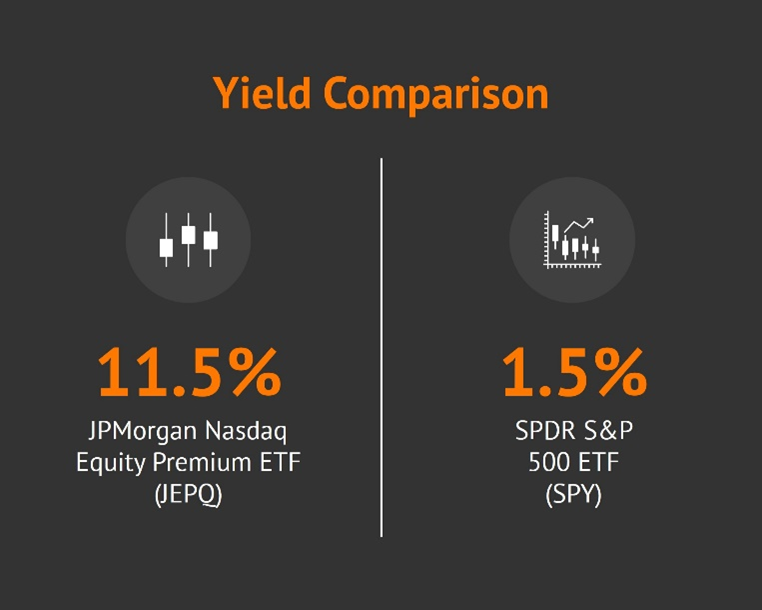

You and I, as careful contrarians, have big payers at our fingertips that we could only dream about back in the days of optional seat belts. Indeed, in the 2020s, Jamie Dimon and his team launched a couple of big paying ETFs – JEPQ among them. It recently yielded 11.5% and, thanks to the recent sharp pullback in tech, this is the time to buy.

JEPQ’s strategy is pretty simple. First, it buys and holds blue-chip tech payers like Apple (NASDAQ:AAPL) (AAPL) and Microsoft (NASDAQ:MSFT) (MSFT). This alone is interesting to me because both stocks look ready to bounce.

Neither name, however, is anywhere close to qualifying for Contrarian Income Report. AAPL recently yielded only 0.6% while MSFT paid only 1%.

But we can create a “synthetic yield” by selling puts and writing covered calls around these positions. Tech stocks tend to command larger option premiums—even cash cows like AAPL and MSFT. Sell a put here, a call there, and we can turn these into double-digit payers.

But option writing is a grind. If it isn’t a full-time job, it’s at least a side hustle. To maximize our cash flows we need to sell options every month or, really, every week.

A J-O-B? When we’re trying to retire on dividends? No thanks. Instead, we’re outsourcing the option writing to Dimon and his management team. These guys eat regional banks for lunch. In between meals, they can write options for us.

The 10-year Treasury yield will eventually settle down, and when it does, the tech-heavy Nasdaq is likely to bounce. When the prices of MSFT and AAPL rise, or merely trade sideways, there is plenty of income for JEPQ to dish out.

I’m not sure what 2024 holds, but that isn’t our concern at the moment. JEPQ is an 11.5% cash cow with a floor in place thanks to the recent market turmoil. Let’s buy it before it bounces.

Recommended Action: Buy JEPQ.

This content was originally published on MoneyShow