The day starts out rather quiet on Tuesday, although there is the Chinese New Yuan Loans number initially. This will necessarily move the entirety of the market in and of itself, but can give you a bit of a heads up on whether or not we will be “risk on”, or “risk off.”

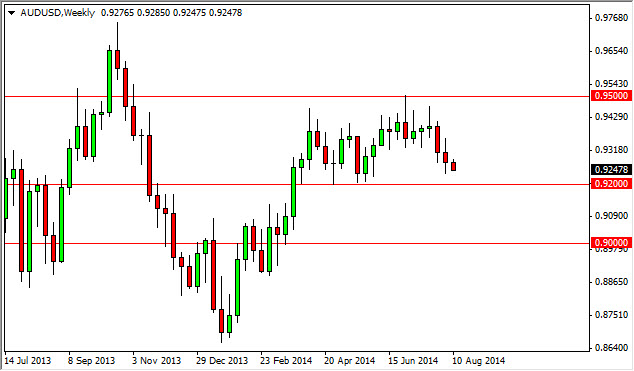

Without a doubt, the easiest way to play the Chinese economy is the AUD/USD pair, as Australia provides China with much of its raw materials and when China is expanding rapidly, they come in and buy quite a bit out of Australia. This creates demand for the Aussie dollar, and as a result the market could start buying that currency. The 0.9250 level has been supportive, and we think it expands all the way down to the 0.92 level. The 0.9350 above is the target on good news. A break below the 0.92 level sends the market down to 0.90 eventually.

Japanese Industrial Production comes out during the day as well, which could move the USD/JPY pair, but ultimately is probably a minor number considering the fact that the Japanese GDP numbers come out. This will be the biggest announcement for the session as far as we see, as it will set focus on the USD/JPY pair as it is actually in the middle of the consolidation area, hugging the 102 level. On a move above 102.30, more than likely this pair should go to the 103 handle. Selling really isn’t something that we like, only because her so much in the way of noise below. The easiest way to trade that pair if it falls is to simply look for support below in order to start buying perhaps in a day or two.

The S&P 500, NASDAQ, and Dow Jones Industrial Average all printed shooting stars for the day, and as a result it’s very likely that we will see a bit of selling in the American indices. However, we do not expect any type of major breakdown, rather just a return to a bit of consolidation as the markets continue to build up momentum to the upside. On the other hand, if the S&P breaks above the 1945 level, we would be breaking above the top of the shooting star, and that of course would be a very bullish sign.