The Weekly VC Price Momentum Indicator

ETF’s, Futures Swing Trading Instructions weekly

Signals are automatically generated by integrating electronic prices and weekly statistics with proprietary algorithms.

WEEKLY SUMMARY

TREND MOMENTUM: 52.56 Bullish

PRICE MOMENTUM: 53.16 Bearish

PRICE INDICATOR

EXIT LONG:

S2) 56.30

S1) 54.72

EXIT SHORTS:

B1) 51.58

B2) 50.02

WEEKLY TREND MOMENTUM

The contract closed at 53.15 The market closing above the 9 SMA 52.56 is confirmation that the trend momentum is bullish. A close below the 9 SMA would negate the weekly bullish short-term trend to neutral.

WEEKLY PRICE MOMENTUM

With the market closing below The VC Weekly Price Momentum Indicator of 53.16 it confirms that the price momentum is bearish. A close above the VC Weekly, it would negate the bearish signal to neutral.

WEEKLY PRICE INDICATOR

Cover short on corrections at the 51.58 levels and go long on a weekly reversal stop. If long, use the 51.58 level as a Stop Close Only and Good Till Cancelled order. Look to take some profits on longs, as we reach the

54.72 - 56.29 levels during the week.

WEEKLY SUMMARY

TREND MOMENTUM: 2235 Bullish

PRICE MOMENTUM: 2265 Bullish

PRICE INDICATOR

EXIT LONGS:

2) 2292

1) 2283

EXIT SHORTS:

1) 2256

2) 2238

WEEKLY TREND MOMENTUM

The contract closed at 2273. The market closing above the 9 SMA 2235 is confirmation that the trend momentum is bullish. A close below the 9 SMA would negate the weekly bullish short-term trend to neutral.

WEEKLY PRICE MOMENTUM

With the market closing above The VC Weekly Price Momentum Indicator of 2265 it confirms that the price momentum is bullish. A close below the VC Weekly, it would negate the bullish signal to neutral.

WEEKLY PRICE INDICATOR

Cover short on corrections at the 2256 - 2238 levels and go long on a weekly reversal stop. If long, use the 2238 level as a Stop Close Only and Good Till Cancelled order. Look to take some profits on longs, as we reach the 2283 - 2292 levels during the week.

First Mining Finance Corp (V:FF)

WEEKLY SUMMARY

TREND MOMENTUM: 0.60 Bullish

PRICE MOMENTUM: 0.64 Bullish

PRICE INDICATOR

EXIT LONGS:

S2) 0.68

S1) 0.65

EXIT SHORTS

B1) 0.60

B2) 0.58

WEEKLY TREND MOMENTUM

The contract closed at 0.65. The market closing above the 9 SMA 0.61 is confirmation that the trend momentum is bullish. A close below the 9 SMA would negate the weekly bullish short-term trend to neutral.

WEEKLY PRICE MOMENTUM

With the market closing above The VC Weekly Price Momentum Indicator of 0.64 it confirms that the price momentum is bullish. A close below the VC Weekly, it would negate the bullish signal to neutral.

WEEKLY PRICE INDICATOR

Cover short on corrections at the 0.62 - 0.59 levels and go long on a weekly reversal stop. If long, use the 0.59 level as a Stop Close Only and Good Till Cancelled order. Look to take some profits on longs, as we reach the 0.67 - 0.70 levels during the week.

McEwen Mining Inc. (NYSE:MUX)

WEEKLY SUMMARY

TREND MOMENTUM: 3.01 Bullish

PRICE MOMENTUM: 3.75 Bearish

PRICE INDICATOR

EXIT LONGS:

S2) 4.12

S1) 3.96

EXIT SHORTS

B1) 3.58

B2) 3.38

WEEKLY TREND MOMENTUM

The contract closed at 3.79 The market closing above the 9 SMA 3.01 is confirmation that the trend momentum is bullish. A close below the 9 SMA would negate the weekly bullish short-term trend to neutral.

WEEKLY PRICE MOMENTUM

With the market closing above The VC Weekly Price Momentum Indicator of 3.75 it confirms that the price momentum is bullish. A close below the VC Weekly, it would negate the bullish signal to neutral.

WEEKLY PRICE INDICATOR

Cover short on corrections at the 3.59 - 3.38 levels and go long on a weekly reversal stop. If long, use the 3.38 level as a Stop Close Only and Good Till Cancelled order. Look to take some profits on longs, as we reach the 3.96 - 4.12 levels during the week.

Direxion Daily Junior Gold Miners Bull 3X Shares (NYSE:JNUG)

WEEKLY SUMMARY

TREND MOMENTUM: 6.35 Bullish

PRICE MOMENTUM: 8.37 Bullish

PRICE INDICATOR

EXIT LONGS:

2) 11.25

1) 10.48

EXIT SHORTS:

7.54

6.70

WEEKLY TREND MOMENTUM

The contract closed at 8.37 The market closing above the 9 SMA 6.35 is confirmation that the trend momentum is bullish. A close bel0w the 9 SMA would negate the weekly bullish short-term trend signal to neutral.

WEEKLY PRICE MOMENTUM

With the market closing at The VC Weekly Price Momentum Indicator of 8.37 it confirms that the price momentum is bullish. A close below the VC Weekly, it would negate the bullish signal to neutral.

WEEKLY PRICE INDICATOR

Cover short on corrections at the 7.54 - 6.70 levels and go long on a weekly reversal stop. If long, use the 6.70 as a Stop Close Only and Good Till Cancelled order. Look to take some profits on longs, as we reach the 9.20 - 10.04 levels during the week.

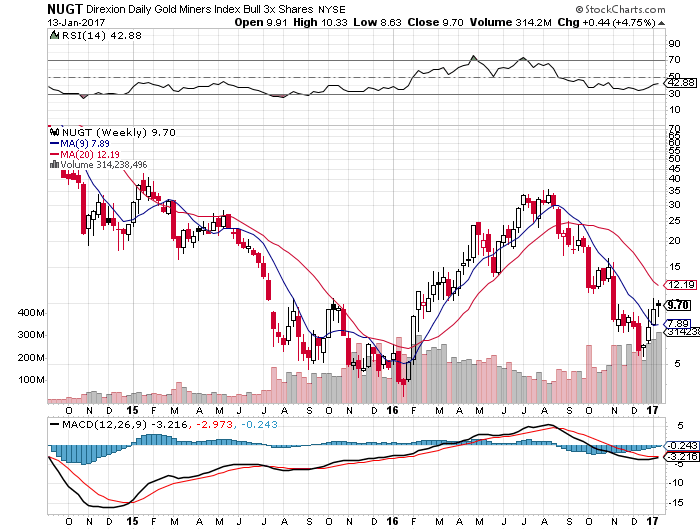

Direxion Daily Gold Miners Bull 3X Shares (NYSE:NUGT)

WEEKLY SUMMARY

TREND MOMENTUM: 7.74 Bullish

PRICE MOMENTUM: 9.17 Bullish

PRICE INDICATOR

EXIT LONGS

2) 11.92

1) 10.59

EXIT SHORTS

1) 7.84

2) 6.42

WEEKLY TREND MOMENTUM

The contract closed above 9.70 The market closing bel0w the 9 SMA 7.89 is confirmation that the trend momentum is bullish. A close below the 9 SMA would negate the weekly bullish short-term trend to neutral.

WEEKLY PRICE MOMENTUM

With the market closing above The VC Weekly Price Momentum Indicator of 9.55, it confirms that the price momentum is bullish. A close above the VC Weekly, it would negate the bullish signal to neutral.

WEEKLY PRICE INDICATOR

Cover short on corrections at the 8.78 - 7.85 levels and go long on a weekly reversal stop. If long, use the 7.85 level as a Stop Close Only and Good Till Cancelled order. Look to take some profits on longs, as we reach the 10.48 - 11.25 levels during the week.

VelocityShares 3x Long Silver linked to S&P GSCI Silver ER Exp 14 Oct 2031 (NASDAQ:USLV)

WEEKLY SUMMARY

TREND MOMENTUM: 12.68 Bullish

PRICE MOMENTUM: 12.68 Bullish

PRICE INDICATOR

EXIT LONGS:

2) 14.21

1) 13.75

EXIT SHORTS

1) 12.74

2) 12.19

WEEKLY TREND MOMENTUM

The contract closed at 13.29. The market closing above the 9 SMA 12.68 is confirmation that the trend momentum is bullish. A close below the 9 SMA would negate the weekly bullish short-term trend to neutral.

WEEKLY PRICE MOMENTUM

With the market closing above The VC Weekly Price Momentum Indicator of 12.68, it confirms that the price momentum is bullish. A close below the VC Weekly, it would negate the bullish signal to neutral.

WEEKLY PRICE INDICATOR

Cover short on corrections at the 12.74 - 12.19 levels and go long on a weekly reversal stop. If long, use the 12.19 level as a Stop Close Only and Good Till Cancelled order. Look to take some profits on longs, as we reach the 13.75 - 14.21 levels during the week.

Yamana Gold Inc (NYSE:AUY)

WEEKLY SUMMARY

TREND MOMENTUM: 2.90 Bullish

PRICE MOMENTUM: 3.16 Bullish

PRICE INDICATOR:

EXIT LONGS:

1) 3.42

1) 3.30

EXIT SHORTS

1) 3.04

2) 2.90

WEEKLY MOVING AVERAGES

The contract closed at 3.17. The market closing above the 9 SMA 2.90 is confirmation that the trend momentum is bullish. A close below the 9 SMA would negate the weekly bullish short-term trend to neutral.

WEEKLY MOMENTUM INDICATOR

With the market closing above The VC Weekly Price Momentum Indicator of 3.16, it confirms that the price momentum is bullish. A close below the VC Weekly, it would negate the bullish signal to neutral.

WEEKLY PRICE INDICATOR

Cover short on corrections at the 3.04 - 2.90 levels and go long on a weekly reversal stop. If long, use the 2.90 level as a Stop Close Only and Good Till Cancelled order. Look to take some profits on longs, as we reach the 3.30 - 3.42 levels during the week.

ProShares Ultra Silver (NYSE:AGQ)

WEEKLY SUMMARY

TREND MOMENTUM: 34.25 Bullish

PRICE MOMENTUM: 35.36 Bullish

PRICE INDICATOR:

EXIT LONGS:

1) 37.57

1) 36.63

EXIT SHORTS

1) 34.42

2) 33.15

WEEKLY MOVING AVERAGES

The contract closed at 35.69. The market closing below the 9 SMA 34.25 is confirmation that the trend momentum is bullish. A close below the 9 SMA would negate the weekly bullish short-term trend to neutral.

WEEKLY MOMENTUM INDICATOR

With the market closing above The VC Weekly Price Momentum Indicator of 35.36, it confirms that the price momentum is bullish. A close below the VC Weekly, it would negate the bullish signal to neutral.

WEEKLY PRICE INDICATOR

Cover short on corrections at the 34.42 - 33.15 levels and go long on a weekly reversal stop. If long, use the 33.15 level as a Stop Close Only and Good Till Cancelled order. Look to take some profits on longs, as we reach the 33.63 - 37.57 levels during the week.

Disclaimer: The information in the Market Commentaries was obtained from sources believed to be reliable, but we do not guarantee its accuracy. Neither the information nor any opinion expressed herein constitutes a solicitation of the purchase or sale of any futures or options contracts.