The Japanese yen edged mildly lower as the week starts. Q3 GDP was revised lower to -0.5% qoq, down from prior estimate of -0.4% qoq and compared to expectation of 0.1% qoq. The worst than expected contraction indicated that the prime minister Shinzo Abe's first sales tax hike back in April had bigger than expected impact on the economy. And it backed his decision to call for delay in the second sales take hike. Abe planned to postpone the second tax hike, from current 8% to 10%, by 18 months to April 2017. And he pulled ahead an election two years ahead of schedule to secure the mandate for his economic policies. The snap election would be held on December 14. Also released from Japan, current account surplus widened to JPY 0.95T in October. USD/JPY took out 120 psychological level last week firmly and is picking up momentum ahead. The pair would likely stay firm this week for next key resistance level at 124.13.

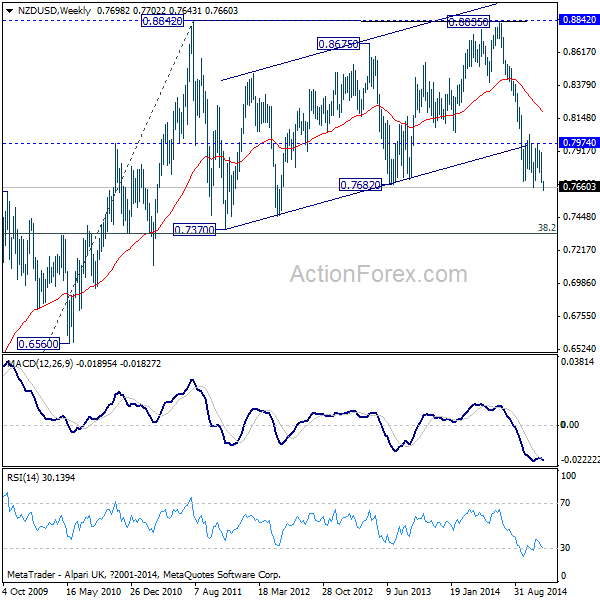

New Zealand manufacturing activity dropped for another quarter by -1.2% in Q3. RBNZ will meet later this week and is expected to keep the key interest rate at 3.50%. There are speculations that RBNZ could turn into a more neutral stance and indicate that it would pause the tightening cycle longer. NZD/USD also dips as the week starts and reaches as low as 0.7643 so far. The break of November's low of 0.7659 suggests that recent fall from 0.8835 has resumed. Such decline is viewed as the third leg of the pattern fro 0.8842. Near term outlook will stay bearish as long as 0.7974 resistance holds and further fall should be seen to 0.7370 support.

As for today, China trade balance will be a focus for Aussie and Kiwi traders. Germany will release industrial production. Eurozone will release Sentix investor confidence. Swiss will release CPI and retail sales. Canada will release housing starts and permits.

Latest CFTC data showed that net positions in major currencies were basically unchanged on December 2 comparing to the prior week. Euro net short dropped slightly from -165k to -159k. Sterling net short rose slightly from -30k to -31k. Yen net short rose slightly from -104k to -111k. Canadian Dollar net short rose slightly from -16k to -18k. Aussie net short dropped slightly from -44k to -41k.