Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Here is the Bear Pennant that is plaguing all of the equity indices, some individual stocks, many commodities and, of course, is a copy of the driving Bear Pennant in EURUSD.

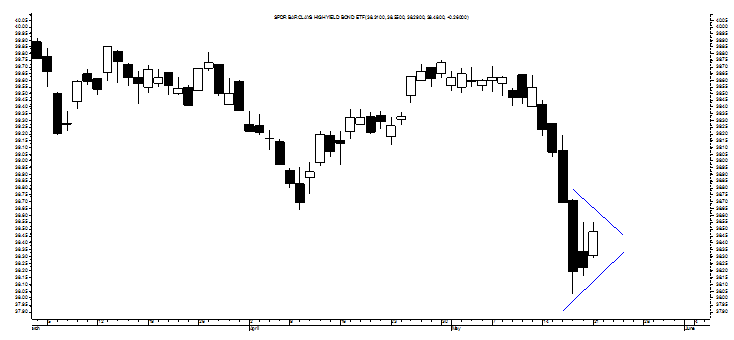

It is worth looking at here in this high-yield fixed-income ETF only because it is the best looking and cleanest of all these patterns and a pattern that is promising a 10%+ decline from current levels in equities.

What is really worth looking at is this Bear Pennant that confirms at about $38 for a target of around $36 for a nearly 10% decline in the context of its 2-year chart below.

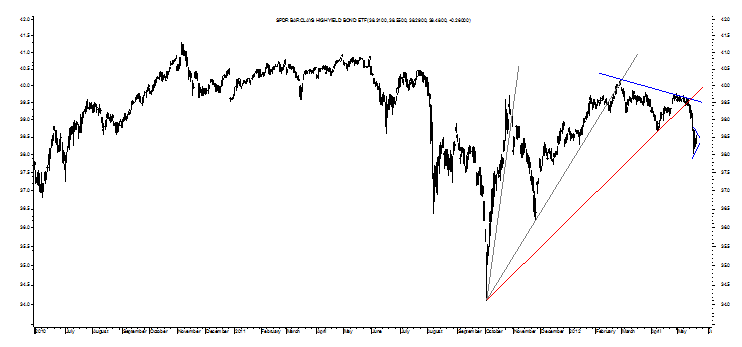

As can be seen, JNK’s Bear Pennant means business just like the patterns plaguing all of the risk asset charts and its business may just be the beginning of what could turn into a more than 30% correction and something that is more commonly called a crash.

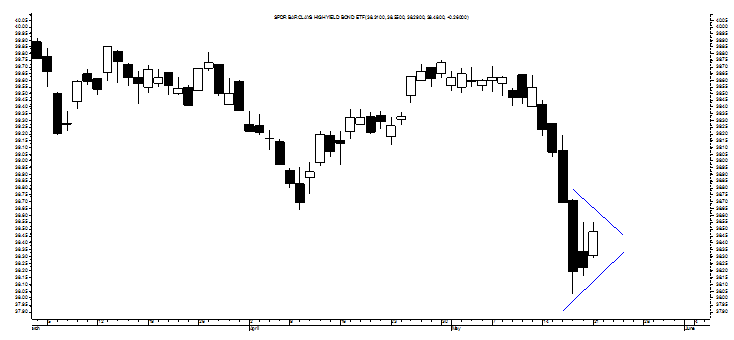

It is worth looking at here in this high-yield fixed-income ETF only because it is the best looking and cleanest of all these patterns and a pattern that is promising a 10%+ decline from current levels in equities.

What is really worth looking at is this Bear Pennant that confirms at about $38 for a target of around $36 for a nearly 10% decline in the context of its 2-year chart below.

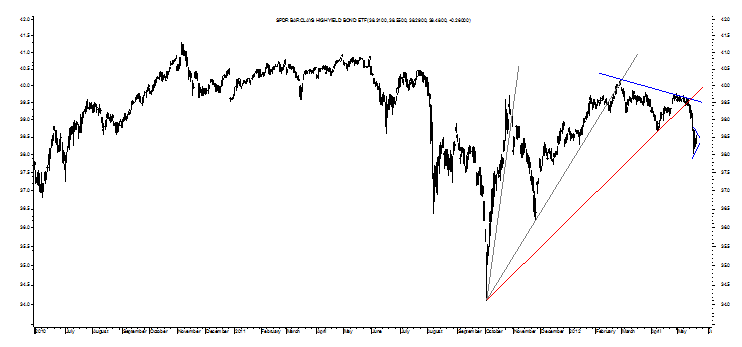

As can be seen, JNK’s Bear Pennant means business just like the patterns plaguing all of the risk asset charts and its business may just be the beginning of what could turn into a more than 30% correction and something that is more commonly called a crash.