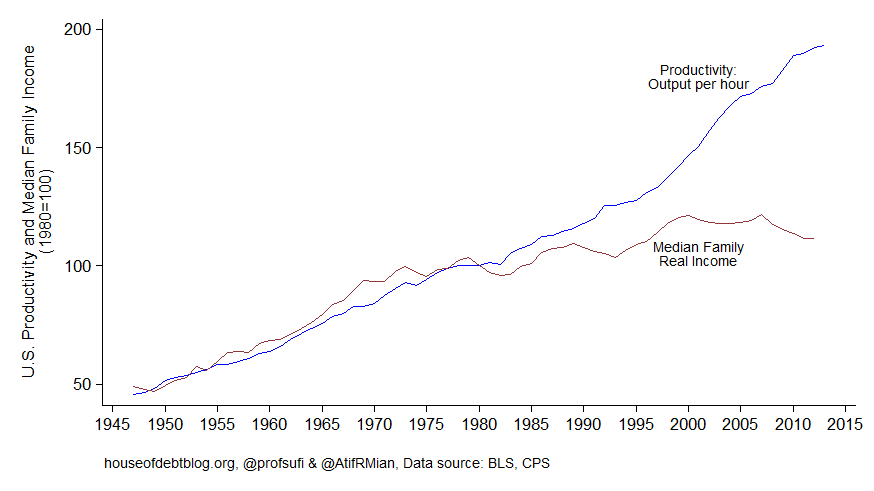

Recent posts have shown that productivity gains are not being reflected in Joe Sixpack's paycheck.

Follow up:

The proof of this is shown in charts and statements such as the following:

So where are all of the gains in productivity going? Two places:

First, owners of capital are getting a bigger share of GDP than before. In other words, the share of profits has risen faster than wages. Second, the highest paid workers are getting a bigger share of the wages that go to labor.

The net result is that families at the higher end of the income distribution have received more of the income produced by the economy since the 1980s. The latter fact has been documented meticulously by the brilliant research of Thomas Piketty and Emmanuel Saez.

The widening gap between productivity and median income is a defining issue of our time. It is not just about inequality – important as that issue is. The widening gap between productivity and median income has serious implications for macroeconomic stability and financial crises.

Let us examine how one improves productivity. As an industrial engineer - my definition is changing an input to reduce cost or improve quality of a product or service. These input elements can be:

- finding out how to execute with less capital;

- automating to reduce labor hours;

- changing the process to make it more efficient;

- educating the workforce to work on more sophisticated and productive equipment;

- redesign the product or service;

- relocating manufacture or service center to lower distribution or delivery costs or hours;

- making the workers work faster, or working longer hours to be able to spread fixed costs over more hours to reduce unit costs;

- outsourcing or insourcing;

- increasing or decreasing inventory;

- eliminate work elements which are not cost or quality effective.

You will note that I believe an element that would increase costs leading to a higher quality product (longer life, higher durability, more uses, etc) is a productivity improvement. The current BLS method of determining productivity could never sense this.

Labor productivity is the ratio of the output of goods and services to the labor hours devoted to the production of that output.

Further, I am curious how many of any cost improvements of these productivity elements should be shared with labor. Two extreme and opposing examples:

- A store has invested in automated sales checkout equipment so that the clerks just sit there an watch the customers instead of "ringing up" each item themselves [should clerks be paid more to do less?]

- A machine shop installs the latest computerized milling machines and lathes. Operators now must not only understand machine shop techniques - but now must possess computer skills to boot. [A much higher level of education is required - and the machine shop quality and quantity output has improved.]

What has happened since 1980 is confusing unit hour improvements with productivity improvements. [Note: Prior to 1980 it is likely that the BLS method of determining productivity improvements were correlating better with median worker income - but it does not prove any causation or a direct relationship.]

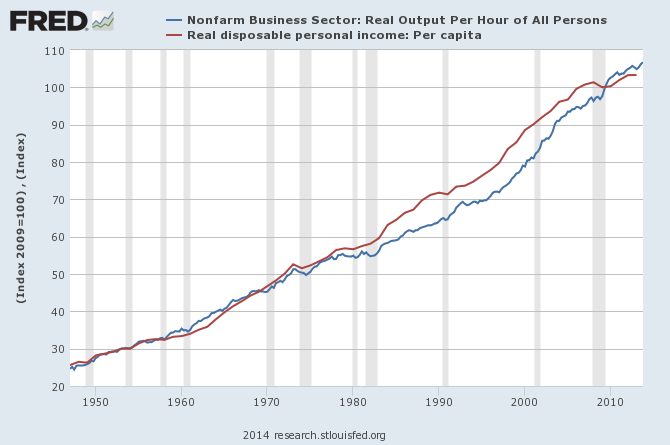

The data series shown in the example began in 1947 - there were no TV's or catalytic converters on cars or shopping centers or highways - or satellites circling the earth. How does one measure productivity improvements when there have been so many product deaths - and so many new products - yet the growth of productivity has been constant. Nonetheless, note on the graph below that indexed productivity and real disposable income has correlated over time.

The cynic that I am is suggesting that the BLS correlates income and productivity in correlating their revision process. Economists believe the two elements should correlate over time - and have made it so.

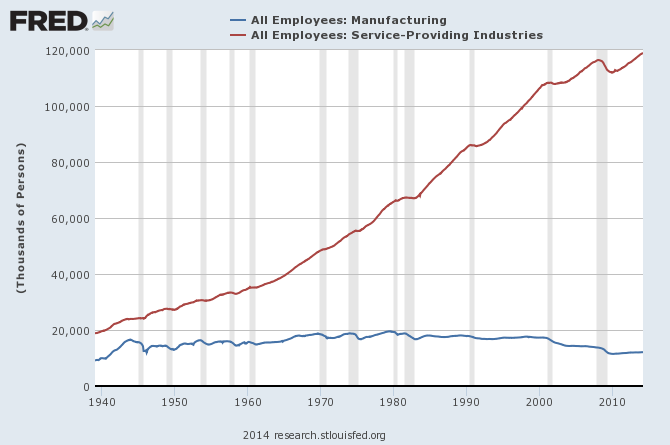

In any event, productivity was spawn from the manufacturing sector - and the USA economy has morphed from industrial to service. It is very hard to measure productivity ACCURATELY in the service sector as the baseline cannot be accurately defined in many service sectors.

My bottom line is that correlation of productivity between periods has been lost over time - and you cannot compare the elements of 1947 to 2014 without a lot of drug and alcohol consumption (and perhaps a return of the Ouija board I used last week). The economy has changed, the world has changed, and our working conditions have changed dramatically.

We are abusing the word productivity - and inferring that "productivity" gains should be shared equally across the economy even if a particular element was not responsible for the gain. HOWEVER, I would guess there likely is a problem with sharing the gains - but you cannot use the BLS output per hour index to "prove" productivity is not being shared properly.

Other Economic News this Week:

The Econintersect Economic Index for April 2014 is again showing an extremely slight growth deceleration - but a growing economy nonetheless. There are a growing number of soft data points we watch outside of our index which bears watching. The economy remains too strong to recess, and too weak to grow.

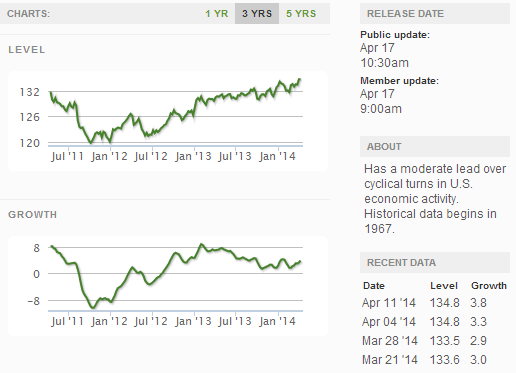

The ECRI WLI growth index value has been weakly in positive territory for many months - but now in a noticeable improvement trend. The index is indicating the economy six month from today will be slightly better than it is today.

Current ECRI WLI Growth Index

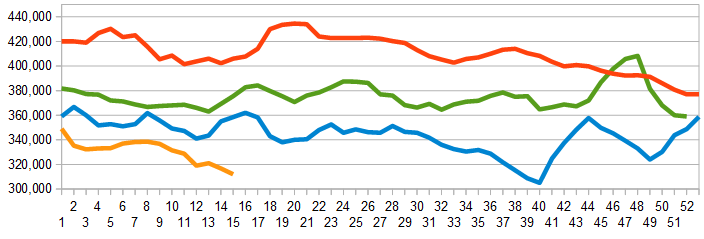

Initial unemployment claims went from 300,000 (reported last week) to 304,000 this week. Historically, claims exceeding 400,000 per week usually occur when employment gains are less than the workforce growth, resulting in an increasing unemployment rate. The real gauge – the 4 week moving average – improved from 316,750 (reported last week as 316,250) to 312,000. Because of the noise (week-to-week movements from abnormal events AND the backward revisions to previous weeks releases), the 4-week average remains the reliable gauge.

Bankruptcies this Week: Momentive Performance Materials (MPM). Beverly Hills Bancorp

Click here to view the scorecard table below with active hyperlinks