- Japanese yen dips below 145 line

- Japan’s GDP expected to expand by 3.2%

- US retail sales projected to rise by 0.4%

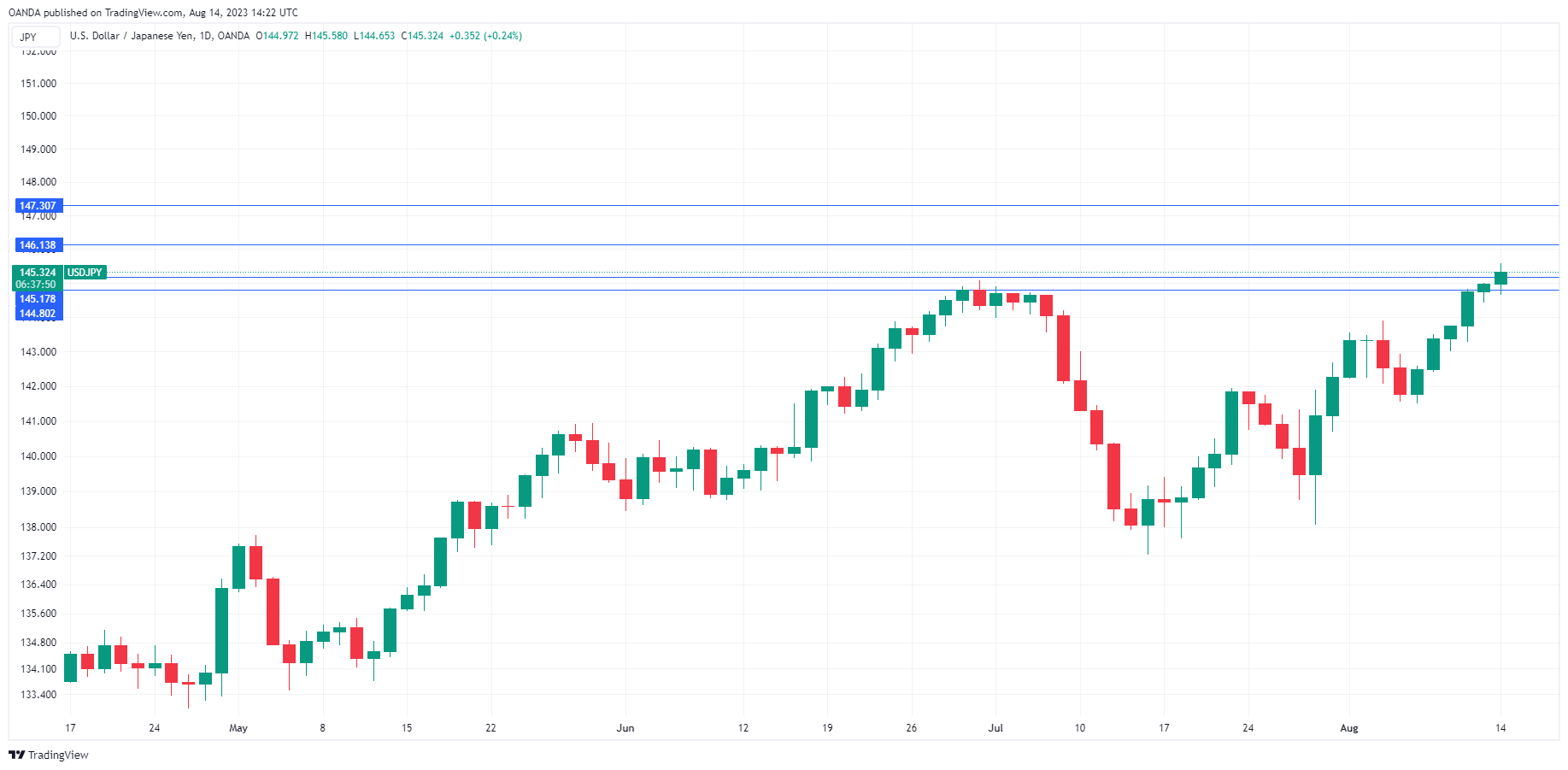

The Japanese yen continues to slide. USD/JPY touched the symbolic 145 line on Friday and moved higher on Monday. In the North American session, USD/JPY is trading at 145.37, up 0.27%.

The yen had its worst week of the year, falling 2.26%, and dropped on Monday as low as 145.58, its lowest level since November 2022. Investors didn’t forget the currency interventions late in 2022 that shocked the markets and sent the yen higher, albeit only briefly. At the time, the yen had fallen below 150, which proved to be a line in the sand for the Ministry of Finance (MOF).

The yen may not be currently at 150, but there’s no doubt that the yen’s sharp deterioration in just a few weeks is making policymakers nervous – just one month ago, USD/JPY was trading around 138. The MOF and the Bank of Japan have said in the past that they are most concerned with sharp swings in the exchange rate and not so much with a particular value for the yen. If the sharp deterioration in the yen continues, we could see another dramatic currency intervention by the MOF.

Japan starts off the week with Preliminary GDP for Q2 today. The economy is expected to have expanded by 3.2% y/y, up from 2.7% in the first quarter. There has been some improvement in domestic demand, and if that trend continues, there will be more pressure on the Bank of Japan to shift away from its ultra-loose monetary policy.

The US economy remains in solid shape despite the Fed’s aggressive rate-hike cycle. Retail sales for July will be released today. Headline retail sales and the core rate are both expected to accelerate to 0.4% m/m in July, up from 0.2% in June. This would signal resilient consumer spending as inflation continues to fall.

USD/JPY Technical

- There is resistance at 146.13 and 147.31

- 145.17 is providing support, followed closely by 144.79