In my latest Hurriyet Daily News column, I discuss why the weakness in the yen did not result in an improvement in the country’s trade balance, as the J-curve effect would predict (and therefore it is a curse) and what this would mean for Turkey. As usual, you can read the whole thing at the HDN website. For a change, I only have a couple of additional points to make, mainly in response to my Twitter followers, who made excellent comments when I tweeted the column:

One reader asked me to specify “the numbers”: I don’t want to get into too much details, especially forecasts, in the column for a number of reasons. For one thing, I have limited space (3000 characters, about 500 words) in the column- space that I would not like to spend with spitting out a bunch of projections that will not hit bull’s eye anyway:) And besides, the thing I hated most about being a market economist was that I had to have forecasts for everything. And so I enjoy the very bearable lightness of being solely a columnist- and yet another movie reference!:) Anyway, I expect the current account deficit to be 5-5.5 percent of GDP this year. Considering it was probably (we’ll know for sure at the end of March when 4Q13 National Accounts are released) 7.5 percent of GDP at the end of 2013, that is quite an adjustment, but nowhere near the 2.5-3 percent some are expecting (for example credit ratings agency S&P in its latest assessment of the Turkish economy). By the way, as I mentioned in the column, the mean of projections in the Central Bank’s survey of expectations ($53 bn)is a bit higher than this, but their growth forecast of 2.8 percent is also higher than my 2-2.5 percent. Besides, those expectations lag a bit; we’ll probably see a downward revision in both growth and deficit expectations when the Central Bank releases the March survey in a couple of weeks. To give you some sort of perspective, Ozlem Derici of Deniz Invest sees the end-year deficit at $ 46.6 bn, corresponding to 5.9 percent of GDP.

Moving on, another Twitter follower noted that we observed a J-curve effect in 2011. I had in mind 2009, when we didn’t. That’s what I actually meant when I noted in the column that ” the deficit is now less sensitive to lower growth rates”. In other words, I believe 2009 was no exception; 2011 was! Unless Turkey undertakes key structural reforms to tackle the country’s competitiveness, among other things, that will be our “new normal”. BTW, I am not the only one who thinks so: Ankara think-tank TEPAV’s director (and fellow HDN columnist) Guven Sak recently made similar arguments in his column in Turkish business daily Dunya. He thinks that, in addition to energy imports, the plunge in the savings rate and the country’s deindustrialization are to blame.

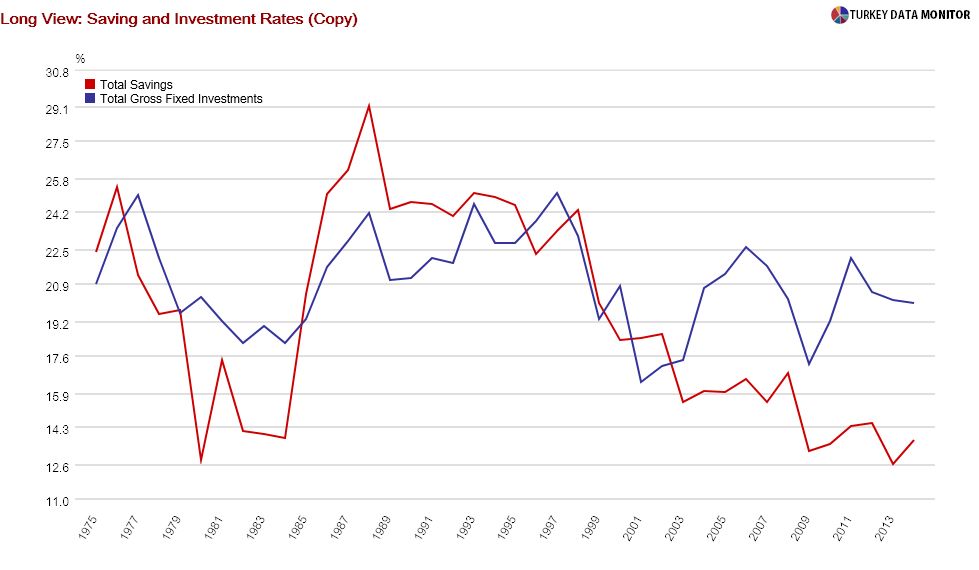

He may be right, but it is important to note that Turkey’s saving rate is falling since the mid-80s. So this is not a new phenomenon:

Similarly, while the share of industry, and specifically manufacturing, in GDP has been on the decline, it has actually risen a little bit in the last decade:

That’s all folks…