Japanese government bonds experienced a spectacular sell-off over the past few days, with the 10-year JGB yield rising by a half of its value.

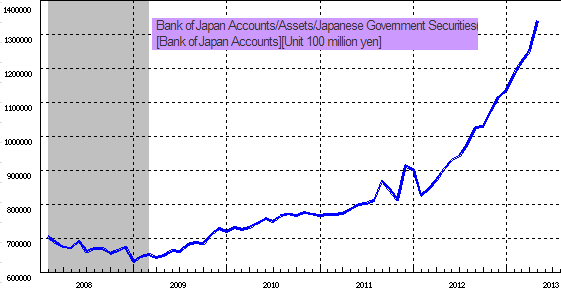

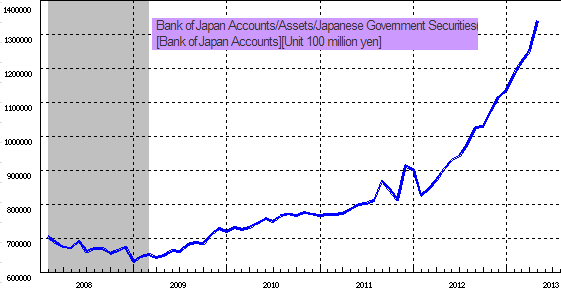

This is taking place in spite of BoJ's pledge to keep on buying paper. Anyone who doubts the central bank's resolve, need only look at its JGB holdings. The Bank of Japan is now buying over 70% of all new government bond issuance.

The spike in JGB yields - in spite of all the central bank buying - is quite troubling. It is precisely the opposite of what the BoJ had intended. It means that liquidity in JGBs is disappearing, as the market is increasingly controlled by a single buyer. And with most speculative players positioned long, what started as a small sell-off, quickly became amplified - as bets are unwound.

WSJ: On Monday, Japanese yields moved higher even as the BoJ scooped up ¥1.2 trillion of JGBs maturing in one to 10 years at three separate operations - exactly the opposite effect the BoJ had been hoping for, strategists said.

With liquidity deteriorating, "a risk-free investment has now become risky," said Manabu Tamaru, senior investment manager at Baring Asset Management (Japan). "Thus investors are demanding a risk premium under the BoJ's buying program."

The sell-off continued as of 10:30 EST (5/14).

This is taking place in spite of BoJ's pledge to keep on buying paper. Anyone who doubts the central bank's resolve, need only look at its JGB holdings. The Bank of Japan is now buying over 70% of all new government bond issuance.

The spike in JGB yields - in spite of all the central bank buying - is quite troubling. It is precisely the opposite of what the BoJ had intended. It means that liquidity in JGBs is disappearing, as the market is increasingly controlled by a single buyer. And with most speculative players positioned long, what started as a small sell-off, quickly became amplified - as bets are unwound.

WSJ: On Monday, Japanese yields moved higher even as the BoJ scooped up ¥1.2 trillion of JGBs maturing in one to 10 years at three separate operations - exactly the opposite effect the BoJ had been hoping for, strategists said.

With liquidity deteriorating, "a risk-free investment has now become risky," said Manabu Tamaru, senior investment manager at Baring Asset Management (Japan). "Thus investors are demanding a risk premium under the BoJ's buying program."

The sell-off continued as of 10:30 EST (5/14).