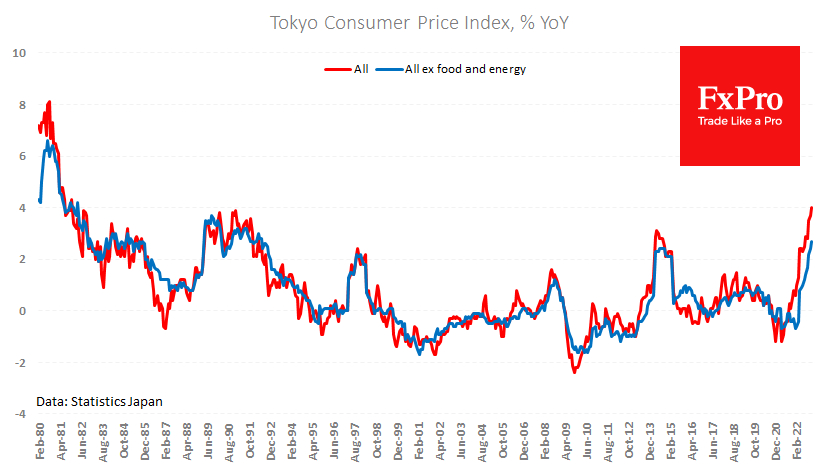

The deflationary days in Japan will become history for at least the next few years. The released advance data from Tokyo yesterday pointed to a further acceleration in the year-on-year price increase.

The overall CPI rose from 3.7% to 4.0% last month, and excluding food and energy, rose by 2.7% y/y. For the former index, these are highs in more than 40 years, and for the latter, they are more than 30.

Fast Retailing, the owner of Uniqlo, was shocked today with the announcement of a 40% pay rise. This is a separate but telling case, signaling a change in a multi-year trend toward cost-cutting.

If this case becomes a trend (albeit not with such a shocking increase), it risks triggering the inflationary spiral that the Central Bank has tried to curb in vain for years.

For companies, wage increases could be the start of competition for labor resources and consumers, a source of both higher income and higher costs, as wage increases will sooner or later begin to be built into prices.

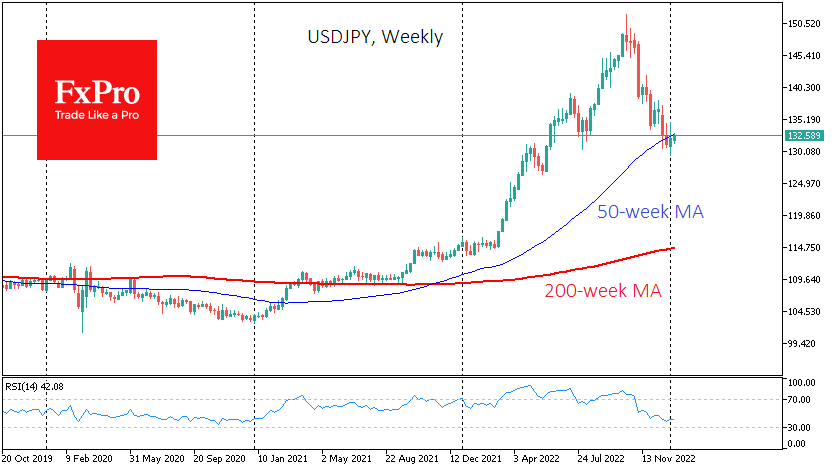

Inflationary news is good for the Japanese yen as it sets the stage for a tightening monetary policy by the Bank of Japan in the coming months. The USD/JPY has retreated 13.5% in the previous two months from a peak of 152 to 132.5.

Nevertheless, the pair remains high by historical standards and is still 30% higher than at the start of 2021, further boosting inflation trends: prices in Japan continue to rise while US and European annual inflation has been declining for the past few months.