Last Thursday saw a 7% dip for the Nikkei as fears over the Bank of Japan’s ability to take the volatility out of asset moves increased. This morning Europe is waking up to find the Nikkei has, as if by appointment, lost another 5% overnight as similar concerns over volatility and the challenges that the Abe government will face in implementing structural reforms into the Japanese economy – the final step or “3rd arrow” of the Abe plan.

Despite this European markets look to be opening in a fairly sleepy fashion ahead of a run of important data points.

Yesterday’s publicised shift away from austerity in Europe, and endorsed by yesterday’s OECD reports, designed to promote employment, although further work will need to be done given the poor employment numbers out of Germany this morning. Unemployment rose by 21,000 against a 5,000 estimate. However, the unemployment rate remained at 6.9%, only slightly above a 20yr low. If this proves to be the beginning of a trend and not the just a blip then we could easily see further euro losses and pressure on political and economic leaders to help out.

UK data was poor this morning as retail sales fell to a 16 month low. We were surprised to see that the general consensus for this number was to be a move back to positivity given the general onerous nature of the UK economy towards its participants.

Unemployment has remained high while the disparity between wages and prices is hurting those who still have a job as well. Energy and food prices have remained high throughout the spring and unless they fall or wages start to recover the High Street will remain a tough place through the summer.

Yesterday we saw the recent USD strength knocked by an 8.8% fall in mortgage applications; the third consecutive weekly falls. This follows a 31bps increase in the rate of a 30yr fixed mortgage. In fact, treasury yields are moving to their highest level in over a year across the board at the moment; something that will only increase if the Fed tapers purchases sooner rather than later.

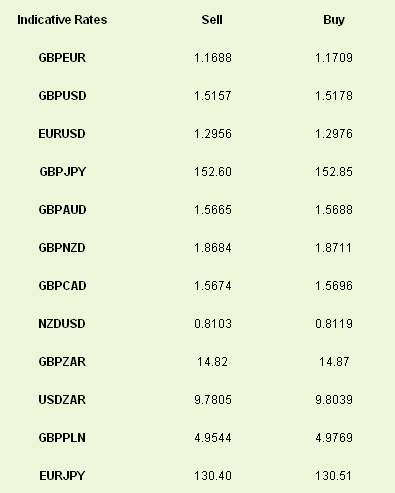

The news has rescued GBPUSD and EURUSD in the short term but they still look vulnerable.

This week has been all about consumer confidence and we receive the European version this morning. Things are expected to improve from the dire levels they occupy at the moment but not by any meaningful amount. Spanish GDP is also expected to remain at -0.5% for Q1.

The key release today, however, is the latest revision to US GDP for Q1 that should remain at 2.5%.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Japanese Issues Swarm Through Asian Markets

Published 05/30/2013, 06:42 AM

Updated 07/09/2023, 06:31 AM

Japanese Issues Swarm Through Asian Markets

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.