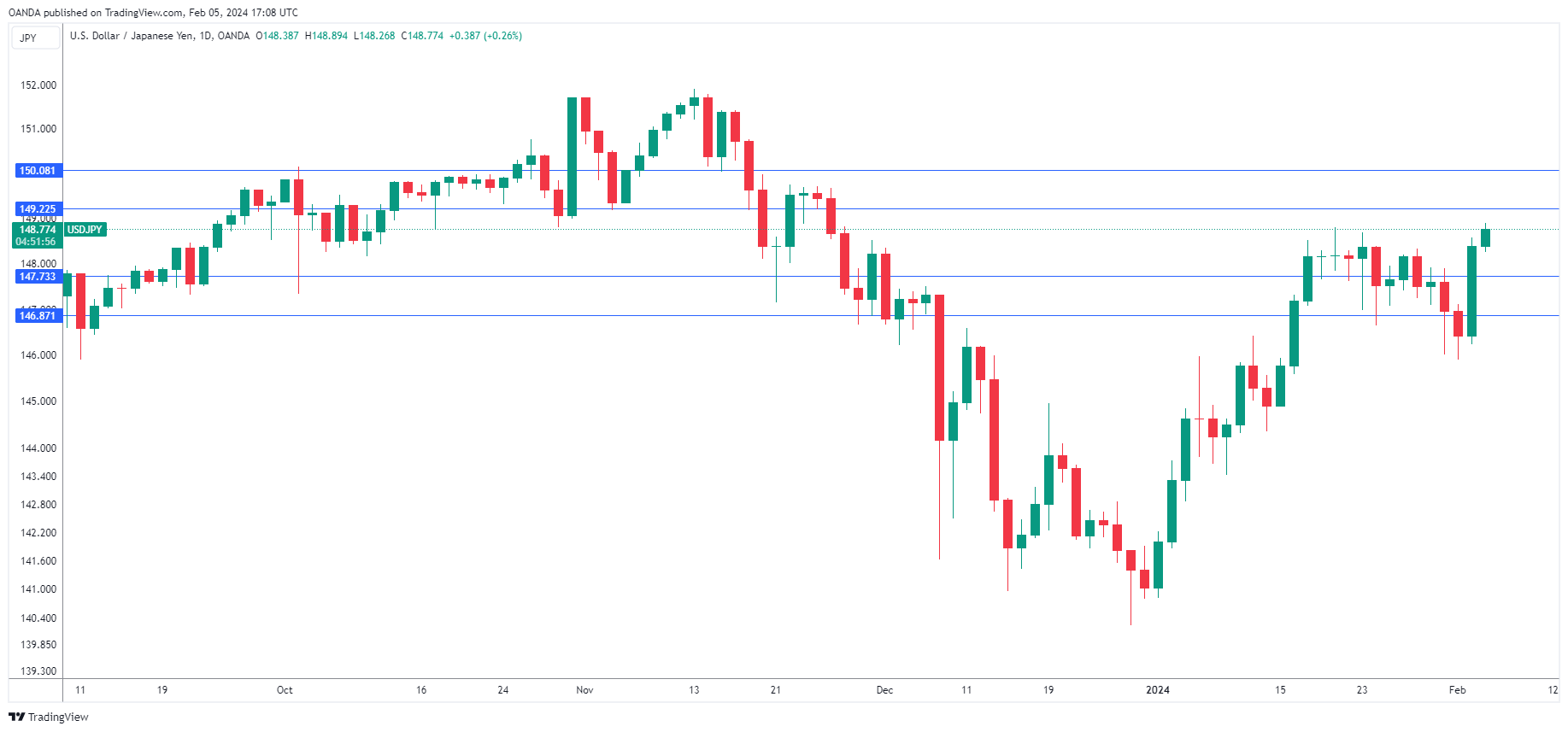

The Japanese yen continues to lose ground in the aftermath of the US nonfarm payroll report, which was much stronger than expected. In the North American session, USD/JPY is trading at 148.88, up 0.33%.

Yen tumbles after hot US nonfarm payrolls

The US dollar ended the week on a high note, courtesy of nonfarm payrolls soaring to 353 thousand in January, crushing the market estimate of 180,000. The December reading was revised upwards to 333,000, up from 216,000, as the US labour market is showing impressive strength.

The yen has looked anemic since New Year’s, sinking 5.4%. On Friday, the US dollar posted sharp gains against the major currencies and climbed 1.3% against the yen, its worst one-day performance since October 31.

Japan releases wage growth and household spending data on Tuesday, with both expected to accelerate in December. Household spending is expected to post a gain of 0.2% m/m after a 1% decline in November. Average cash earnings are projected to climb 1.3% y/y, up from 0.2% in November.

The Bank of Japan is watching closely, as solid income and spending data on Tuesday would support the view that the economy is improving and is strong enough to handle an exit from negative interest rates. Governor Ueda and other senior bank officials have hinted that the BoJ plans to phase out its ultra-loose monetary policy, which has been in place since 2016. A shift in policy would mark a sea-change for the BoJ and the yen would likely climb sharply. The markets are keeping a close eye on the BoJ and policy meetings have become potential market changers.

There are signs that wages and service prices are pushing higher, which means that a policy change could be announced in April or in June. National wage negotiations will start next month and are expected to result in higher wages for workers, which would put pressure on the BoJ to tighten policy.