US Dollar Index Speculator Positions

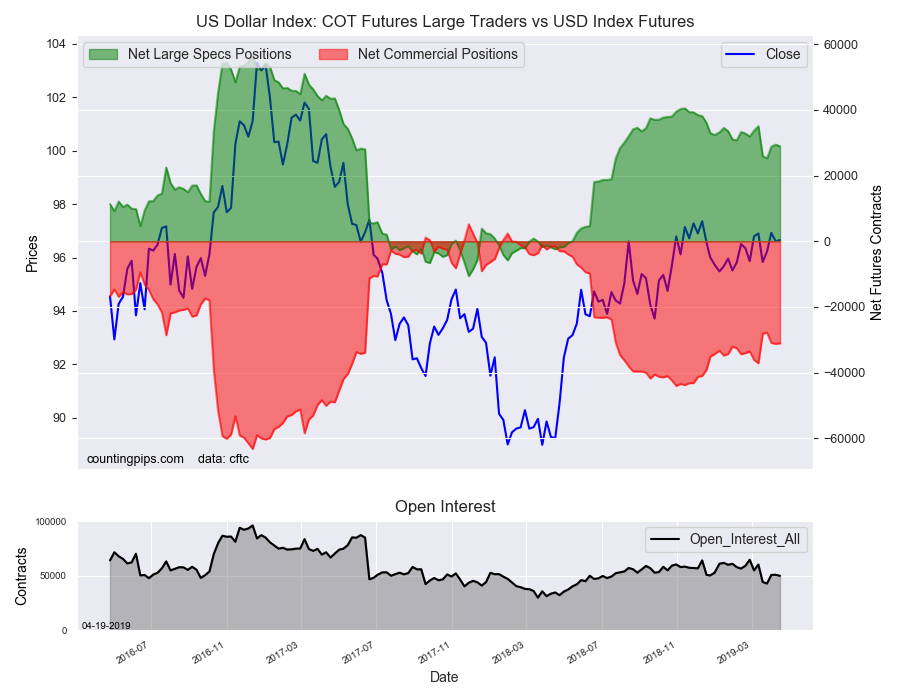

Large currency speculators reduced their bullish net positions in the US Dollar Index futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 28,938 contracts in the data reported through Tuesday, April 16th. This was a weekly decrease of -508 contracts from the previous week which had a total of 29,446 net contracts.

This week’s net position was the result of the gross bullish position declining by -1,443 contracts to a weekly total of 43,126 contracts that overtook the gross bearish position total of 14,188 contracts which also saw a decline by -935 contracts for the week.

The speculative net position had risen for two straight weeks before this week’s decline. The current standing overall has remained very steady in bullish territory and above the +25,000 net contract level for thirty-nine straight weeks. Despite the bullish positioning streak, we have seen a little bit of weakening recently in the dollar sentiment as net contracts have now been below +30,000 contracts for the past five weeks.

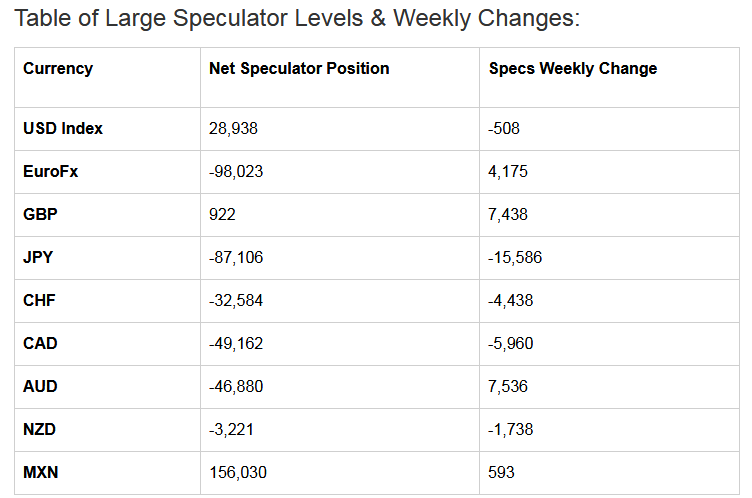

Individual Currencies Data this week:

In the other major currency contracts data, we saw just one substantial change (+ or – 10,000 contracts) in the speculators category this week.

Japanese yen positions saw bearish bets rise sharply this week by more than -15,000 contracts. The yen position had been shedding bearish bets in January and February but have now picked up in March and April. Currently, the overall yen standing is at the most bearish level since December 31st when the net position totaled -88,623 contracts.

Overall, the major currencies that saw improving speculator positions this week were the euro (4,175 weekly change in contracts), British pound sterling (7,438 contracts), Australian dollar (7,536 contracts) and the Mexican peso (593 contracts).

The currencies whose speculative bets declined this week were the US dollar index (-508 weekly change in contracts), Japanese yen (-15,586 contracts), Swiss franc (-4,438 contracts), Canadian dollar (-5,960 contracts) and the New Zealand dollar (-1,738 contracts).

Other Notables for the week:

British pound sterling bets went into a (small) bullish position for the first time since June 6th of 2018. GBP bets have now gained for two straight weeks and for four out of the past five weeks. Overall, there has been a significant drop in trader action in this market as the Brexit deadline prompted traders to pull back on positions. The open interest levels (contracts open in the market) dropped from a 3-year average above +200,000 contracts to an average around +145,000 contracts in the five weeks through April 16th.

Australian dollar speculator bets rose for a second straight week and the overall bearish position dipped to the least bearish level of the past five weeks. Previously, AUD bets had gone more bearish for five straight weeks to the most bearish standing since November.

Euro positions improved after four straight weeks of increasing bearish positions. The gain this week brought the speculator position below the -100,000 net contract level and off the most bearish level since December 6th of 2016 which was reached last week.

See the table and individual currency charts below.

Weekly Charts: Large Trader Weekly Positions vs Price

EuroFX:

The Euro large speculator standing this week was a net position of -98,023 contracts in the data reported through Tuesday. This was a weekly advance of 4,175 contracts from the previous week which had a total of -102,198 net contracts.

British Pound Sterling:

The large British pound sterling speculator level equaled a net position of 922 contracts in the data reported this week. This was a weekly rise of 7,438 contracts from the previous week which had a total of -6,516 net contracts.

Japanese Yen:

Large Japanese yen speculators recorded a net position of -87,106 contracts in this week’s data. This was a weekly reduction of -15,586 contracts from the previous week which had a total of -71,520 net contracts.

Swiss Franc:

The Swiss franc speculator standing this week equaled a net position of -32,584 contracts in the data through Tuesday. This was a weekly decrease of -4,438 contracts from the previous week which had a total of -28,146 net contracts.

Canadian Dollar:

Canadian dollar speculators totaled a net position of -49,162 contracts this week. This was a reduction of -5,960 contracts from the previous week which had a total of -43,202 net contracts.

Australian Dollar:

The large speculator positions in Australian dollar futures was a net position of -46,880 contracts this week in the data ending Tuesday. This was a weekly lift of 7,536 contracts from the previous week which had a total of -54,416 net contracts.

New Zealand Dollar:

The New Zealand dollar speculative standing equaled a net position of -3,221 contracts this week in the latest COT data. This was a weekly decrease of -1,738 contracts from the previous week which had a total of -1,483 net contracts.

Mexican Peso:

Mexican peso speculators was a net position of 156,030 contracts this week. This was a weekly boost of 593 contracts from the previous week which had a total of 155,437 net contracts.

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).