Strong portfolio and market outlook

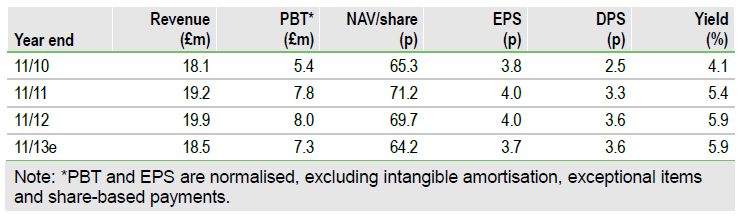

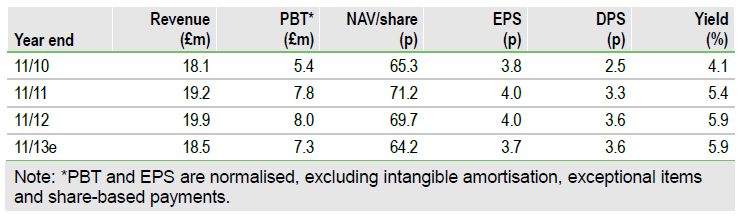

A strong FY12 portfolio performance was backed by improving market fundamentals. Average portfolio occupancy was 95.2% (FY11: 94.9%) and there was 2.6% growth in like-for-like asset values (FY11:0.1% growth). Japan’s economic stimulus package, which includes monetary easing and a 2% inflation target has spurred investor interest in real estate as a traditional inflation hedge. Our FY13e forecasts incorporate underlying Yen net profit growth this year due to a full year contribution from an asset acquired in June at a 5.6% net initial rental yield, funded by debt (60% LTV) at just 1.03% pa. In sterling terms we expect 3.7p/share FY13e earnings to cover a flat FY13 dividend. That puts Japan Residential Investment Company (JRIC) on a prospective 5.9% yield. The fund’s continuation vote is due later this year.

Growth prospects underpinned by improving market

JRIC’s portfolio benefits from household formation running ahead of new supply. That drives high occupancy rates and asset values. Banks are ready to refinance debt at lower cost; new facilities secured in June 2013 are at 1.03% (floating rate), vs 2.31% on debt maturing before the end of 2014. That compares well with the 6.0% pa net portfolio rental yield in FY12 (net rent/average investment portfolio).

Sensitivities: Yen weakness dampens sterling EPS

The economic stimulus package has resulted in a weaker Yen, which dampens sterling EPS and dividend cover. We assume 9% lower average JPY/GBP y-o-y for FY13. JRIC seeks to enhance EPS via portfolio growth, better asset performance and finer debt terms. With an active investment market and renewed bank appetite for property lending, management believes the timing is right for a more assertive investment approach, add new assets and dispose of non-core properties which have achieved full performance. The manager’s indicative investment pipeline is equivalent to 37% of our 2013 net rental forecast.

Valuation: 5.9% yield, 5% discount to FY13e NAV

The outlook for underlying earnings and capital value growth is supported by portfolio profile and improving investment backdrop. We assume a flat dividend this year, a 5.9% yield, as sterling EPS would be negatively affected if current Yen weakness is sustained. Underlying earnings will however benefit from a full year of an acquisition and lower cost debt refinanced in FY12; other facilities due this year should also contribute positively to EPS. The shares are at a 13% discount to 69.7p FY12 NAV/share; 5% below our 64.2p FY13e forecast.

To Read the Entire Report Please Click on the pdf File Below.

A strong FY12 portfolio performance was backed by improving market fundamentals. Average portfolio occupancy was 95.2% (FY11: 94.9%) and there was 2.6% growth in like-for-like asset values (FY11:0.1% growth). Japan’s economic stimulus package, which includes monetary easing and a 2% inflation target has spurred investor interest in real estate as a traditional inflation hedge. Our FY13e forecasts incorporate underlying Yen net profit growth this year due to a full year contribution from an asset acquired in June at a 5.6% net initial rental yield, funded by debt (60% LTV) at just 1.03% pa. In sterling terms we expect 3.7p/share FY13e earnings to cover a flat FY13 dividend. That puts Japan Residential Investment Company (JRIC) on a prospective 5.9% yield. The fund’s continuation vote is due later this year.

Growth prospects underpinned by improving market

JRIC’s portfolio benefits from household formation running ahead of new supply. That drives high occupancy rates and asset values. Banks are ready to refinance debt at lower cost; new facilities secured in June 2013 are at 1.03% (floating rate), vs 2.31% on debt maturing before the end of 2014. That compares well with the 6.0% pa net portfolio rental yield in FY12 (net rent/average investment portfolio).

Sensitivities: Yen weakness dampens sterling EPS

The economic stimulus package has resulted in a weaker Yen, which dampens sterling EPS and dividend cover. We assume 9% lower average JPY/GBP y-o-y for FY13. JRIC seeks to enhance EPS via portfolio growth, better asset performance and finer debt terms. With an active investment market and renewed bank appetite for property lending, management believes the timing is right for a more assertive investment approach, add new assets and dispose of non-core properties which have achieved full performance. The manager’s indicative investment pipeline is equivalent to 37% of our 2013 net rental forecast.

Valuation: 5.9% yield, 5% discount to FY13e NAV

The outlook for underlying earnings and capital value growth is supported by portfolio profile and improving investment backdrop. We assume a flat dividend this year, a 5.9% yield, as sterling EPS would be negatively affected if current Yen weakness is sustained. Underlying earnings will however benefit from a full year of an acquisition and lower cost debt refinanced in FY12; other facilities due this year should also contribute positively to EPS. The shares are at a 13% discount to 69.7p FY12 NAV/share; 5% below our 64.2p FY13e forecast.

To Read the Entire Report Please Click on the pdf File Below.