There is a busy day of Economic Data ahead, starting with PMIs for european countries and the eurozone as a whole. PMI Data across the euro block has been improving but the consensus is for a slight drop in figures today. The UK Jobs data then follows, with most data points expected to be in line with expectations. However, Claimant Count Change is expected to be lower, and while this data is volatile at the best of times, the January number is particularly so as seasonal workers are released from contracts from the Christmas period. BOE Members will testify in parliament in the afternoon, followed by US PMI data and FOMC minutes this evening. Chinese traders will return from Spring Festival celebrations tomorrow.

The US Treasury auction sold $179B to drive yields to the highest in ten years. US Stock markets slipped lower following the sale, to finish just off the lows.

Eurogroup meetings will take place today and this may impact on moves in EUR crosses.

German Producer Prices Index (MoM) (Jan) was 0.5% v an expected 0.3%, from 0.2% previously. Producer Prices Index (YoY) (Jan) was 2.1%v an expected 1.9%, from 2.3% previously. EUR/USD reached a high of 1.23915 before selling off to 1.23449 after the release of this data.

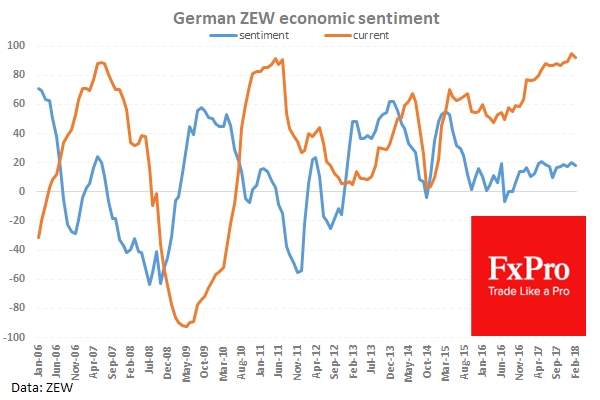

German ZEW Survey – Current Situation (Feb) was 92.3 v an expected 93.9, from a prior 95.2. ZEW Survey – Economic Sentiment (Feb) was 17.8 v an expected 16.0, from 20.4 previously.

Eurozone ZEW Survey – Economic Sentiment (Feb) was released, coming in at 29.3 against an expected 28.4, from 31.8 previously.

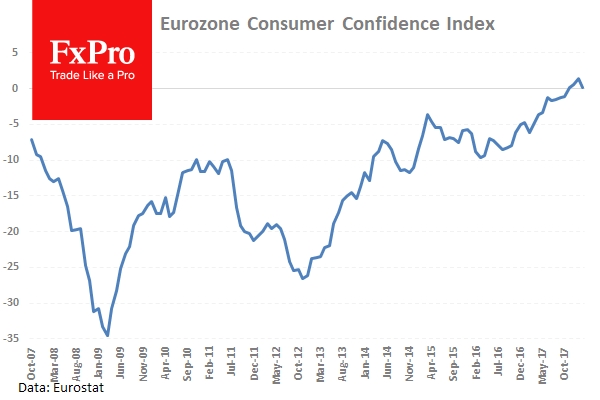

Eurozone Consumer Confidence (Feb) was 0.1 v an expected 1.0, from a previous reading of 1.3. EUR/GBP sold off from a high of 0.88318 to a low of 0.88109 following this data release.

Japanese All Industries Activity Index (MoM) (Dec) was released, as expected, at 0.5%, from 1.0% prior.

EUR/USD is unchanged overnight, trading around 1.23328.

USD/JPY is up 0.37% in early session trading at around 107.724.

GBP/USD is down -0.04% to trade around 1.39880.

AUD/USD is down -0.29% overnight, trading around 0.78582.

Gold is down -0.14% in early morning trading at around $1,327.40.

WTI is down -0.58% this morning, trading around $61.22.

Major data releases for today:

At 08:00 GMT, the ECB’s Non-Monetary Policy meeting will take place and this may impact on moves in EUR crosses.

At 08:15 GMT, Swiss Industrial Production (YoY) (Q4) will be released, with a previous value of 5.5%. Industrial Production (QoQ) (Q4) will also be released, with a previous value of 8.6%. CHF crosses may increase in volatility after this release.

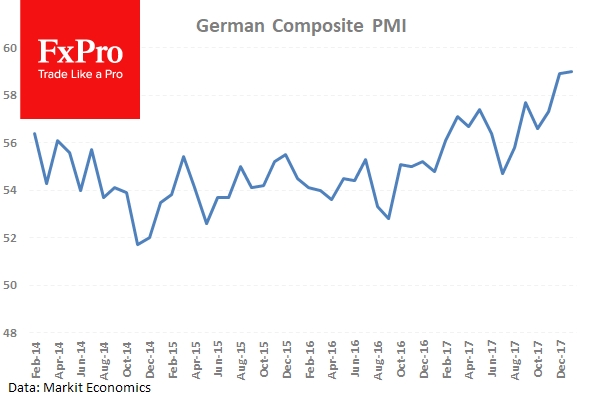

At 08:30 GMT, German Markit Manufacturing PMI (Feb) is expected to come in at 60.6 from 61.1 previously. Markit Services PMI (Feb) is expected at 57.0 v 57.3 previously. Markit PMI Composite (Feb) is expected to be 58.5 from 59.0 prior. EUR traders will be closely following this data release.

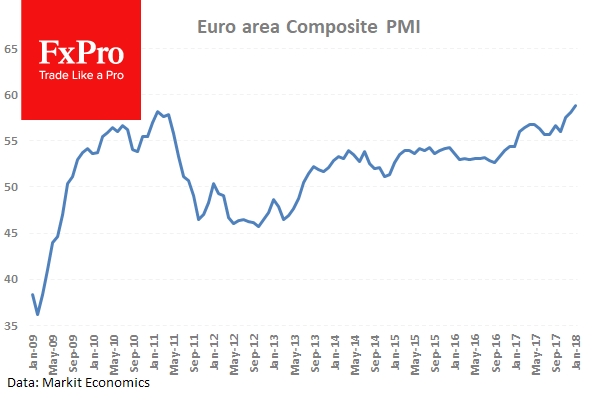

At 09:00 GMT, eurozone Markit Manufacturing PMI (Feb) is expected to come in at 59.3 from 59.6 previously. Markit Services PMI (Feb) is expected at 57.6 v 58.0 previously. Markit PMI Composite (Feb) is expected to be 58.5 from 58.8 prior. EUR crosses could see a spike in volatility should the data released differ from the consensus.

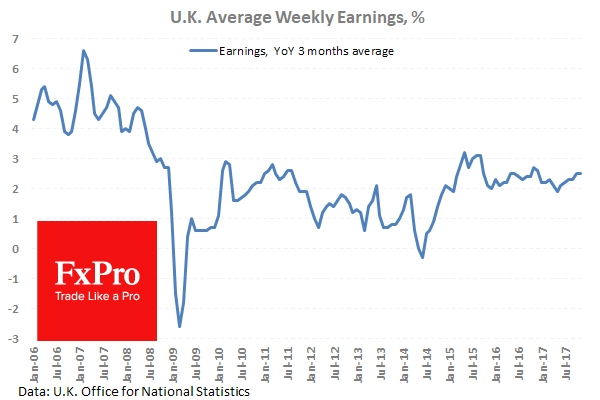

At 09:30 GMT, UK Average Earnings Excluding Bonus (3Mo/Yr) (Dec) is expected unchanged at 2.4%. Claimant Count Change (Jan) is expected at 4.1K from a previous reading of 8.6K. ILO Unemployment Rate (3M) (Dec) is expected to be unchanged at 4.3%. Average Earnings Including Bonus (3Mo/Yr) (Dec) is expected to be unchanged at 2.5%. Claimant Count Rate (Jan) was 2.4% previously. Public Sector Net Borrowing (Jan) is expected to be £-11.100B from £0.979B prior. GBP crosses could be influenced by this data release.

At 14:00 GMT, FOMC Member Harker will speak, with his comments potentially influencing prices in USD and US assets.

At 14:15 GMT, BOE Governor Carney and MPC Members Broadbent, Haldane and Tenreyo will take part in the Parliament’s Treasury Committee Hearings and Inflation Report Hearings. Comments made here may potentially influence prices in GBP crosses.

At 14:45 GMT, US Markit Manufacturing PMI (Feb) is expected to come in at 55.4 from 55.5 previously. Markit Services PMI (Feb) is expected at 54.4 v 53.8 previously. Markit PMI Composite (Feb) is expected to be 54.0 from 53.3 prior. USD crosses may be heavily traded as a result of this data.

At 19:00 GMT, the Federal Open Market Committee Minutes will be published from the last meeting three weeks ago. Traders will look for changes in the text of the previous meeting’s minutes that may point to policy adjustments impacting future interest rates.

At 23:50 GMT, Foreign Investment in Japanese Stocks (Feb 16) is expected to be in the region of the previous number of ¥-429.5B. Foreign Bond Investment (Feb 16) was ¥-973.2B previously. The report is released by the Ministry of Finance, detailing the flows from the public sector, excluding the Bank of Japan. The net data shows the difference of capital inflow and outflow. A positive difference indicates net sales of foreign securities by residents (capital inflow), and a negative difference indicates net purchases of foreign securities by residents (capital outflow).