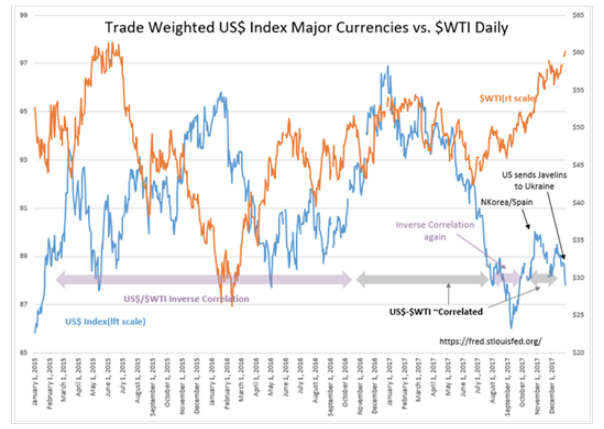

I am a long-term investor with the goal of taking advantage of long-term market cycles which can last 5yrs-10yrs. Just the same, my research always pays attention to changes in market psychology and whether or not this correlates to fundamentals. It has been fascinating to watch US crude inventories fall more than 100mil BBL since March 2017 in the face of the market perception of a continued ‘oil glut’. It has been fascinating to watch algorithm trading impose an inverse US$/$WTI relationship since 2003, then watch its dominance waver with geopolitics and then see the algorithmic dominance reappear the past few days.

Markets are never simple with multiple cross currents competing for dominance every day. The US$/$WTI which has had an algorithmic imposed inverse correlation since 2003 has had periods of correlation depending on geopolitical headlines the past 12mos. Which pattern would win out did not permit simple analysis. At the moment, it appears that the inverse relationship is taking control. The rise in $WTI over $60/BBL is also correlated to the nearly 3yr low US crude inventories.

The media chatter supports a shift towards energy related issues simply because they have been so out of favor. The current cold snap pushing natgas and home heating oil demand is helpful. I cannot help but also notice that US sending Javelin missiles to Ukraine for defense against Russia’s invasion may be responsible for the sudden weakness in the US$. Russia’s invasion of Ukraine in 2014 was responsible for US$ strength as capital sought safe haven in US$ assets. Sending Javelins to Ukraine may have the same impact as sending Stinger missiles to Afghanistan which were responsible for the rapid end of the 9yr Russian invasion of that country. This potential is not lost on investors and capital may have already begun to repatriate to Emerging Markets resulting in US$ weakness. A good sign in my opinion.

To see more posts on any of the companies mentioned in this article, enter their stock ticker symbol in the search box.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.