The Japanese yen continues to slide and is down 1.41% this week. In Tuesday’s European session, USD/JPY is trading at 143.16, up 0.64%.

Dollar/yen powers above 143

The yen continues to lose ground against the US dollar. Earlier in the day, the yen weakened to 143.18, its weakest level against the US dollar since July 7th. The yen has plunged 370 basis points since Friday when the Bank of Japan stunned the markets and tweaked its yield control (YCC) policy.

The Bank of Japan has loosened its YCC and this has sent the yen sharply lower. The BoJ had set a rigid cap of 0.50% yields on 10-year government bonds but has turned that cap into a yardstick, saying it would offer to purchase JGBs at 1%. The 10-year yield rose has risen to a multi-year high of 0.61% and there is a strong possibility of the yield continuing to rise.

The BoJ has been an outlier of central banks, sticking to its policy of negative rates. True, inflation in Japan is much lower than in other developed economies, but there is growing criticism that this policy is outdated and the central bank needs to take further steps toward normalization. Governor Ueda stressed on Friday that the YCC tweak was not a move towards normalization and we’re unlikely to see any tightening from the BoJ unless inflation moves significantly higher.

In the US, ISM Manufacturing PMI is today’s key release. The manufacturing sector remains in the doldrums and has been in decline since October, with readings below the 50.0 level. Demand has been weak and production has been declining due to the lack of orders. In June, the Manufacturing PMI slipped to 46.0, the lowest level since May 2020. Another decline is expected for July, with a consensus estimate of 46.8 points.

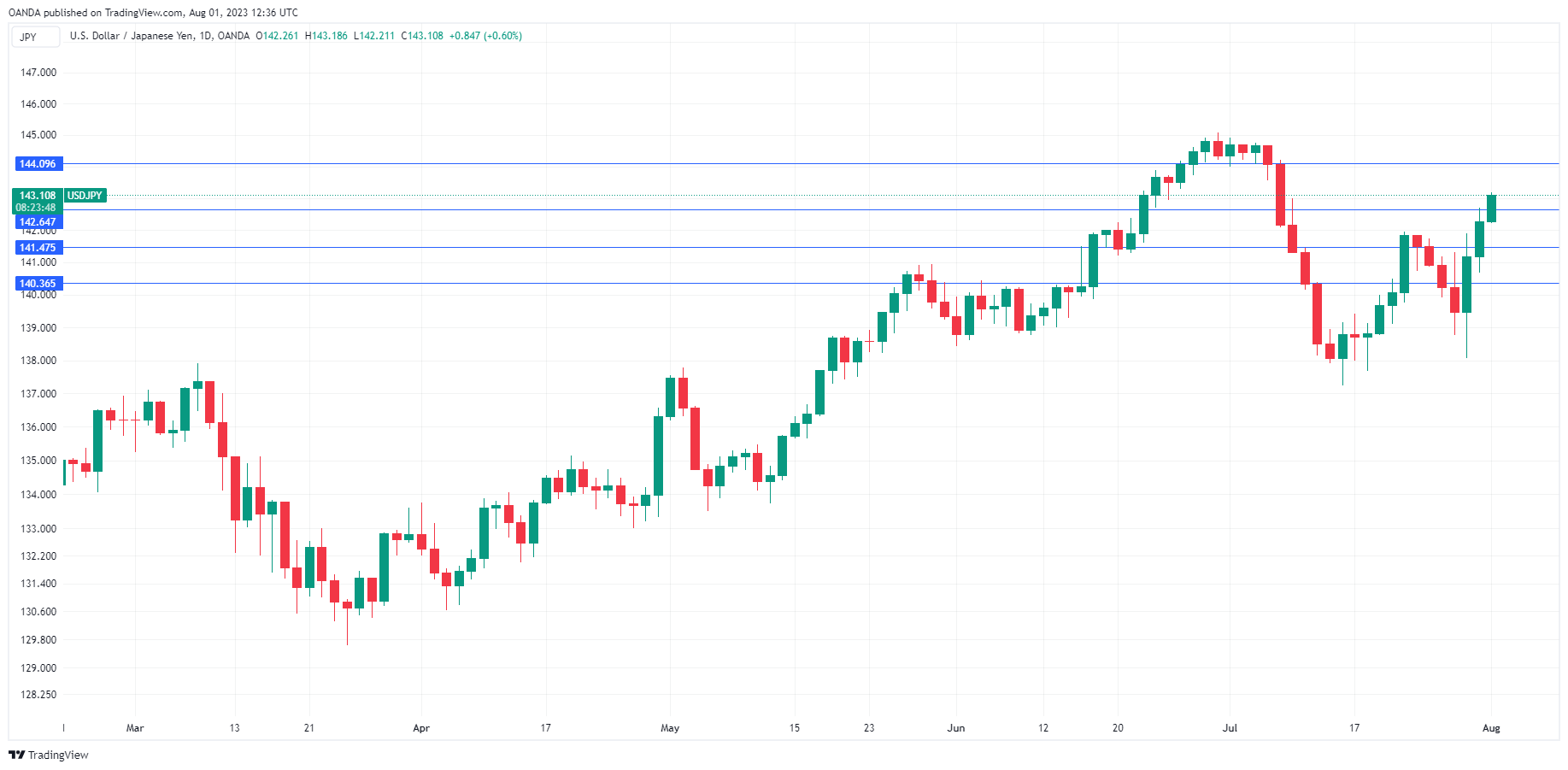

USD/JPY Technical

- USD/JPY has pushed above resistance at 142.63. Above, there is resistance at 144.09

- There is support at 141.47 and 140.35