Je suis Paris:

I see quotes in articles around the internet being written this morning saying analysts and markets are almost de-sensitised to the sorts of attacks that we saw in Paris over the weekend. While a sad state of affairs for the society we now live in, this is how it is and we have to get on with it.

Learning from past attacks, for example most recently in London, we didn’t get the sustained equity or Forex risk sell-off that could possibly have been expected. Markets were jumpy yes, but while I’m not there yet, unfortunately financial markets it seems have become de-sensitised to these sorts of world events and I’m expecting only short term volatility and falls when European markets come online tonight, before a possibly snap back as normal service is resumed.

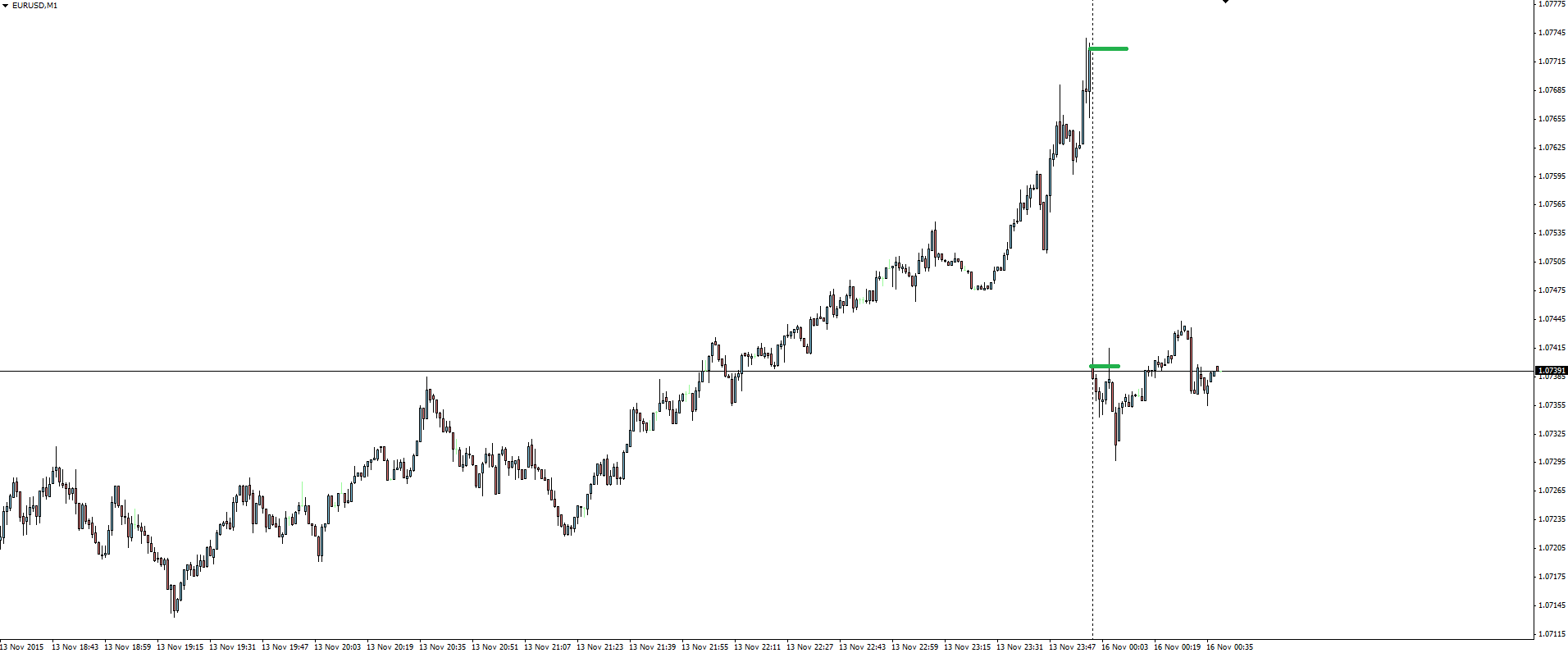

EUR/USD 1 Minute:

A 30 pip gap down on EUR/USD really isn’t anything to write home about and although we’re still seeing some follow through, I think that initial move is quite telling in terms of de-sensitised market psyche following the weekend’s events.

As much as the headlines will tell you otherwise, the major market moving theme is still monetary policy from the Federal Reserve and whether December is actually in play or not. This week’s calendar sees a whole raft of USD sensitive, tier 1 news including inflation on Wednesday and FOMC Meeting Minutes on Thursday. Attention will soon turn back to the Fed, potentially undoing any panic driven moves from early in the week in a single trading session.

All I can say from here is make sure your major levels are marked and your position sizing is appropriate to start the week. Keep an eye on the Technical Analysis section of the Vantage FX News Centre throughout the week as we focus on some major levels that Forex, indices and commodities markets are all heading into.

On the Calendar Monday:

NZD Retail Sales q/q

JPY Prelim GDP q/q

EUR ECB President Draghi Speaks

CAD Manufacturing Sales m/m

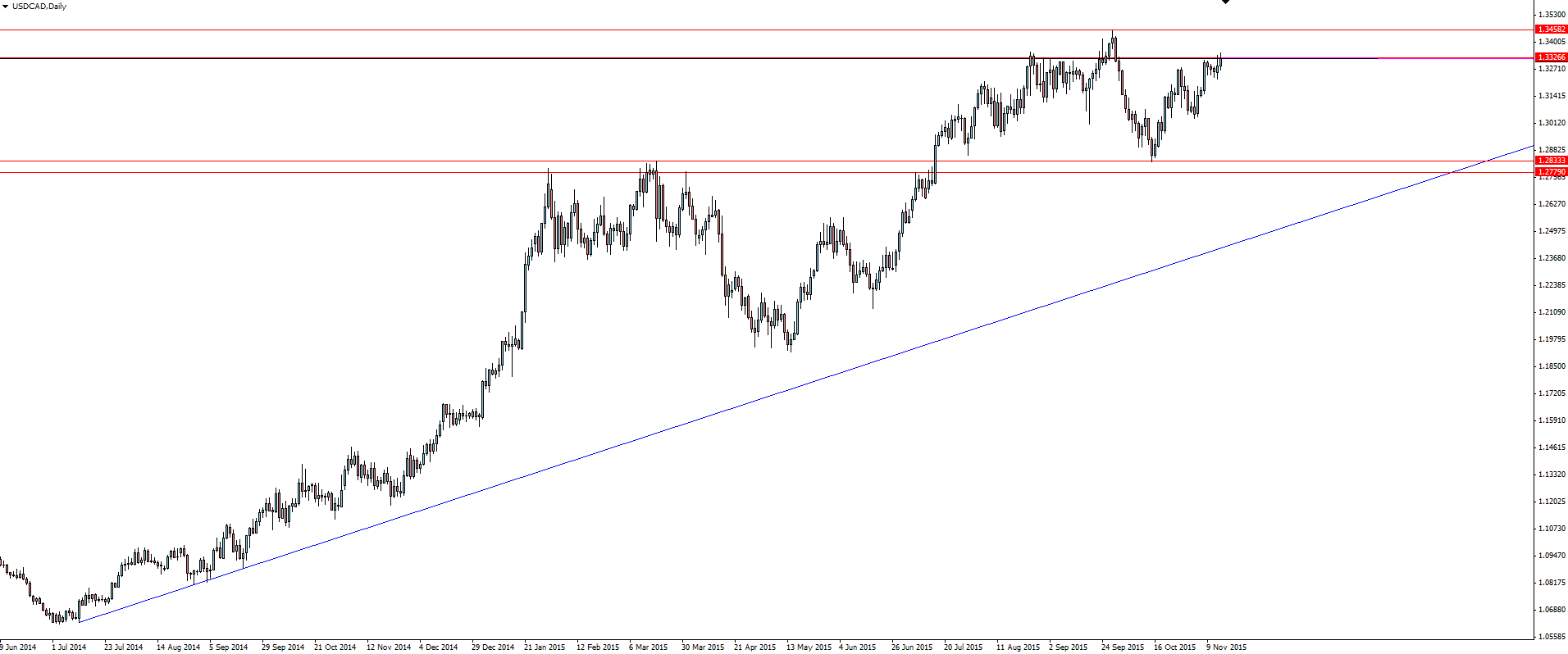

Chart of the Day:

With USD/CAD pushing toward its swing highs, the pair comes back into play.

USD/CAD Daily:

Although gapping down at open, USD/CAD has still pushed into our marked supply zone. While not actually reaching the high, price has still pushed into the zone with a lack of momentum which is giving the faders something to think about.

With the gap down helping to exaggerate the lack of momentum, any weak push back up could be viewed as an opportunity to sell weakness. Keep an eye on the @VantageFX Twitter) as we take a look at some lower time frame charts throughout Monday as price action evolves from here.

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Australian Forex broker Vantage FX Pty Ltd does not contain a record of our prices, or an offer of, or solicitation for, a transaction in any financial instrument. The research contained in this report should not be construed as a solicitation to trade. All opinions, news, research, analysis, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person opening a trading account and acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness and STP Forex broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.