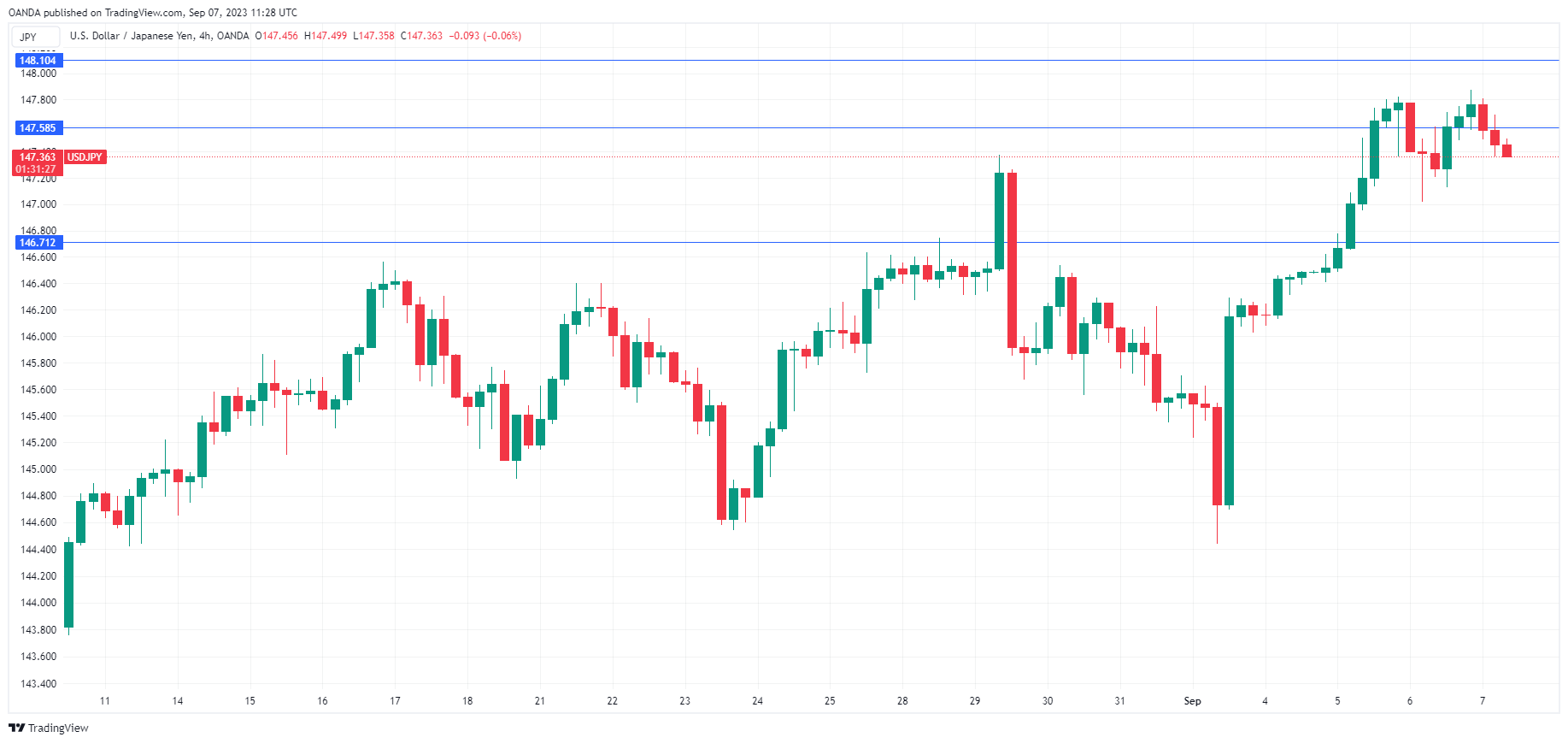

The Japanese yen is slightly higher on Thursday. In the European session, USD/JPY is trading at 147.39, down 0.19%.

The yen can’t seem to find its footing and has dropped close to 1% this week. Earlier today, the yen fell as low as 147.87, closing in on the 148 line which has held since October 2022.

Bank of Japan policymakers don’t make public statements or hold interviews nearly as much as Fed members, and I must admit to being pleasantly surprised at seeing that two BoJ officials had made public comments in as many days. I have found the Fed to be considerably more transparent than the BoJ, and the more we hear from BoJ policymakers, the better, especially during a time of expectations of a shift in BoJ policy.

On Wednesday, Bank of Japan member Hajime Takata said that the BoJ needed to “patiently maintain” its massive monetary stimulus, noting that the central bank would need a year to determine whether recent wage increases were sustained. The BoJ has insisted that it will not tighten policy until it sees evidence that inflation is sustainable, such as higher wage growth.

What was more interesting was that Takata said that Japan’s economy is “finally seeing early signs of achieving the BoJ’s 2% inflation target”. This may not be a ringing endorsement that the target is close, but at least is an acknowledgment of broad inflationary pressures, which the BoJ has tended to downplay despite core CPI exceeding the 2% target for 16 consecutive months.

On Thursday, BoJ member Junko Nakagawa had a more dovish message, saying that the central bank needed to maintain its ultra-loose monetary policy and argued that there was an “equal degree of upside and downside risks to the inflation outlook”, which made it difficult to determine when inflation might hit 2% in a sustainable manner.

The BoJ next meets on September 22nd and the markets will be looking for hints of a shift in policy, which could have major ramifications on the direction of the Japanese yen.

USD/JPY Technical

- USD/JPY is testing support at 147.58. Below, there is support at 146.71

- 1.4810 and 1.4893 are the next resistance lines