Having traded in a tight range recently, USD/JPY has broken down yesterday. The momentum goes on and the pair’s losses keep mounting. Let’s explore what kind of change in outlook have these moves brought.

Let’s recall our yesterday’s observations as they’re still up-to-date:

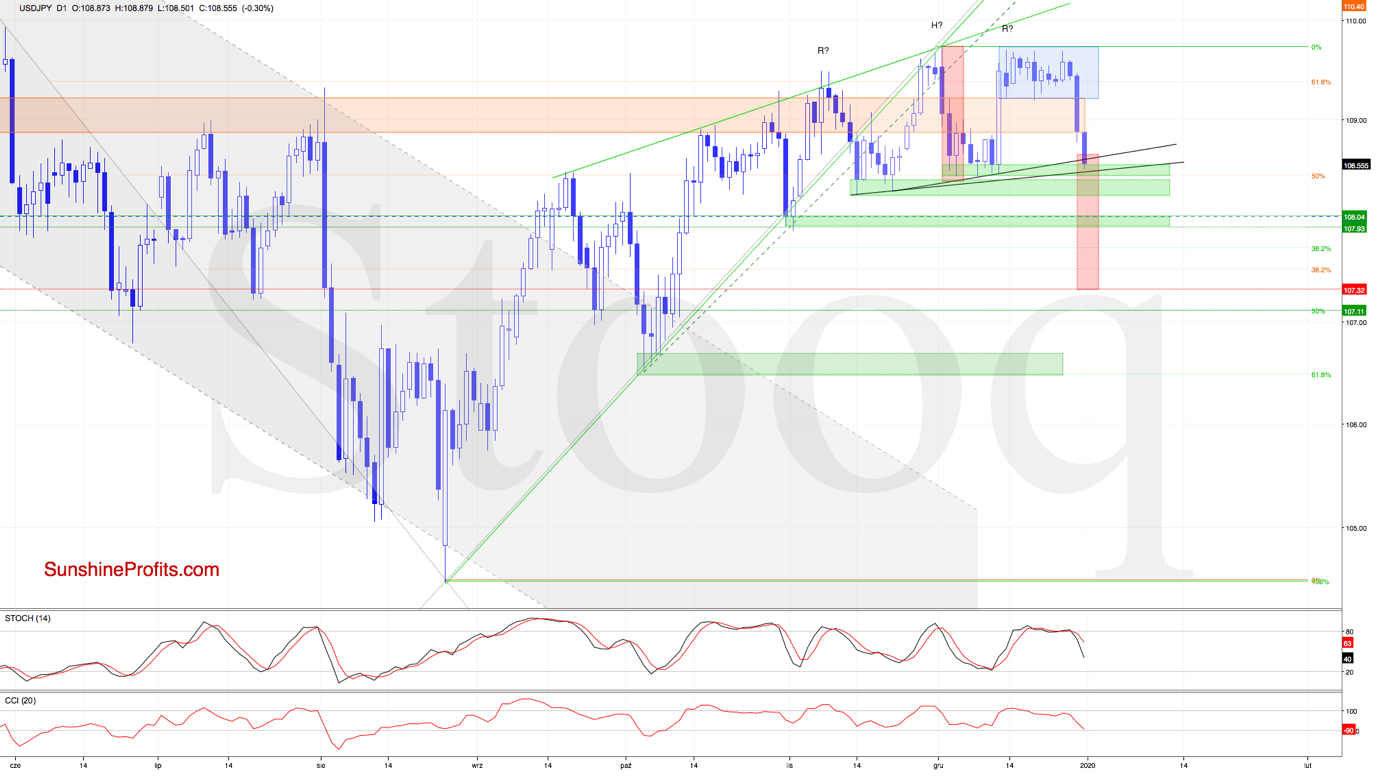

(…) the exchange rate is still trading below the rising green wedge, which suggests that another reversal may be just around the corner. This is especially the case when we factor in a potential head-and-shoulders formation.

Should it be the case and the pair moves lower from here, thus creating the right arm of the formation, the first downside target will be the support area created by the early December lows.

The situation has indeed developed in tune with our assumptions, and USD/JPY moved sharply lower after our yesterday’s Alert was posted.

Earlier today, the pair extended losses, making our short positions even more profitable. Today’s downswing brought the exchange rate below the black support line that is based on previous lows. It suggests that further deterioration may be just around the corner – especially when we factor in the sell signals generated by the daily indicators.

If this is the case and the pair extends losses from here, where could the bears aim to go? We would likely see not only a test of the next green support zone based on the mid-November lows, but also a test of the lows created at the turn of October and November, which is where our initial downside target currently is.

There’s one more thing, and it’s the head and shoulders formation in the making. The exchange rate dropping below the lower black support line (that would be the neck line) could trigger a move even to around 107.32. This is where the size of the downward move would correspond to the height of the head-and-shoulders formation.