The USD/JPY pair has risen to 161.65, with the market cautious ahead of today's US consumer price index release. Despite this, the yen remains weakened by the significant interest rate differential between the Bank of Japan (BoJ) and the Federal Reserve.

Earlier this year, the BoJ abandoned its longstanding negative interest rate policy, adjusting the rate to zero. However, this adjustment has not halted the yen's depreciation, raising concerns about the currency's ongoing decline.

Investors eagerly await the BoJ's meeting in July, where crucial decisions on bond purchases are expected. The outcome of this meeting could mark a significant shift in Japan's monetary policy.

Mixed Economic Signals from Japan

Morning statistics from Japan showed mixed results. Core machinery orders declined by 3.2% month-on-month in May, following a 2.9% decrease the previous month. However, on an annual basis, these orders increased by 10.8%, surpassing the expected 7.2% growth, suggesting some underlying strength in the industrial sector.

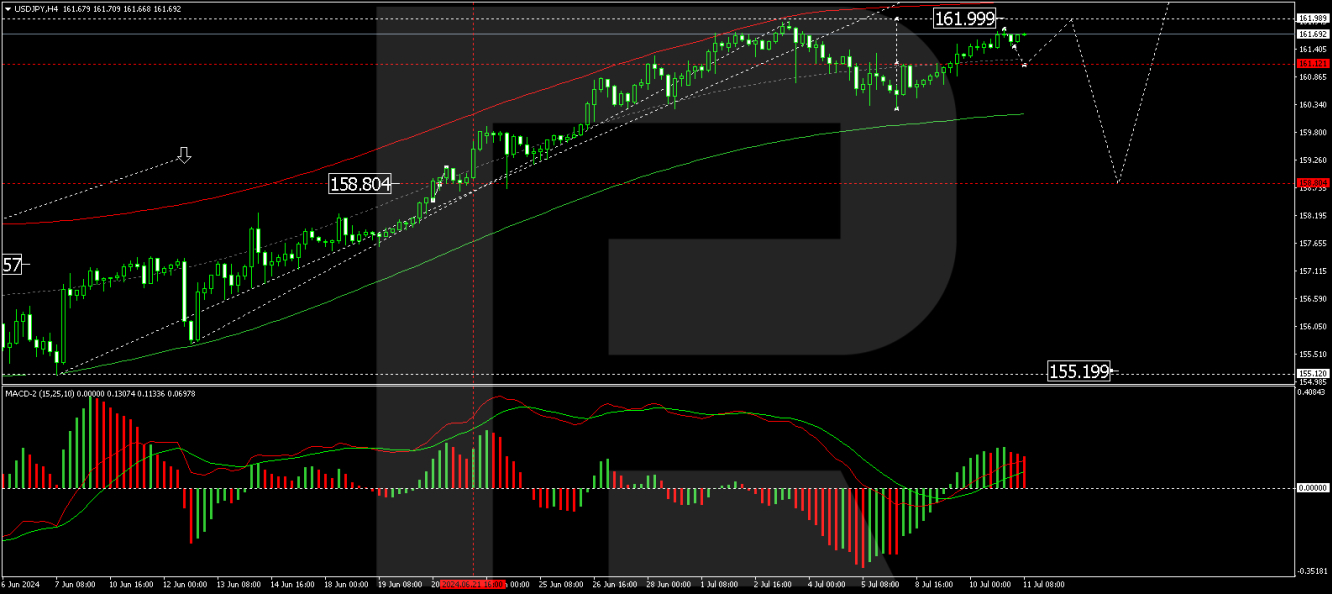

USD/JPY Technical Analysis

The USD/JPY is establishing a consolidation range around 161.12. The price could reach up to 162.00, considered a local target within the current upward trend. Following this level, a correction to 158.80 is anticipated, which could lead to another growth phase targeting 163.30.

This bullish outlook is supported technically by the MACD indicator, where the signal line is prominently above zero and oriented upward.

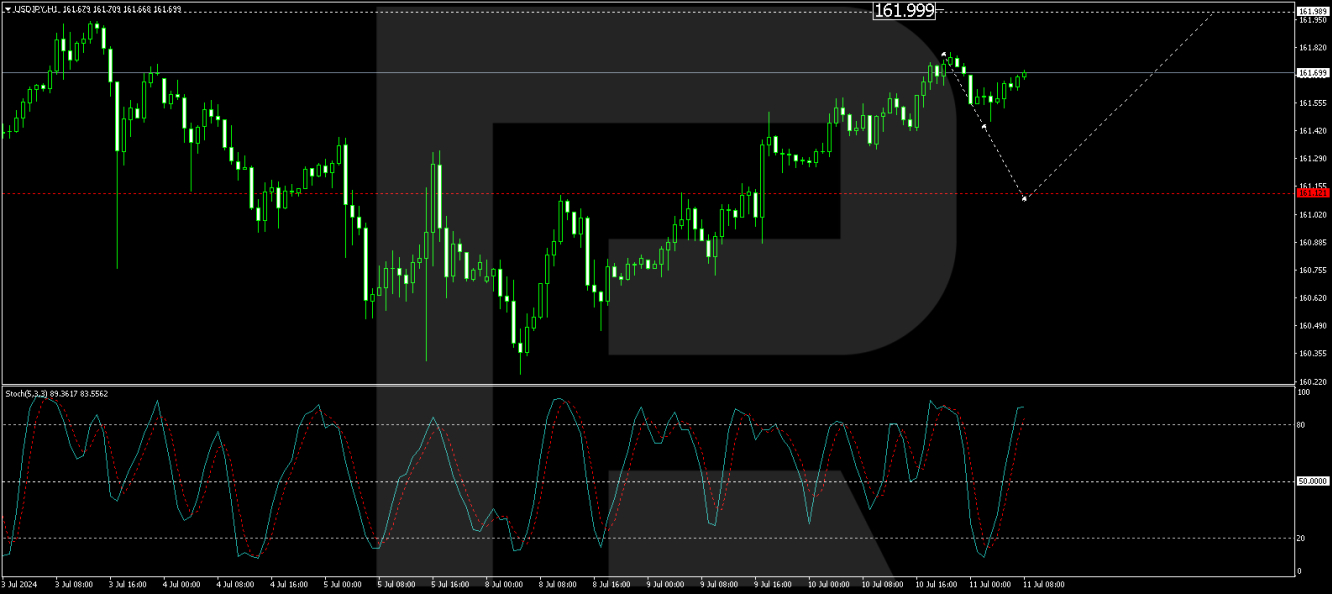

On the H1 chart, the pair has completed a growth structure, reaching 161.79. Currently, a downward impulse to 161.47 has been observed. A continuation of this correction to 161.12 is expected, which should precede another rise to 162.00.

This analysis is corroborated by the Stochastic oscillator, with the signal line poised to drop from above 80 to 20, indicating potential short-term pullbacks before further gains.

Investors and traders will closely monitor upcoming data releases and central bank communications to gauge the potential directions for both the yen and broader currency markets.

By RoboForex Analytical Department

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.