Economic from Japanese showed the economy pulled out from recession in Q4. GDP grew 0.6% qoq in Q4 but was below expectation of 0.9% qoq. Year-over-year rate was negative for the third consecutive quarter at -0.4%. GDP deflator, nonetheless, grew 2.3% yoy versus expectation of 1.9% yoy. Some economists noted that the growth in household spending was surprisingly weak, at just 0.3% qoq. Growth in capital spending was also weak at 0.1% qoq. However, exports showed health growth of 2.7% yoy. Overall, economists expected that the recent decline in oil prices, and the delay in the second planned sales tax hike would give a lift to the economy for expansion in the year ahead. And there are expectations that Japan will reinflate strongly until 2017. The Japanese yen is mildly softer today but stays in tight range. Also released from Japan, industrial production was finalized at 0.8% mom in December

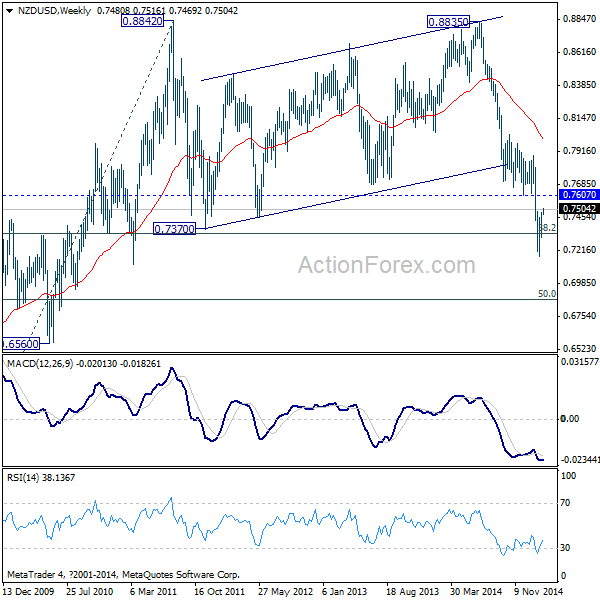

New Zealand dollar started the week strongly. Retail sales showed 1.7% qoq growth in Q4 versus expectation of 1.3% qoq. Recently, RBNZ changed its bias from tightening to neutral and opened up the possibility of cutting rates. But solid economic growth should continue to lower the chance of materializing a cut. NZD/USD had another decline attempt last week but again failed to sustain below 38.2% retracement of 0.4890 to 0.8842 at 0.7332. Focus is back on 0.7607 support turned resistance. Break will indicate near term reversal and bring stronger rebound back to 55 weeks EMA (now at 0.8003).

In Eurozone, finance meetings are meeting in Brussels again for the second time in less than a week on discussion regarding Greece. Prime minister Alexis Tsipras said he was "full off confidence" regarding the negotiations and Greece will be a "completely different country" in six months' time. He emphasized that Greece needs "time" rather than "money" to put into effect the reforms. Greece is seeking a bridge program to be put in place for a few months before a new bailout deal is reached. However, other Eurozone countries, in particular Germany, insisted that Greece must continue with the commitments for the EUR 280b bailout it received.

Elsewhere, UK right move house prices rose 2.1% mom in February. Eurozone will release trade balance today.