Investing.com’s stocks of the week

Look, we are all wrong sometimes. That's because the markets are this way one day, that way the next and then something else the day after that. That is why we need bigger picture plans.

I for instance, have been guarded on the gold sector and technically at least, still need to see some upside parameters taken out. But today’s market information brings a potential fundamental underpinning as the stock market flirts with some important parameters of its own.

The point? We are all wrong and we are all right sometimes, but you need guiding plans to smooth the process. What you most certainly don’t need is Louise Yamada harvesting eyeballs for Bloomberg…

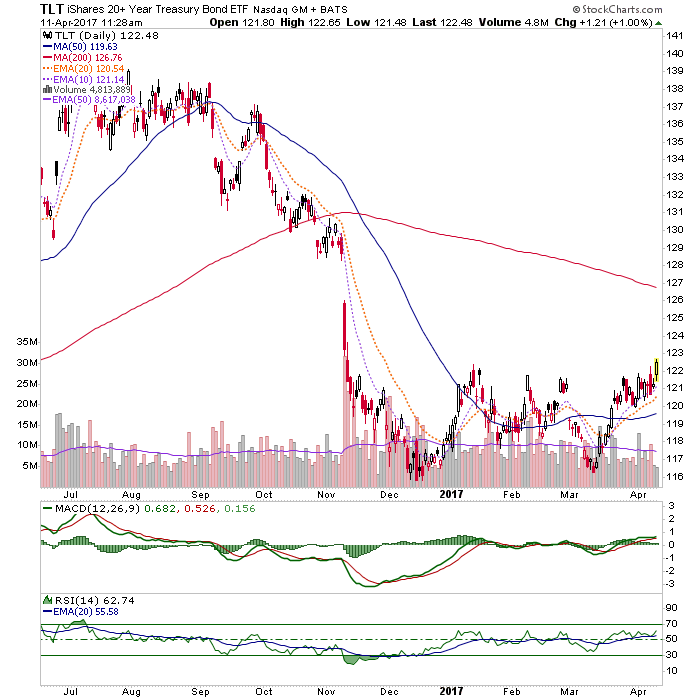

The above was published on December 15 and as you can see by the chart below, of iShares 20+ Year Treasury Bond (NASDAQ:TLT), that was exactly the bottom for the long-term Treasury bond market (which went on to form a double bottom in March).

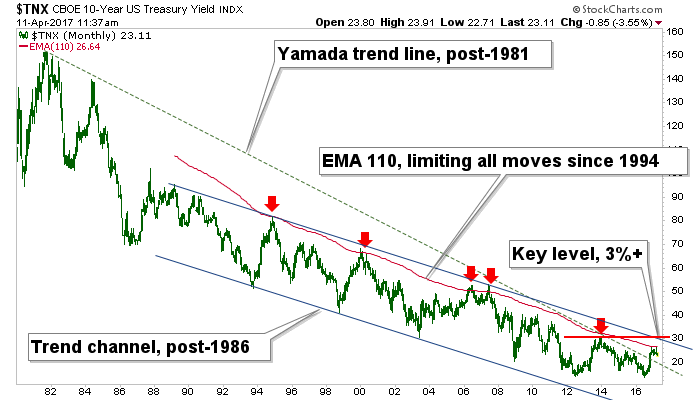

On December 16 I made a big stink about this media crap and Yamada’s overly simplistic line on a chart of the 10-year yield that produced the hype-filled headline above: See R.I.P. Bond Bull!!!!!

Here is the updated chart of TNX from that post, that I produced in response. In all the subsequent months the 10-year yield has remained below its limiter, the monthly EMA 110. Go figure.

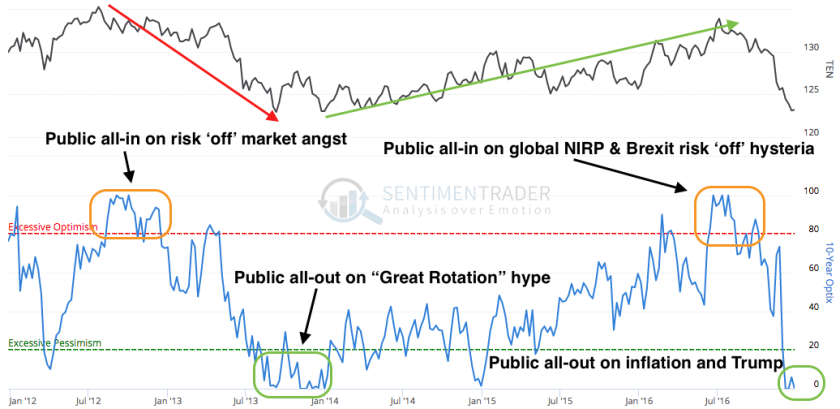

And again, here is the sentiment view (from Sentimentrader w/ my mark ups) of the 10-Y bond, showing the sordid history of the public’s involvement and the media that tend them. The opportunity to buy the low was heralded in by the media star technical analyst Louise Yamada, she of the ability to draw a trend line, and Bloomberg, they of the ability to create a headline.