The J.M. Smucker Company (NYSE:SJM) , a leading manufacturer of food products, has been in troubled waters of late, due to unfavorable volume/mix, in its coffee segment. The food company also posted disappointing first-quarter fiscal 2018 results and slashed earnings guidance for the fiscal year.

Dismal First-Quarter Results

Smucker posted dismal first-quarter fiscal 2018 results on Aug 24 wherein both the top and bottom lines lagged the Zacks Consensus Estimate. Earnings nosedived 19% year over year due to planned increases in commodity costs and higher marketing expense. Net sales in the quarter also declined 4% year over year on account of lower volume/mix.

The quarter also marked the fifth straight quarter of sales decline in its coffee business. Moreover, the Pet Foods segment also did not generate significant growth owing to unfavorable cost to price relationship combined with high marketing expenses.

Following the dismal results, the company lowered its earnings guidance for fiscal 2018. It now envisions fiscal 2018 earnings in the range of $7.75-$7.95 per share, compared with $7.85-$8.05 expected earlier. Also, the company expects lower pricing in U.S. Retail Coffee to negatively impact profits in the remainder of fiscal 2018.

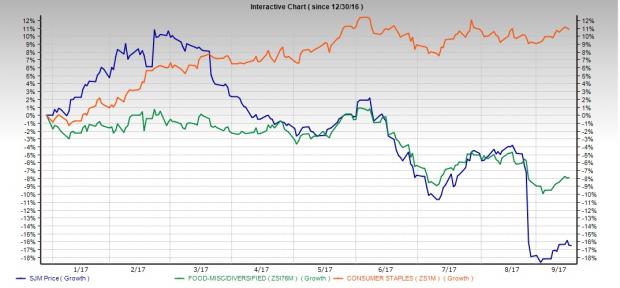

Weak first-quarter results also pulled down shares of the company. We observed that the stock has not only underperformed the industry but also the broader consumer staple sector on a year-to-date basis. Over the period, the stock has decreased 16.5%, while the industry declined 7.9%. The broader Consumer Staples sector of which they are part of, grew 10.9% in the said time frame.

Estimates Declining

The Zacks Consensus Estimate for the second quarter as well as for fiscal 2018 and fiscal 2019 has been declining over the last 30 days. The Zacks Consensus Estimate for the second quarter declined 9.6%, 2.8% for fiscal 2018 and 3% for fiscal 2019, respectively.

Currency Headwinds and Sluggish Pet Food Sales

The company is also bearing the brunt of unfavorable currency and weak pet food business. Heightened competitive activity from more-premium brands and challenges in dry dog food against a deflationary macro environment is impacting the performance of the Kibbles 'n Bits brand. Also, retailers are increasingly looking at pet snacks as a new category separate from regular food, and are focusing more on to it. The company continues to expect softness in Pet Food sales in the near term.

Initiatives to Boost Business

Though heightened competition in the pet food business in the near term remains a concern, we are impressed with strong organic sales growth, product innovation and constant efforts to expand through acquisitions. Within pet snacks, the change in pricing strategies to improve the competitive positioning of Kibbles 'n Bits in the mainstream dog food category is driving volumes and is expected to support further growth.

In the long term, the company expects to remain on track with its cost-savings initiatives. The company anticipates to launch improved K-Cup products in the Coffee and snacking segments.

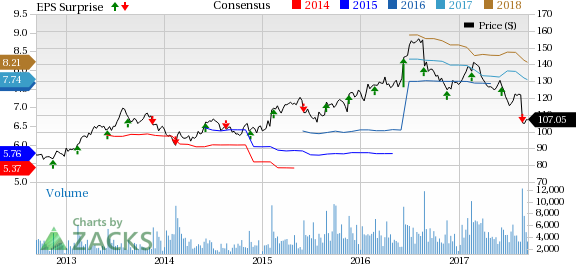

Further, the company has delivered positive earnings surprises in seven out of the past nine quarters, with in-line earnings in one quarter. A low beta of 0.62, a dividend yield of 2.90%, VGM score of B and a long-term earnings growth rate of 6.6% also makes the stock attractive.

Zacks Rank & Key Picks

Smucker currently carries a Zacks Rank #3 (Hold).

Some better-ranked food stocks in the industry are Nomad Foods Ltd. (NYSE:NOMD) , Ingredion, Inc. (NYSE:INGR) and The Chef’s Warehouse Inc. (NASDAQ:CHEF) .

Nomad has a VGM Score of B and sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Ingredion and Chef’s Warehouse, both carrying a Zacks Rank #2 (Buy), have VGM Score of B each.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure.

See these buy recommendations now >>

J.M. Smucker Company (The) (SJM): Free Stock Analysis Report

Ingredion Incorporated (INGR): Free Stock Analysis Report

The Chefs' Warehouse, Inc. (CHEF): Free Stock Analysis Report

Nomad Foods Limited (NOMD): Free Stock Analysis Report

Original post

Zacks Investment Research