After last year's shock, Japan's economic indicators are slowly returning to normal. But conditions are still unsuitable for raising interest rates for the Bank of Japan. This is not good news for the Yen. The interest rate differential, which has risen sharply over the past year, creates the conditions for carry trade. The only obstacle to an active interest rate differential play is the uncertainty surrounding monetary policy due to the change in the central bank governor.

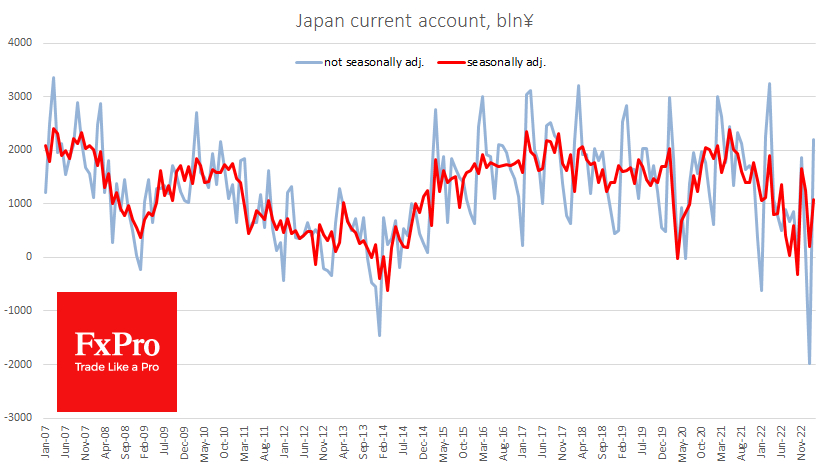

The balance of payments rebounded from last month's record deficit as the February trade deficit fell to its lowest level in 11 months. The balance of payments appears to have turned around. This is supported by lifting China's export restrictions and falling container prices, which should boost demand for goods from Japan.

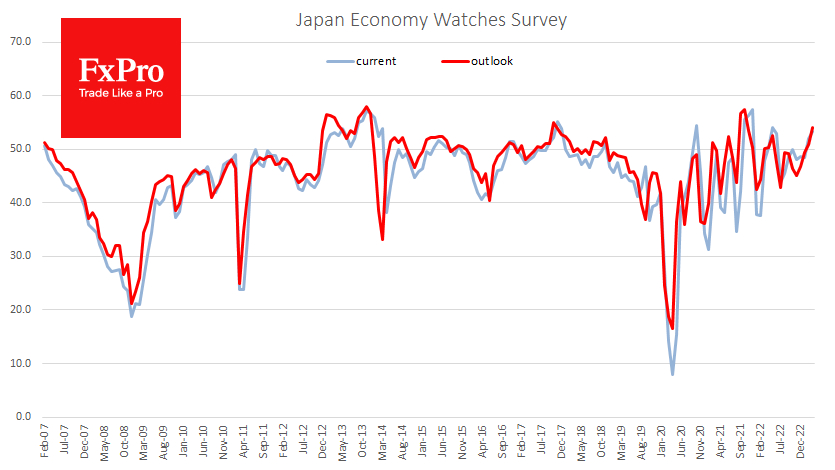

In addition, consumer optimism is on the rise. Household consumer confidence has risen every month since November, from 31.3 to 33.9 in March, the highest level since May last year. The "economy watchers" survey also returned to last year's highs in current conditions and was at its highest level since October 2021 in terms of forecasts.

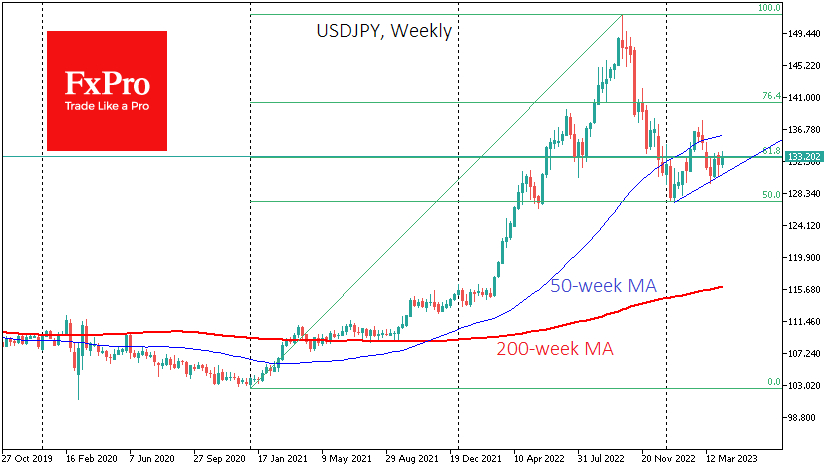

A key driver of the Yen's appreciation in recent months has been speculation about a change in monetary policy. Expectations have grown that Kuroda's resignation as governor of the Bank of Japan would trigger a tightening of monetary policy. But so far, there has been no real change or even a hint in that direction from the new BoJ governor, who formally took office on 9 April. His latest speech signalled that he would continue to ease policy.

He has not been seen as a proponent of tightening policy, but a confirmation after his inauguration could potentially trigger a new wave of pressure on the Japanese currency. The USDJPY jumped more than 1% on Monday, taking advantage of the dollar's general bullishness. Today, however, the Yen is in no hurry to regain its losses, as the Pound and Euro are doing. And this may not be the end of the samurai path.

Lower inflation eases the pressure on the BoJ to raise interest rates. The USDJPY's pullback from 151 to 127 corrected 50% of the rally on the monetary policy change and stopped the pair's uncontrolled rise. Technically, the path to the upside for the pair is now clear, but it is difficult to identify a clear technical target for this path. The 140 level could be a medium-term target.

Much more helpful is the dynamics of interest rate expectations. The fundamental pressure on the Yen may continue as long as the spread between the Yen's government bond yields and those of its major rivals widens.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Japan Is Recovering, but What About the Yen?

Published 04/11/2023, 09:01 AM

Updated 03/21/2024, 07:45 AM

Japan Is Recovering, but What About the Yen?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.