By Adam Button

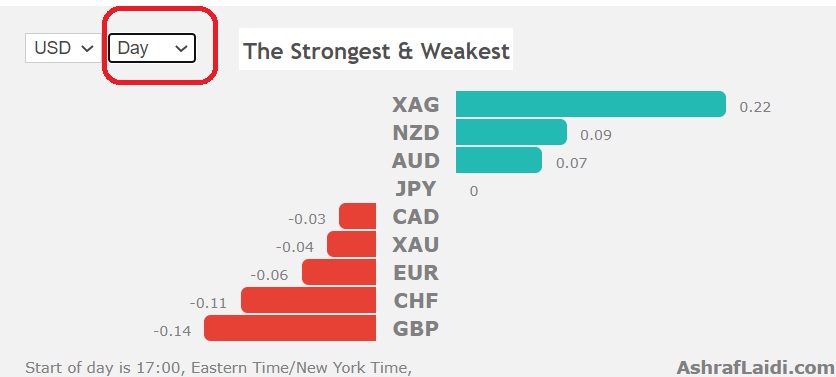

Risk trades initially cheered an unexpectedly strong non-farm payrolls report but the enthusiasm didn't last (More on the dynamics of market reaction below). Strong US data and recovering China PMIs helped affirm the paradigm of stabilizing growth = USD weakness, which was anticipated in yesterday's NFP preview here. XAG/USD, AUD/USD, NZD/USD are leading against the USD, while GBP and CHF lag. The US is on holiday, giving markets a chance to regroup. Monday's long Dow 30 trade hit its 26200 target yesterday for a 670-pt gain, while last week's Premium long in DAX at 12130 has yet to reach its final target of 12770, but we may close it before today's close.

Strong US jobs & Caveats

US June non-farm payrolls roundly beat expectations with 4.8m new jobs added compared to the 3.2m consensus. In addition, the prior two reports were revised modestly higher. Perhaps most impressive was the unemployment rate at 11.1% compared to 12.5% expected.

The caveat that market participants had been watching surrounding that metric was in those absent from work for 'other reasons'. It had swelled recently and would have meant an additional 3 percentage point increase in May. The BLS highlighted that many of those probably belonged in the unemployed category were estimated at up to 3%. This month, they estimated that only 1 pp of them were likely miscategorized.

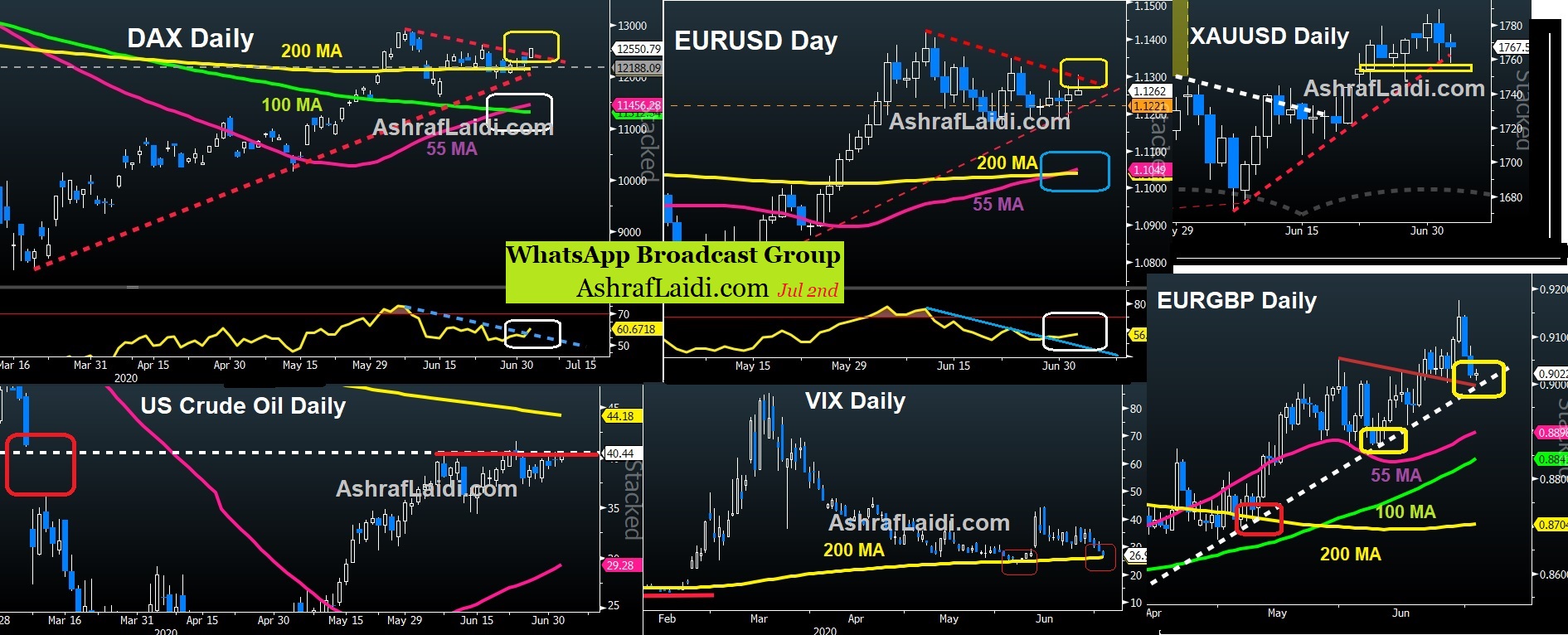

Perhaps more interesting was how the market responded to the data. Initially it was strongly positive for risk assets but that faded, particularly late in the day. The tug-of-war between the virus and reopening continues and it was data from a growing number of problem states that weighed. In particular, 10,109 cases in Florida was a new record an exceed all the daily cases in the EU. The charts below were posted on Ashraf's WhatsApp Broadcast Group after the release of US jobs report, highlighting intermarket backing of tapering risk appetite.

With the US headed out for a holiday on Friday, the market is likely to quiet but case numbers Friday and on the weekend will set the tone for next week.