JBLU Traders Put-Heavy The past 10 Weeks Of Trading

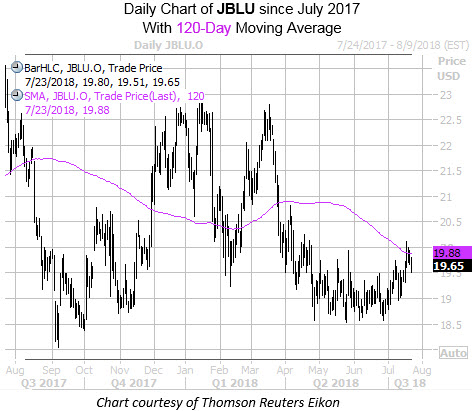

JetBlue Airways Corporation (NASDAQ:JBLU) stock is down 1.1% at $19.65 this afternoon, pulling back after last week's breakout attempt. Although the airline issue is set for its best month since November, recently bounding off support in the $18.60 region, it's struggled to overtake its 120-day moving average and the round-number $20 level just overhead. What's more, it seems recent options buyers are expecting more lows for JBLU shares after earnings tomorrow.

The airliner is slated to report second-quarter earnings before the bell tomorrow. Digging into its earnings history, JBLU stock has closed flat or lower the day after the company reported in five of the past eight quarters -- including a 6.2% drop in January. On average, the shares have moved 3.6% in the subsequent session over this two-year time frame, regardless of direction. This time around, the options market is pricing in a larger-than-usual 5.4% next-day move for JetBlue stock.

Digging deeper, data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) shows the aerospace concern with a 50-day put/call volume ratio of 0.86, ranking in the 96th percentile of its annual range. In other words, while JBLU calls bought to open have outnumbered puts on an absolute basis in the past 10 weeks, bearish bets have been initiated at a much faster-than-usual clip, pointing to a skeptical pre-earnings skew among speculators.

Looking toward analyst sentiment, those following the stock have also been wary, with 10 of the 13 brokerage firms covering JBLU sporting "hold" or "sell" ratings. Those bears could be caught off-guard if JetBlue surprises to the upside after earnings, as we saw with sector peers Delta Air Lines (NYSE:DAL) and United Continental (NYSE:UAL).