JNK has the Same Set-Up on its Chart as Oil Before its Crash Out of Last Summer’s High and as NYSE:FXI Right Now

NYSE:JNK has the same set-up on its chart as oil did coming off last summer’s high. The set-up is a prolonged topping formation at roughly the 61.8% retrace point after a crash. The topping formation tends to lead to a revisit of the crash low.

On the JNK chart, that means JNK should be about to plunge to the 2009 low.

What’s especially helpful is that if you close in on the price move down from the March 2015 reversal, there is another crash set-up to roughly the same target.

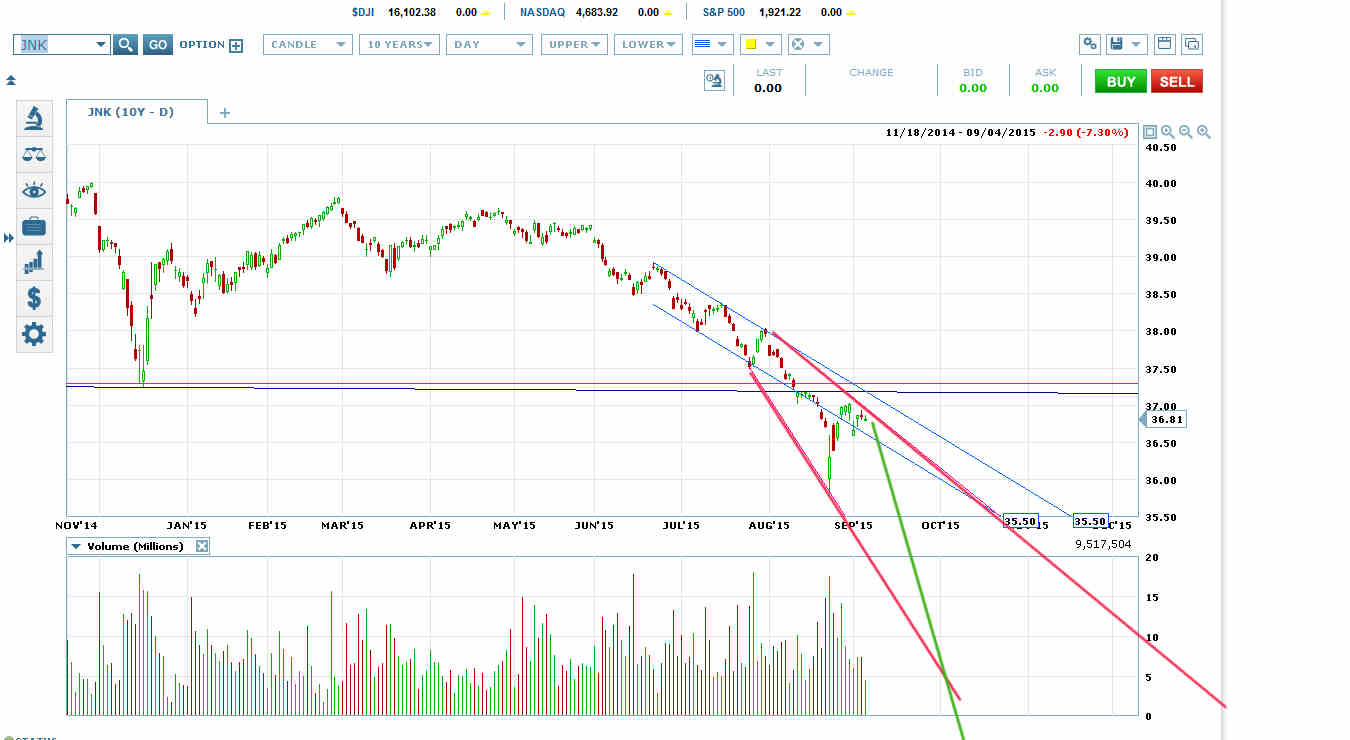

JNK Price Channel (Blue) into Falling Megaphone (Red) Crash Set-Up

This particular crash set-up starts with a confirmed price channel (blue on chart above) that breaks out through the channel bottom in its critical decision wave (the wave to a lower low after two pairs of alternating touches on the channel bottom and then the channel top).

The break through the channel bottom would usually set up a breakout into a melt-down channel. But in this case, the price retraced all the way to the blue channel top.

The retrace to the channel top means a bottoming pattern is starting. But the price continued down in too big of a wave for a conventional channel bottoming pattern. In fact, it put in another big breakout through the channel bottom.

That almost always means a falling megaphone bottom is forming (red on chart). The next wave down should be the biggest, fastest move of the formation, and the price would usually break out the formation bottom before beginning a sideways bottoming pattern at the target.

In addition, JNK is completing a short set-up on its 15-minute chart.

JNK is Legal for a Downwards Breakout from its Pink Megaphone – a Set-Up to Short for a Crash to the 2009 Low

JNK formed a rising megaphone top (blue) on the move off its August 24th low, and then topped it with a megaphone (red) that is now legal for a downwards breakout (green scenario). A downwards breakout would be a set-up to short to roughly the 2009 low.

An upwards breakout would be a breakout from a small inverse H&S, which would postpone or cancel the short set-up on JNK and probably a lot of other things.