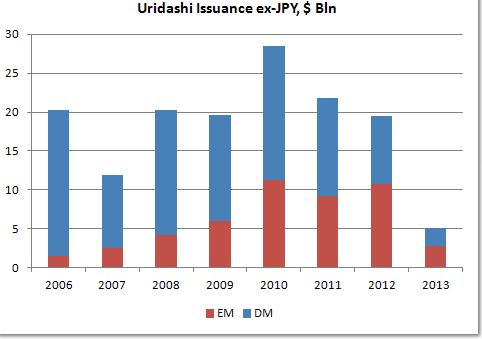

With all the talk about Japanese money going into EM, we thought it would be interesting to look at recent trends in Uridashi bond issuance. As always, we net out JPY-denominated issues in order to focus on the foreign currency aspects of the Uridashi market. Foreign currency-denominated issuance peaked near $28.5 bln in 2010 before falling to near $22 bln in 2011 and $19.5 bln in 2012. So far in 2013, we are on a $15 bln pace for the entire year, which is significantly slower pace than what was seen in 2012 in terms of non-JPY issuance.

Marketed to retail investors, Uridashi bonds represent only a very small slice of the FX market. However, we believe that the observed trends in the Uridashi market reflect those of the larger Japan investment community as well. Given near-zero rates in much of the DM and relatively high interest rates still in pockets of EM, we think that the flows into EM will continue this year.

The share of EM-denominated Uridashi bonds has increased steadily from less than 10% in 2006 to 55% in both 2012 and so far in 2013. It is also clear that the growth in EM Uridashi issuance has really come at the expense of DM stalwarts AUD and NZD. The share of these two of total non-JPY Uridashi issuance was 80% in 2006, but has steadily fallen to a low of 34% so far in 2013. This shouldn’t be too surprising, since AUD and NZD interest rates currently stand at historic lows after an aggressive easing cycle.

However, we note that the flood of Japanese money that is expected from a more aggressive QE program by the BOJ has yet to materialize. The weekly Ministry of Finance data show that Japanese investors have sold foreign bonds every week this year, with three exceptions. Two of those were in January. On the institutional side, we note that the benchmark indices that many Japanese institutional investors use give only a small weighting to EM. As such, we would take a cautiously optimistic approach to investment flows going into EM in 2013.

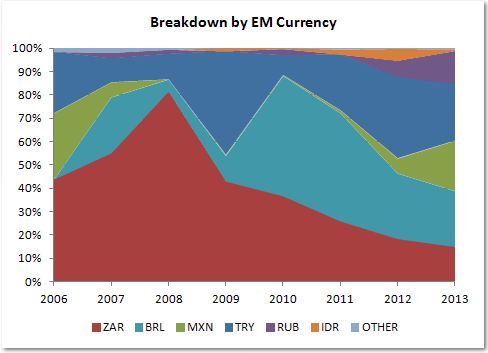

MXN share of total EM Uridashi issuance has risen to nearly 22% in 2013 from an average near 6% from 2006-2012. Banco de Mexico’s 50 bp cut in March is widely seen as “one and done” and so the peso’s yield advantage should remain intact. Coupled with strong fundamentals and little official concern with a strong currency, the peso should continue to outperform within EM.

BRL share of total EM Uridashi issuance is 24% in 2013, down from near 50% in 2010 and 2011 but close to the 2006-2012 average of 24% despite ongoing concerns about FX policy. BRL still retains a fairly big share despite talk that Japan investors have been trying to diversify away from BRL. With Brazil local rates headed higher as the fight against inflation takes shape, BRL should remain attractive provided policymakers try to get back ahead of the curve. We see 100-150 bp of total tightening in this cycle, more likely closer to the lower end of expectations.

ZAR share of total EM Uridashi issuance has fallen to 15% in 2013, down from an average of nearly 44% from 2006-2012. With rates at historically low levels, social turmoil, a very weak fundamental outlook, and risk of credit downgrades, we believe this shift away from the rand is well-deserved. With planned fiscal tightening likely to hurt growth, we think there may be more pressure on SARB to cut rates from an already low 5% in H2 2013 if growth remains sluggish. This would of course narrow the rand's yield advantage.

TRY and RUB shares of total EM Uridashi issuance should continue to rise. So far in 2013, RUB share is near 14% vs. an average of 2% from 2006-2012, while TRY share has risen to 25% this year from an average 23% from 2006-2012. The ruble outlook is a bit more problematic near-term due to commodity market upheaval and the recent slide in oil prices. However, if WTI can stabilize in the $85-90 area, we think the ruble can gain some traction. Near-term, TRY also faces some headwinds from a stagflationary outlook coupled with a widening current account gap, but relatively high rates will likely help support the lira until fundamentals improve.

Taken together, these five EM currencies make up 99% of the EM Uridashi issuance so far in 2013. Indeed, since 2006, these five have never accounted for less than 95% of the total EM Uridashi issuance, and are typically more in the 98-99% range. We stand by our belief that fundamentals will matter more in 2013. Clearly, high yielders like HUF and ZAR are no longer as attractive as they once were due to deteriorating fundamentals.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Japanese Uridashi Issuance

(This Great Graphic and the following analysis is provided by my colleague, Dr. Win Thin. He focuses on Uridashi bond issuance in Japan, which are bonds sold directly to households. The data comes from Bloomberg and the Japan's Ministry of Finance.)

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.