The Weekly VC Price Momentum Indicator

ETF’s, Futures Swing Trading Instructions weekly 2.17.17

Signals are automatically generated by integrating electronic prices and weekly statistics with proprietary algorithms.

WEEKLY SUMMARY

TREND MOMENTUM: 53.79 Bullish

PRICE MOMENTUM: 53.31 Bullish

PRICE INDICATOR

EXIT LONG:

S2) 54.68

S1) 54.04

EXIT SHORTS:

B1) 52.67

B2) 51.94

WEEKLY TREND MOMENTUM

The contract closed at 53.40 The market closing below the 9 SMA 53.79 is confirmation that the trend momentum is bearish. A close above the 9 SMA would negate the weekly bearish short-term trend to neutral.

WEEKLY PRICE MOMENTUM

With the market closing above The VC Weekly Price Momentum Indicator of 53.31 it confirms that the price momentum is bullish. A close below the VC Weekly, it would negate the bullish signal to neutral.

WEEKLY PRICE INDICATOR

Cover short on corrections at the 52.67 - 51.94 levels and go long on a weekly reversal stop. If long, use the 51.94 level as a Stop Close Only and Good Till Cancelled order. Look to take some profits on longs, as we reach the 54.04 - 54.64 levels during the week.

ES

WEEKLY SUMMARY

TREND MOMENTUM: 2272 Bullish

PRICE MOMENTUM: 2303 Bullish

PRICE INDICATOR

EXIT LONGS:

2) 2337

1) 2323

EXIT SHORTS:

1) 2290

2) 2229

WEEKLY TREND MOMENTUM

The contract closed at 2348. The market closing above the 9 SMA 2283 is confirmation that the trend momentum is bullish. A close below the 9 SMA would negate the weekly bullish short-term trend to neutral.

WEEKLY PRICE MOMENTUM

With the market closing above The VC Weekly Price Momentum Indicator of 2337 it confirms that the price momentum is bullish. A close below the VC Weekly, it would negate the bullish signal to neutral.

WEEKLY PRICE INDICATOR

Cover short on corrections at the 2324 2299 levels and go long on a weekly reversal stop. If long, use the 2299 level as a Stop Close Only and Good Till Cancelled order. Look to take some profits on longs, as we reach the 2362 - 2375 levels during the week.

FFMGF (SG:FMGG)

WEEKLY SUMMARY

TREND MOMENTUM: 0.66 Bullish

PRICE MOMENTUM: 0.76 Bullish

PRICE INDICATOR

EXIT LONGS:

S2) 0.95

S1) 0.87

EXIT SHORTS

B1) 0.68

B2) 0.57

WEEKLY TREND MOMENTUM

The contract closed at 0.79. The market closing above the 9 SMA 0.66 is confirmation that the trend momentum is bullish. A close below the 9 SMA would negate the weekly bullish short-term trend to neutral.

WEEKLY PRICE MOMENTUM

With the market closing above The VC Weekly Price Momentum Indicator of 0.76 it confirms that the price momentum is bullish. A close below the VC Weekly, it would negate the bullish signal to neutral.

WEEKLY PRICE INDICATOR

Cover short on corrections at the 0.68 - 0.57 levels and go long on a weekly reversal stop. If long, use the 0.57 level as a Stop Close Only and Good Till Cancelled order. Look to take some profits on longs, as we reach the 0.87 - 0.95 levels during the week.

MUX (NYSE:MUX)

WEEKLY SUMMARY

TREND MOMENTUM: 3.67 Bullish

PRICE MOMENTUM: 4.18 Bearish

PRICE INDICATOR

EXIT LONGS:

S2) 4.36

S1) 4.26

EXIT SHORTS

B1) 4.05

B2) 3.97

WEEKLY TREND MOMENTUM

The contract closed at 4.13 The market closing above the 9 SMA 3.67 is confirmation that the trend momentum is bullish. A close below the 9 SMA would negate the weekly bullish short-term trend to neutral.

WEEKLY PRICE MOMENTUM

With the market closing below The VC Weekly Price Momentum Indicator of 4.18 it confirms that the price momentum is bearish. A close above the VC Weekly, it would negate the bearish signal to neutral.

WEEKLY PRICE INDICATOR

Cover short on corrections at the 4.05 - 3.97 levels and go long on a weekly reversal stop. If long, use the 3.97 level as a Stop Close Only and Good Till Cancelled order. Look to take some profits on longs, as we reach the 4.26 - 4.39 levels during the week.

JNUG (NYSE:JNUG)

WEEKLY SUMMARY

TREND MOMENTUM: 8.47 Bullish

PRICE MOMENTUM: 11.60 Bearish

PRICE INDICATOR

EXIT LONGS:

2) 13.02

1) 12.23

EXIT SHORTS:

- 10.81

- 10.18

WEEKLY TREND MOMENTUM

The contract closed at 11.44 The market closing above the 9 SMA 8.47 is confirmation that the trend momentum is bullish. A close bel0w the 9 SMA would negate the weekly bullish short-term trend signal to neutral.

WEEKLY PRICE MOMENTUM

With the market closing below The VC Weekly Price Momentum Indicator of 11.60 it confirms that the price momentum is bearish. A close above the VC Weekly, it would negate the bearish signal to neutral.

WEEKLY PRICE INDICATOR

Cover short on corrections at the 10.81 - 10.18 levels and go long on a weekly reversal stop. If long, use the 10.18 as a Stop Close Only and Good Till Cancelled order. Look to take some profits on longs, as we reach the 13.23 - 13.02 levels during the week.

NUGT (NYSE:NUGT)

WEEKLY SUMMARY

TREND MOMENTUM: 10.03 Bullish

PRICE MOMENTUM: 12.35 Bullish

PRICE INDICATOR:

EXIT LONGS

2) 13.60

1) 12.91

EXIT SHORTS

1) 11.67

2) 11.11

WEEKLY TREND MOMENTUM

The contract closed above 12.23 The market closing above the 9 SMA 10.03 is confirmation that the trend momentum is bullish. A close below the 9 SMA would negate the weekly bullish short-term trend to neutral.

WEEKLY PRICE MOMENTUM

With the market closing below The VC Weekly Price Momentum Indicator of 12.36, it confirms that the price momentum is bearish. A close above the VC Weekly, it would negate the bearish signal to neutral.

WEEKLY PRICE INDICATOR

Cover short on corrections at the 12.07 - 11.16 levels and go long on a weekly reversal stop. If long, use the 11.16 level as a Stop Close Only and Good Till Cancelled order. Look to take some profits on longs, as we reach the 13.79 - 14.60 levels during the week.

USLV (NASDAQ:USLV)

WEEKLY SUMMARY

TREND MOMENTUM: 13.69 Bullish

PRICE MOMENTUM: 16.02 Bullish

PRICE INDICATOR:

EXIT LONGS:

2) 17.09

1) 16.61

EXIT SHORTS

1) 15.54

2) 14.95

WEEKLY TREND MOMENTUM

The contract closed at 16.12. The market closing above the 9 SMA 13.69 is confirmation that the trend momentum is bullish. A close below the 9 SMA would negate the weekly bullish short-term trend to neutral.

WEEKLY PRICE MOMENTUM

With the market closing above The VC Weekly Price Momentum Indicator of 16.02, it confirms that the price momentum is bullish. A close below the VC Weekly, it would negate the bullish signal to neutral.

WEEKLY PRICE INDICATOR

Cover short on corrections at the 15.54 - 14.95 levels and go long on a weekly reversal stop. If long, use the 14.95 level as a Stop Close Only and Good Till Cancelled order. Look to take some profits on longs, as we reach the 16.61 - 17.09 levels during the week.

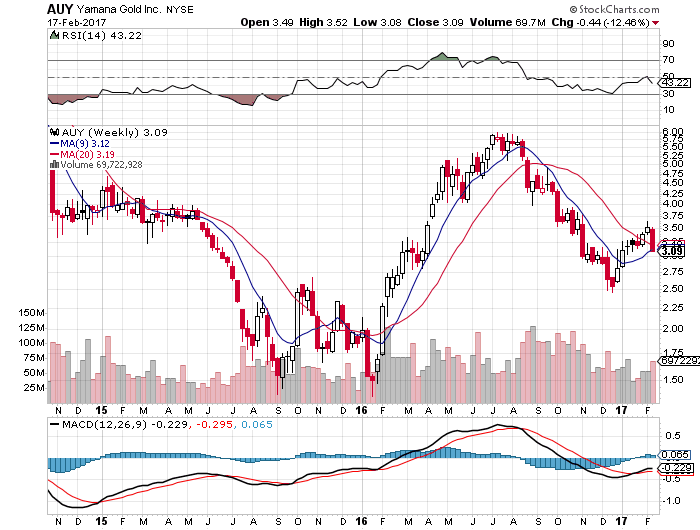

AUY (NYSE:AUY)

WEEKLY SUMMARY

TREND MOMENTUM: 3.09 Bearish

PRICE MOMENTUM: 3.23 Bearish

PRICE INDICATOR:

EXIT LONGS:

1) 3.67

1) 3.38

EXIT SHORTS

1) 2.94

2) 2.79

WEEKLY MOVING AVERAGES

The contract closed at 3.09. The market closing above at the 9 SMA 3.09 is confirmation that the trend momentum is bearish. A close above the 9 SMA would negate the weekly bullish short-term trend to neutral.

WEEKLY MOMENTUM INDICATOR

With the market closing below The VC Weekly Price Momentum Indicator of 3.23, it confirms that the price momentum is bearish. A close above the VC Weekly, it would negate the bearish signal to neutral.

WEEKLY PRICE INDICATOR

Cover short on corrections at the 2.94 - 2.79 levels and go long on a weekly reversal stop. If long, use the 2.79 level as a Stop Close Only and Good Till Cancelled order. Look to take some profits on longs, as we reach the 3.38 - 3.67 levels during the week.

AGQ (NYSE:AGQ)

WEEKLY SUMMARY

TREND MOMENTUM: 36.26 Bullish

PRICE MOMENTUM: 40.75 Bearish

PRICE INDICATOR:

EXIT LONGS:

1) 41.92

1) 41.20

EXIT SHORTS

1) 40.51

2) 40.34

WEEKLY MOVING AVERAGES

The contract closed at 40.67. The market closing above the 9 SMA 36.26 is confirmation that the trend momentum is bullish. A close below the 9 SMA would negate the weekly bullish short-term trend to neutral.

WEEKLY MOMENTUM INDICATOR

With the market closing below The VC Weekly Price Momentum Indicator of 40.75, it confirms that the price momentum is bearish. A close below the VC Weekly, it would negate the bearish signal to neutral.

WEEKLY PRICE INDICATOR

Cover short on corrections at the 40.51 - 40.34 levels and go long on a weekly reversal stop. If long, use the 40.34 level as a Stop Close Only and Good Till Cancelled order. Look to take some profits on longs, as we reach the 40.94 - 41.16 levels during the week.

*Disclaimer: The information in the Market Commentaries was obtained from sources believed to be reliable, but we do not guarantee its accuracy. Neither the information nor any opinion expressed herein constitutes a solicitation of the purchase or sale of any futures or options contracts. This report is for educational purposes only.