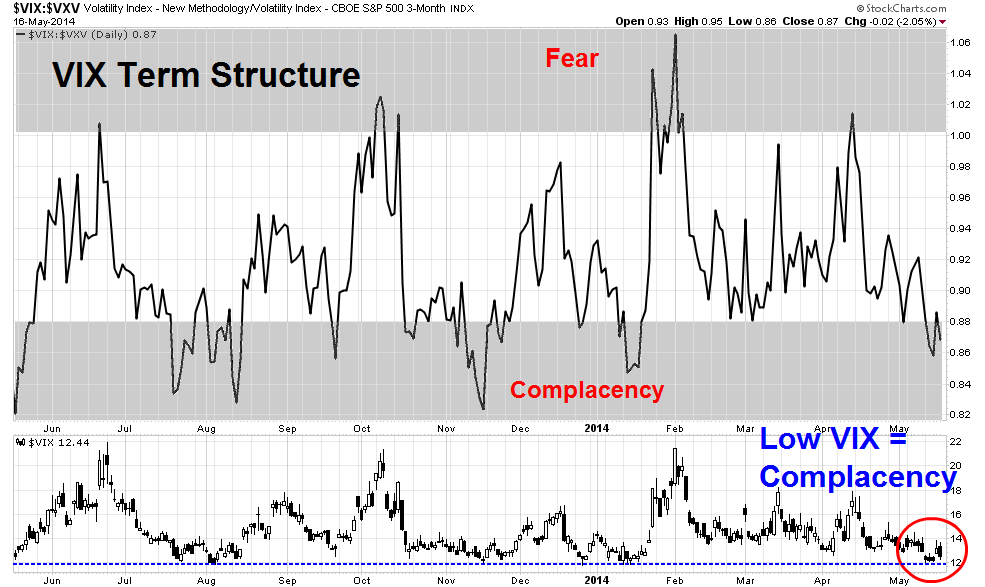

I've been seeing some odd and contradictory readings from the option market throughout last week. One screams "fear" while the other screams "complacency".

On the one hand, the equity put-call ratio, which I highlighted last Sunday night (see Watch for the sentimental rally), remains elevated and is suggestive of a high level of fear. Such a condition is contrarian bullish for equities. The chart below shows the 5 day exponential moving average of the equity only put-call ratio (in blue) and the 21 day moving average (in red). Both are at elevated levels relative to their own recent history.

The bottom panel shows the VIX Index. If the markets are so fearful, then why is this so-called "fear index" so low?

A regime change?

I had written about a possible volatility regime change (see Interpreting a possible volatility regime change). In my previous post, I had featured this chart of the equity put-call ratio (top panel) and VIX (bottom panel). I showed how changes in the trend in equity put-call ratio may be a precursor to a higher volatility environment:

Jittery sentiment

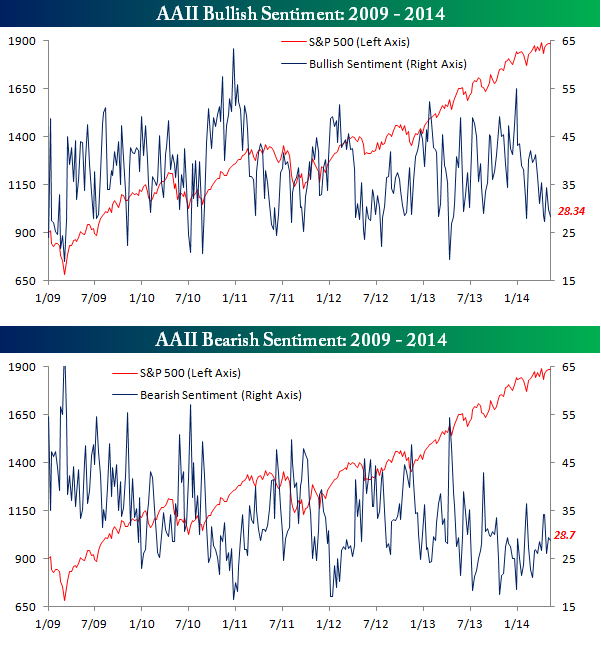

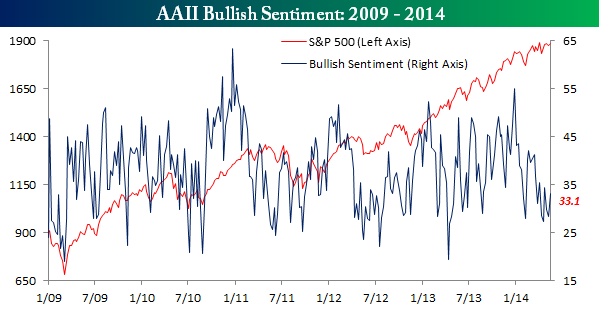

Indeed, the latest AAII sentiment readings (via Bespoke) could be a clue of a volatility regime change. Even though the major large cap averages made a new high, AAII bulls rose from 28.3% to 33.1% this week, but they remain low on an absolute basis, which would normally be interpreted as bullish.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this blog constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or I may hold or control long or short positions in the securities or instruments mentioned.