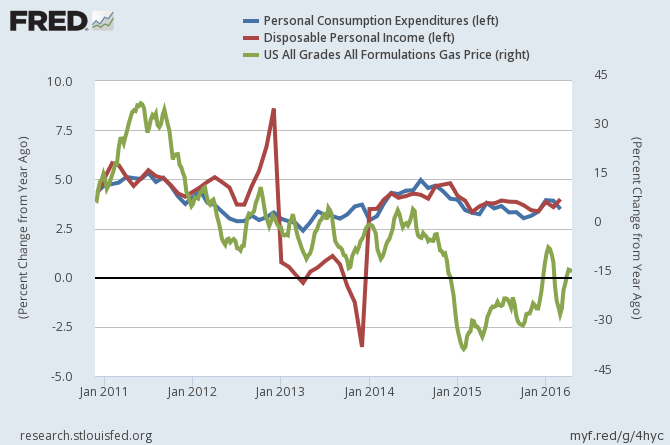

A quick look shows the rate of consumption growth has declined from its peak in January 2015. Lower oil prices did not seem to lift consumption.

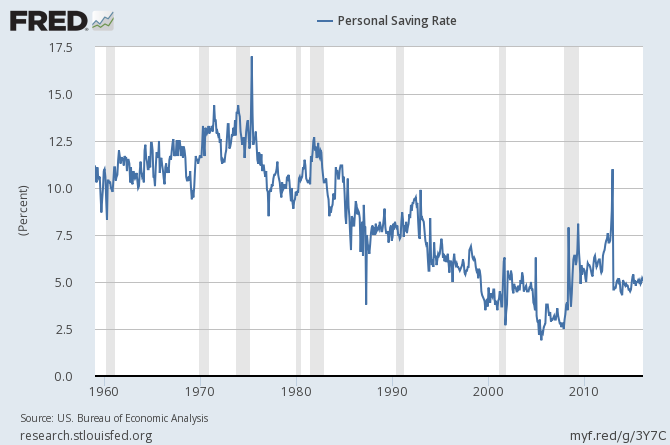

And the personal savings rate, peaked at the end of 2012 - has been in a very tight range since January 2013. Any savings from lower fuel costs did not migrate into savings (money banked or debt reduced).

Energy prices at times positively correlates to expenditures, at times negatively correlates - but most of the time it does its own thing.

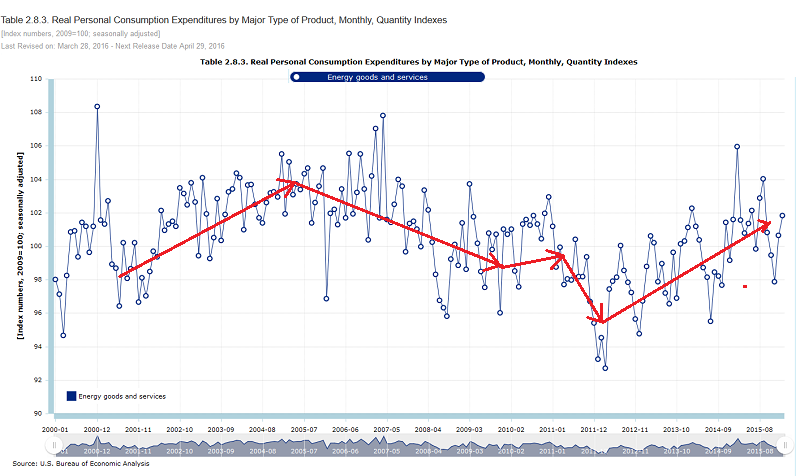

What I found interesting is that consumers are currently spending more on energy related items than they did before the recent decline in energy prices.

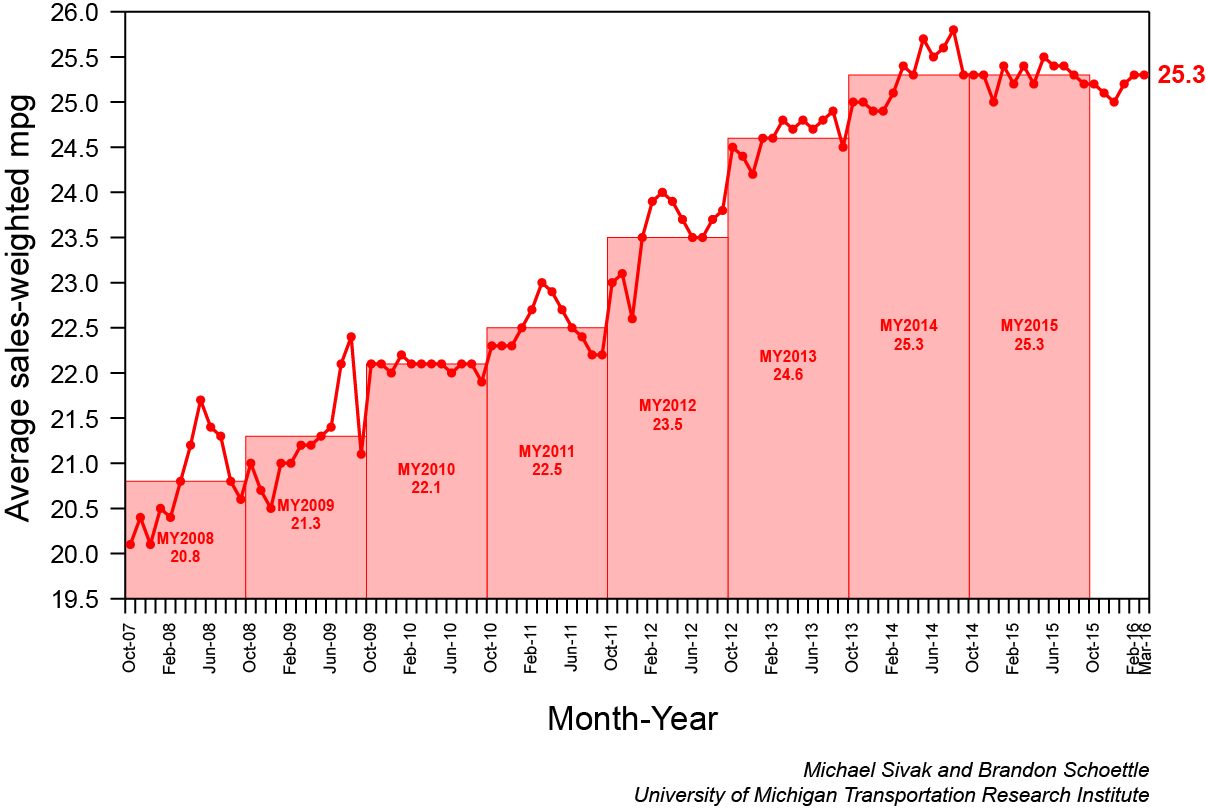

Increased consumer spending since the beginning of 2015 came from durable goods - and to a large extent from the auto sector. The consumer seems have invested the fuel savings on gas guzzling beasts. [graphic below from University of Michigan]

And consumers started driving more. The graph below is population adjusted miles driven.

Still, over time - the real correlation for expenditures is to income. People eventually spend all they make. If you measure an economy by how much it spends (GDP) - why would anyone believe lower prices for anything could provide an economic boost. Said Yellen at a press conference at a press conference on 17 December 2015:

From the standpoint of the U.S. and U.S. outlook, the decline we've seen in oil prices is likely to be, on net, a positive ... It's good for families, for households. It's putting more money in their pockets.

GDP is far from a perfect tool to measure the economy, and does not attempt to measure the economic health of its median citizen.

Consider during the periods of lower gasoline prices, consumers began to spend more than they made. Did lower fuel prices make families feel richer? Is this a coincidence or just another economic law not understood?

Other Economic News this Week:

The Econintersect Economic Index for April 2016 again insignificantly improved but remains relatively weak. The index continues near one of the lowest values since the end of the Great Recession. This marginal index improvement is due to data being compared against relatively soft data - both month-over-month and year-over-year. Our employment six month forecast is for slightly weaker employment growth for April - and the long term decline in the employment forecast remains in play.

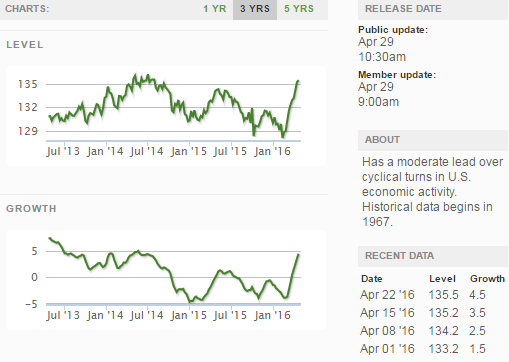

Economic Cycle Research Institute (ECRI) Weekly Leading Index (WLI) Growth Index is now in positive territory and forecasting a marginally strengthening economy six months from now.

Current ECRI WLI Growth Index

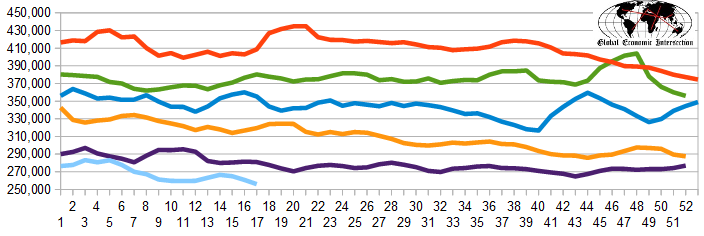

The market expectations for weekly initial unemployment claims (from Bloomberg) were 240,000 to 264,000 (consensus 260,000), and the Department of Labor reported 257,000 new claims. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 260,750 (reported last week as 260,500) to 256,000. The rolling averages generally have been equal to or under 300,000 since August 2014.

Weekly Initial Unemployment Claims - 4 Week Average - Seasonally Adjusted - 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line), 2015 (violet line)

Bankruptcies this Week: Goodrich Petroleum, SunEdison (fka MEMC Electronic Materials), Sao Paulo, Brazil-based Lupatech (f/k/a Valmicro Industria e Comercio de Valvulas - Chapter 15).

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: