1. USD/CAD

As we can see in the H4 chart, USD/CAD continues updating its lows and forming reversal patterns. Right now, the pair is forming a pullback after completing a "Hammer pattern". Taking into account a stable descending tendency, the price is expected to correct towards 1.3280. Most likely, the asset will rebound from the resistance level and resume trading downwards to update the lows again. In this case, the downside target is at 1.3115.

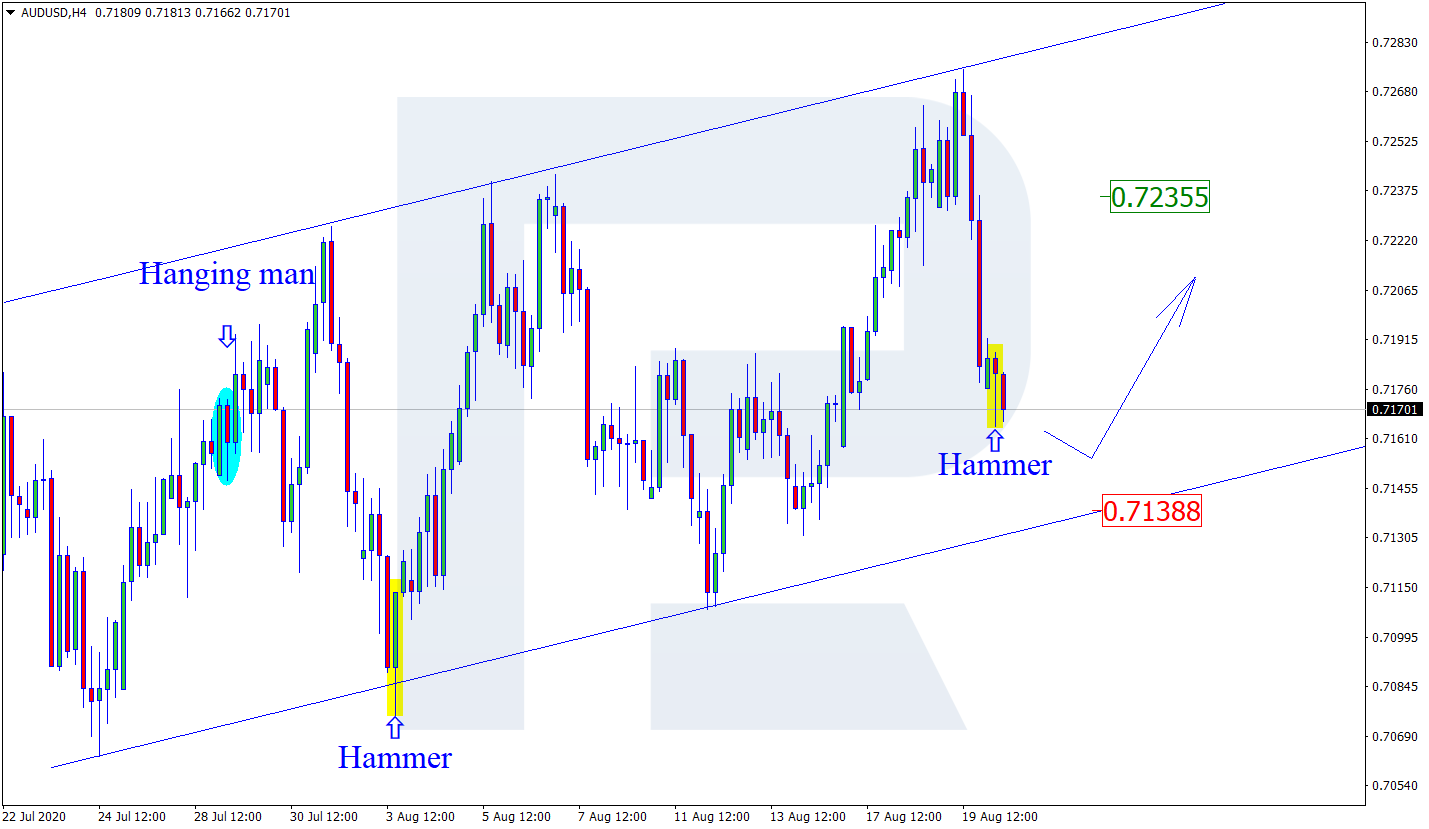

2. AUD/USD

As we can see in the H4 chart, the asset continues correcting within the uptrend. By now, AUD/USD has formed another "Hammer" pattern. However, considering that the pattern was formed in the middle of the rising channel, the pair is not expected to reverse. Most likely, the price will continue trading downwards. The downside target may be the rising channel’s downside border at 0.7138. Later, the price may rebound from the support level and resume the rising tendency. In this case, the upside target will be at 0.7235.

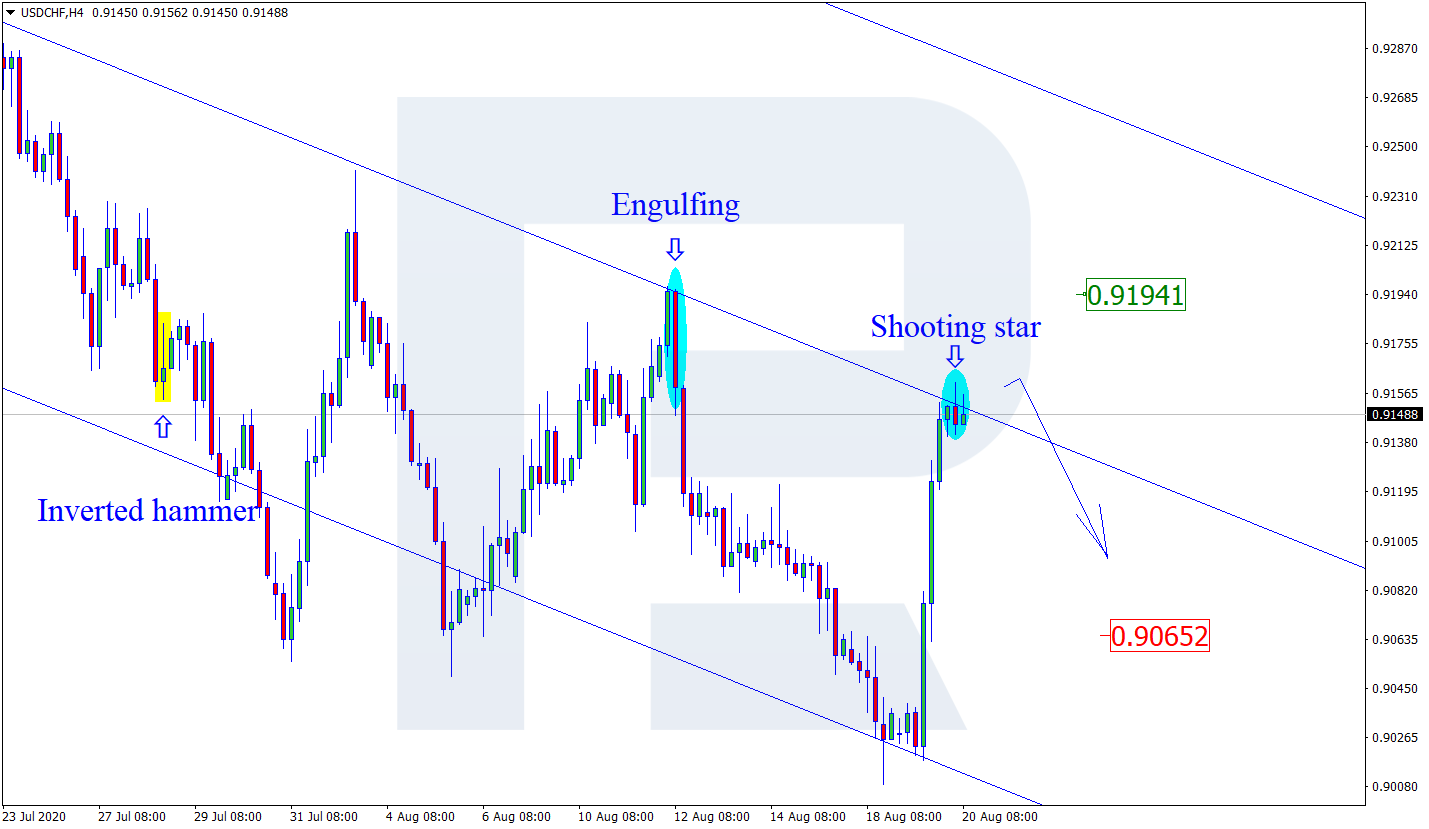

3. USD/CHF

As we can see in the H4 chart, after rebounding from the support area, USD/CHF has formed several reversal patterns, including "Shooting Star", not far from the descending channel’s upside border. The downside target is at 0.9065. Still, there might be an alternative scenario, according to which the asset may grow towards 0.9194 before resuming the downtrend.

Disclaimer: Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.