Weak data has been driving the USD/JPY pair which saw a ten week high hit before pulling back on weak US employment figures. BoJ Governor Haruhiko Kuroda said he would implement another round of stimulus if inflation remains low thanks to energy prices and at this stage that looks a given.

Japanese average cash earnings turned sour with last week's results showing a drop of -2.4% y/y. This is only adding to the headaches the BoJ are facing as the economy limps along. Yen traders hammered the yen and pushed it to a 10 week high just above the psychological 125.00 level. The pair pulled back after US Nonfarm result was weaker than expected as it came in at 215k vs 224k exp. This will likely not help the case for an interest rate rise, so it’s no surprise to see the dollar affected.

The pain is likely to continue for the yen thanks to the Bank of Japan tying the expected next round of stimulus even more closely to oil prices. BoJ Governor Kuroda said he would implement more stimulus if oil prices continued to drop, thanks to its effect on inflation. This could see the recent highs come under real pressure this week if oil slips further. Questions will begin to be asked about the effectiveness of the QE programme and whether another round is a good idea.

Already this week we have seen the Japanese current account figure released and it is yet another cause for concern. The account balance fell from 1.64t to 1.30t thanks to the weakening yen making imports more expensive. Watch for the BoJ monthly report and the monetary policy meeting minutes this week along with tertiary industry activity figures and machine orders which are also due. The US side will be busy as usual with retail sales and more jobs data.

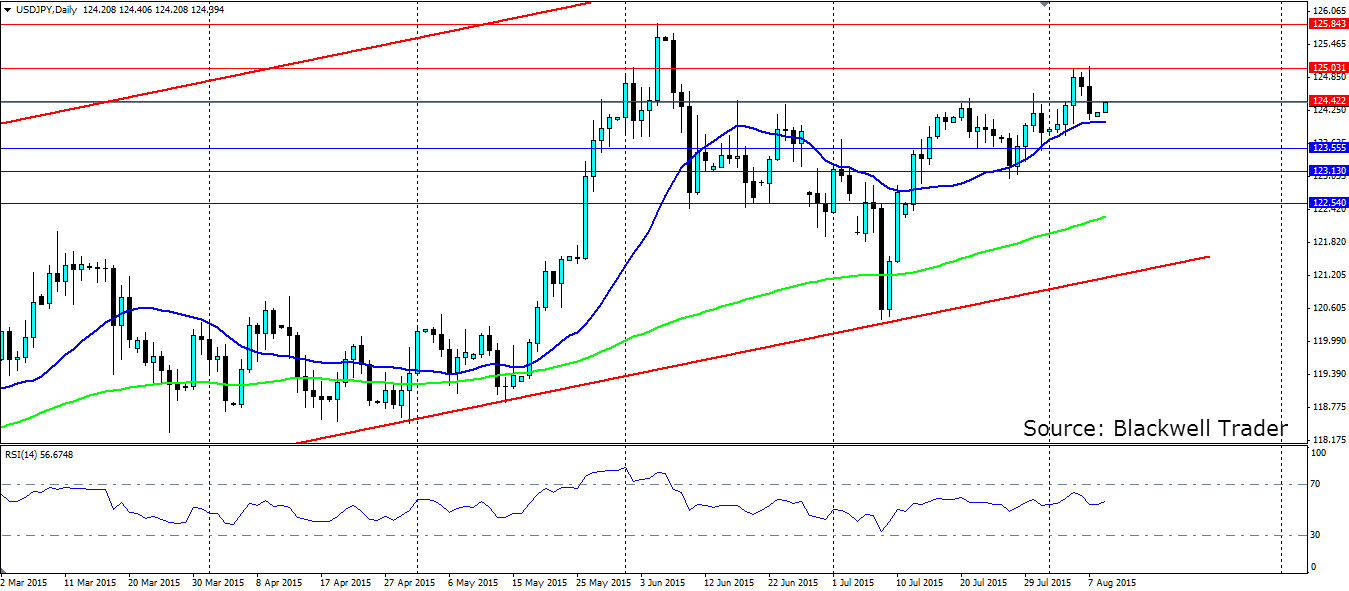

Looking at the technical analysis and the pair is looking bullish after breaking the resistance at 124.42. It has pulled back under it but with higher lows and the MAs looking bullish, we can expect the recent highs to come under pressure. Look for support at 123.55, 123.13 and 122.54 while resistance is found at 124.42, 125.03 and 125.84.