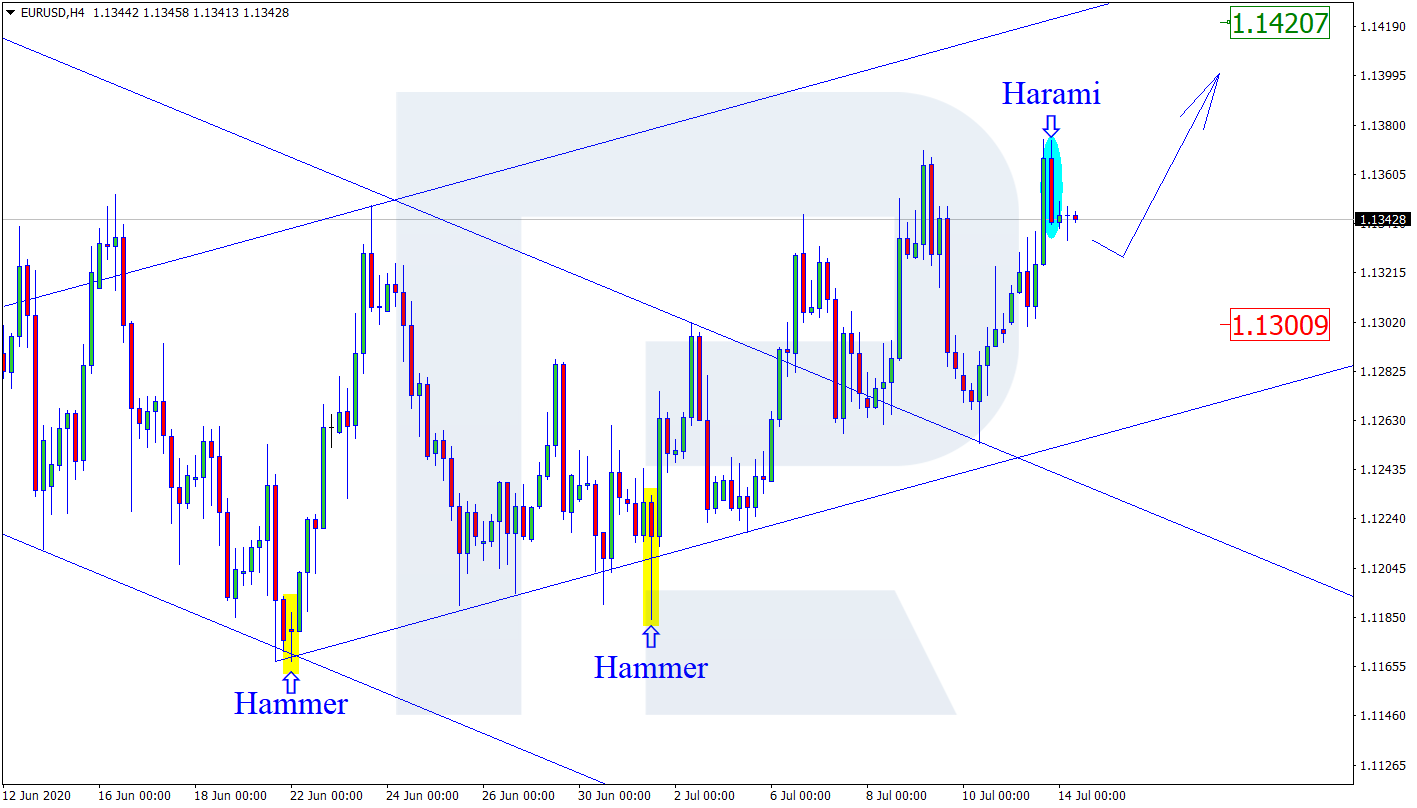

EUR/USD

As we can see in the H4 chart, the pair is still forming the ascending channel. After forming a "Harami" pattern, EUR/USD is reversing. Considering the current bullish dynamics, the price may finish the correction and then resume trading upwards to reach the resistance level at 1.1420. At the same time, an alternative scenario implies that the instrument may continue falling to return to 1.1300.

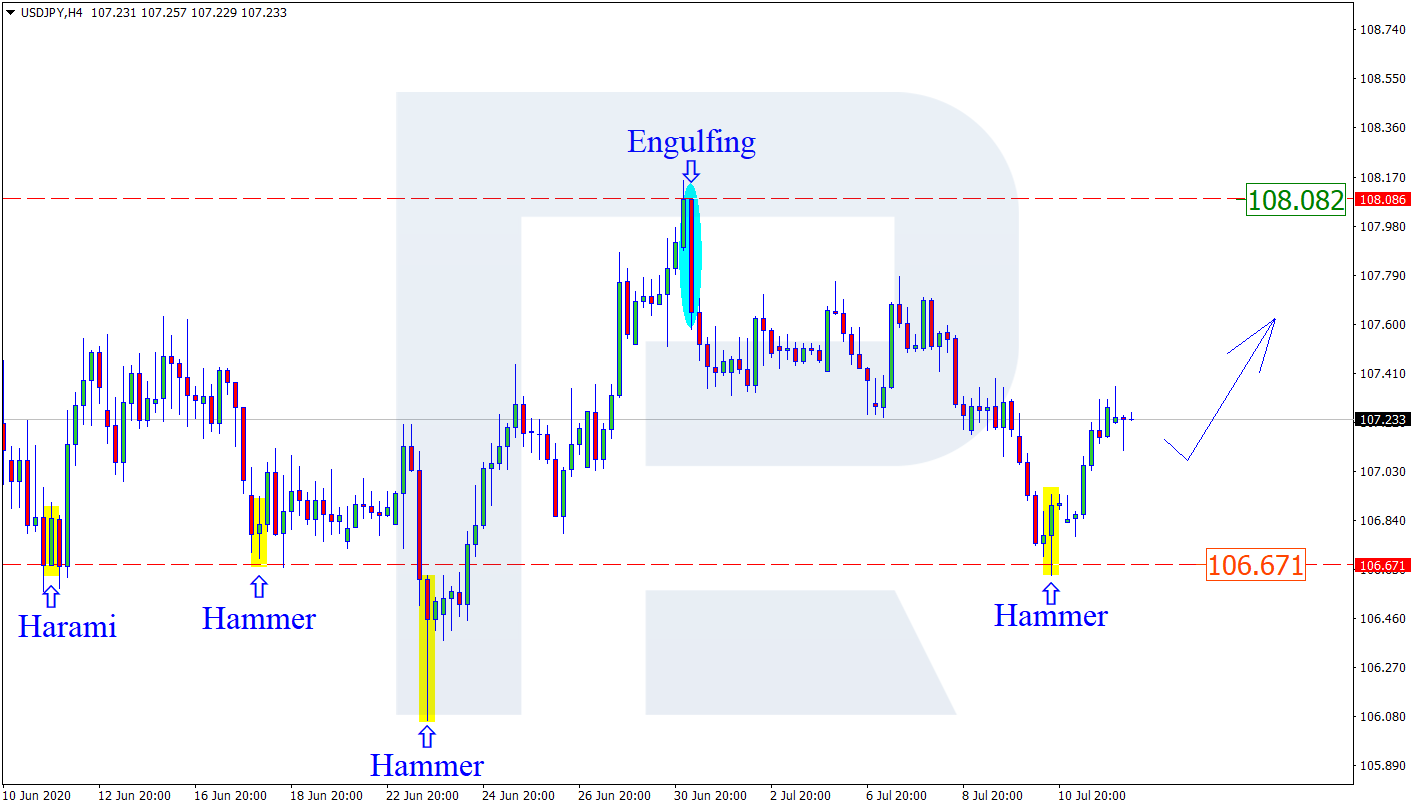

USD/JPY

As we can see in the H4 chart, after forming a "Hammer" pattern not far from the support area, USD/JPY has started reversing. At the moment, the pair is moving upwards. The current situation implies that after a slight correction the market may resume the ascending tendency towards the resistance level at 108.08. Still, there is an opposite scenario, which says that the instrument may fall and return to 106.67.

EUR/GBP

As we can see in the H4 chart, the pair is moving inside the rising channel again. By now, EUR/GBP has completed a "Harami" pattern, which may signal a new correction. After the correction, the price may resume moving to reach its upside target at 0.9120. In the future, the instrument may continue trading upwards to update the highs. However, there might be another scenario, according to which the asset may correct towards the support level at 0.8989.

Disclaimer: Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.