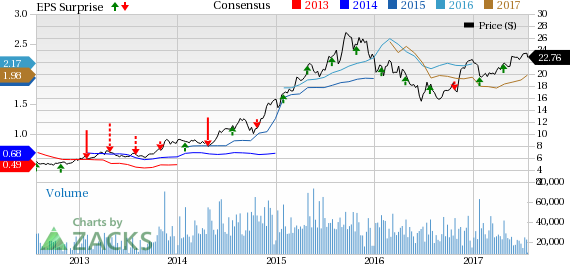

Low-cost carrier, JetBlue Airways Corporation’s (NASDAQ:JBLU) second-quarter 2017 earnings (excluding special items) of 64 cents per share beat the Zacks Consensus Estimate by 8 cents, which pleased the investors.

Consequently, shares of the company rallied in early trading. Moreover, quarterly earnings improved 20.75% from the year-ago figure. Results were aided by higher revenues.

Operating revenues came in at $1,842 million, ahead of the Zacks Consensus Estimate of $1,822.1 million. Revenues improved 12.11% from the year-ago figure. Passenger revenues, which accounted for bulk of the top line (89.6%), improved 11% in the second quarter. Other revenues increased 22.8%.

Operating Statistics

Capacity, measured in available seat miles, expanded 4.8% year over year. Traffic, measured in revenue passenger miles, grew 5% in the second quarter. Load factor (percentage of seats filled by passengers) improved 20 basis points (bps) year over year to 85.2% in the reported quarter as traffic growth outpaced capacity expansion.

Yield per passenger mile improved 5.7% year over year to 13.6 cents in the reported quarter. Passenger revenue per available seat mile (PRASM: a key measure of unit revenue) increased 5.9% to 11.59 cents, while operating revenue per available seat mile (RASM) climbed 7% to 12.93 cents.

Operating Income and Expenses

In the second quarter, total operating expenses (on a reported basis) increased 11.9% year over year. Average fuel cost per gallon (including fuel taxes) escalated 12.3% to $1.61. Moreover, JetBlue’s operating cost per available seat mile (CASM) increased 6.8% to 10.45 cents in the reported quarter. Excluding fuel, the metric also climbed 5.1% to 8.16 cents on the back of rise in labor costs.

Balance Sheet

JetBlue sporting a Zacks Rank #1 (Strong Buy), exited the quarter with cash and cash equivalents of $550 million compared with $433 million at the end of 2016. Total debt, at the end of the quarter was $1,305 million than $1,384 million at the end of 2016. In fact, the company is constantly working toward reducing its debt levels.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Outlook

For the third quarter of 2017, the carrier expects capacity to increase in the band of 6.5% to 7.5%. For the full-year 2017 the metric is projected to increase in the range of 5.5% to 6.5%.

CASM, excluding fuel, is expected to grow in the band of 1.5% to 3.5% for the third quarter. For the full-year 2017 the metric is now anticipated to grow in the range of 2% to 3.5% (old guidance had called for growth in the range of 1.5% to 3.5%). Furthermore, RASM growth is projected to range between (0.5)% and 2.5% for the third quarter of 2017 compared to the same period in the previous year. Fuel cost, net of hedges, is projected at $1.61 per gallon for the third quarter.

Other Important Releases Coming Up

Investors interested in the airline space keenly await the second-quarter earnings reports of SkyWest, Inc. (NASDAQ:SKYW) , Spirit Airlines (NASDAQ:SAVE) and Alaska Air Group (NYSE:ALK) . While SkyWest and Spirit Airlines are scheduled to report results on Jul 27, Alaska will unveil its earnings report on Jul 26.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

JetBlue Airways Corporation (JBLU): Free Stock Analysis Report

Spirit Airlines, Inc. (SAVE): Free Stock Analysis Report

SkyWest, Inc. (SKYW): Free Stock Analysis Report

Alaska Air Group, Inc. (ALK): Free Stock Analysis Report

Original post

Zacks Investment Research