Sustainable yield and NAV upside

Solid interims reflected continued steady portfolio occupancy. Having stabilised portfolio performance, we see the fund entering a new phase as it seeks to capitalise upon a recovering market via active management of its assets, selective disposals and acquisitions. In June it added its first new asset since 2008 on EPS accretive terms, backed by bank debt at a cost well under initial yields on residential property.

Interim results: Benefit of yen strength and portfolio stability

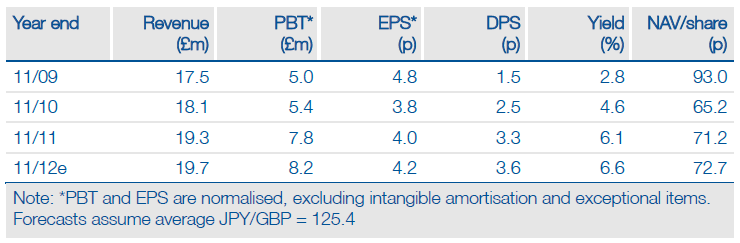

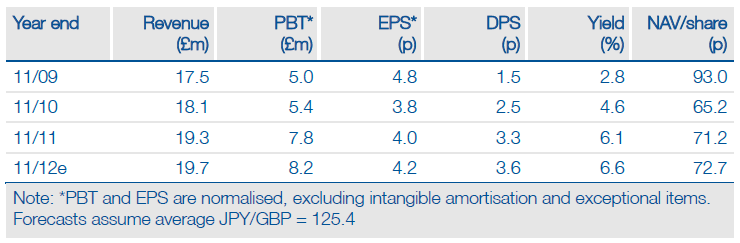

Occupancy and rental income was broadly stable in the first half; average occupancy was 95.2% vs 95.5% in H1 FY11. JPY/GBP appreciation drove stronger sterling performance y-o-y, with gross rent up 4.8% and underlying operating profit by 2% y-o-y to £5.7m. Interim pre-tax profit, at £4.4m was 4.4% ahead although EPS fell 7% to 2.2p, due to a higher £0.238m tax charge as carried forward tax losses are progressively being consumed by cumulative profits at the portfolio level. Although rents edged down 0.7% in local currency terms and underlying PBT by c 3% due to operational and financial costs, the interim dividend was fully covered and the earnings outlook underpinned by an EPS accretive acquisition in the first half.

72.3p NAV/share at end May 2011, 12% ahead y-o-y

The components of a 1.1p increase in sterling NAV/share in the period were underlying profit (2p/share), forex gains (0.7p) and a £0.26m (0.2p) unrealised increase in the portfolio valuation, the third consecutive six month period of positive growth. These were offset by a 20% increase in the interim dividend to 1.8p/share. Aggregate portfolio loan to value was 52% at the half year. There is appetite to recycle capital, selectively dispose of non-core, possibly mature assets and redeploy the proceeds in new residential apartments, to improve average portfolio and earnings quality.

Valuation: Attractive rating and growth outlook

The shares provide an attractive combination of a 25% NAV discount and 6.6% prospective yield, with dividends covered by cash earnings from stable revenues. We see that as undervalued relative to the existing portfolio and market outlook, with investment yields falling since 2009 and rents levelling off. The portfolio is located in Asia’s largest real estate market and Japanese residential asset prices are attractive relative to historic measures of affordability and international comparatives. As opportunities arise, a robust domestic credit market in which banks are willing to lend should provide JRIC with access to debt on terms that provide further opportunities to invest on earnings and cash flow accretive terms, due to the sizeable spread between initial cash yields and financing costs.

To Read the Entire Report Please Click on the pdf File Below.

Solid interims reflected continued steady portfolio occupancy. Having stabilised portfolio performance, we see the fund entering a new phase as it seeks to capitalise upon a recovering market via active management of its assets, selective disposals and acquisitions. In June it added its first new asset since 2008 on EPS accretive terms, backed by bank debt at a cost well under initial yields on residential property.

Interim results: Benefit of yen strength and portfolio stability

Occupancy and rental income was broadly stable in the first half; average occupancy was 95.2% vs 95.5% in H1 FY11. JPY/GBP appreciation drove stronger sterling performance y-o-y, with gross rent up 4.8% and underlying operating profit by 2% y-o-y to £5.7m. Interim pre-tax profit, at £4.4m was 4.4% ahead although EPS fell 7% to 2.2p, due to a higher £0.238m tax charge as carried forward tax losses are progressively being consumed by cumulative profits at the portfolio level. Although rents edged down 0.7% in local currency terms and underlying PBT by c 3% due to operational and financial costs, the interim dividend was fully covered and the earnings outlook underpinned by an EPS accretive acquisition in the first half.

72.3p NAV/share at end May 2011, 12% ahead y-o-y

The components of a 1.1p increase in sterling NAV/share in the period were underlying profit (2p/share), forex gains (0.7p) and a £0.26m (0.2p) unrealised increase in the portfolio valuation, the third consecutive six month period of positive growth. These were offset by a 20% increase in the interim dividend to 1.8p/share. Aggregate portfolio loan to value was 52% at the half year. There is appetite to recycle capital, selectively dispose of non-core, possibly mature assets and redeploy the proceeds in new residential apartments, to improve average portfolio and earnings quality.

Valuation: Attractive rating and growth outlook

The shares provide an attractive combination of a 25% NAV discount and 6.6% prospective yield, with dividends covered by cash earnings from stable revenues. We see that as undervalued relative to the existing portfolio and market outlook, with investment yields falling since 2009 and rents levelling off. The portfolio is located in Asia’s largest real estate market and Japanese residential asset prices are attractive relative to historic measures of affordability and international comparatives. As opportunities arise, a robust domestic credit market in which banks are willing to lend should provide JRIC with access to debt on terms that provide further opportunities to invest on earnings and cash flow accretive terms, due to the sizeable spread between initial cash yields and financing costs.

To Read the Entire Report Please Click on the pdf File Below.