Jazz Pharmaceuticals Public Limited Company (NASDAQ:JAZZ) announced that its wholly owned subsidiary, Jazz Investments I Limited, intends to offer exchangeable Senior Notes, due 2024, for an aggregate principal amount of $500 million in a private offering to qualified institutional buyers.

Notably, the notes will be exchangeable for cash, ordinary shares or a combination of both to certain circumstances.

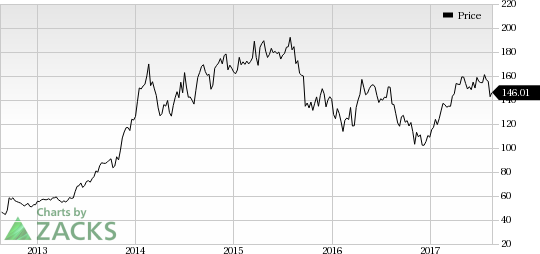

Jazz’s shares have significantly outperformed the industry so far this year. The stock has surged 33.9% compared with the industry’s 3% decrease during the same period.

The initial purchasers have a 13-day option to buy up to an additional $75 million aggregate principal amount of notes.

The net proceeds from the offering are expected to be used by Jazz to fully or partially repay a portion of its outstanding $500 million debt under its revolving credit facility. Also, the company plans to use the remaining net proceeds, if any, for general corporate purposes, including potential business development activities.

The company already completed a private placement of another $575.0 million principal amount of exchangeable notes due 2021 in August 2014, bearing an annual interest of 1.87%.

Significantly, Jazz has been very active on the acquisition front. Deals include the company’s buyout of biopharma company, Gentium, which added Defitelio (treatment of severe hepatic VOD) to its portfolio. With the Celator merger in May last year, Jazz has added Vyxeos to its pipeline.

The company completed the rolling NDA submission for Vyxeos to the FDA in March for treatment of acute myeloid leukemia (AML). Later in May, the FDA accepted Vyxeos NDA under priority review. Hence, Jazz expects this Celator takeover to be earnings accretive from 2018.

Zacks Rank & Stocks to Consider

Jazz currently carries a Zacks Rank #2 (Buy). Some other stocks worth considering in the pharma sector are Summit Therapeutics PLC (NASDAQ:SMMT) , Aduro Biotech, Inc. (NASDAQ:ADRO) and ACADIA Pharmaceuticals Inc. (NASDAQ:ACAD) , all three carrying a Zacks Rank #2 as well. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Summit’s loss estimates narrowed from $2.59 to 32 cents for 2018 over the last 60 days. The company delivered a positive earnings surprise in each of the trailing four quarters with an average beat of 25.55%. Its share price soared 48.4% so far this year.

Aduro Biotech’s loss per share estimates narrowed from $1.46 to $1.32 for 2017 and from $1.54 to $1.24 for 2018 over the last 30 days. The company delivered positive surprises in two of the trailing four quarters with an average beat of 2.53%.

ACADIA’s loss estimates narrowed from $2.82 to $2.65 for 2017 and from $2.07 to $1.98 for 2018 over the last 30 days. The company came up with a positive earnings surprise in two of the trailing four quarters with an average beat of 3.52%.

4 Surprising Tech Stocks to Keep an Eye on

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really take off.

Aduro Biotech, Inc. (ADRO): Free Stock Analysis Report

ACADIA Pharmaceuticals Inc. (ACAD): Free Stock Analysis Report

Jazz Pharmaceuticals PLC (JAZZ): Free Stock Analysis Report

Summit Therapeutics PLC (SMMT): Free Stock Analysis Report

Original post

Zacks Investment Research