Much like the wheat and the chaff have been separated at the World Cup with the knock-out phases beginning on Saturday, we have also seen a couple of quiet weeks of economic data come to an end. There have been some memorable events but next week’s action is where the real action begins.

Yesterday’s markets were a case in point. Traders received yesterday’s PCE inflation numbers at the market’s consensus and gave the USD a nudge higher but all eyes will be focused on next week’s PMIs and ISMs for an up to date view of output, jobs and sectoral confidence. The US’s PCE inflation number met expectations in rising by 1.5% over the course of the past 12 months with consumer spending showing positive but limited gains in the month of May. It is patently obvious that the US consumer is looking for additional improvements in the jobs and wage markets before deciding to outlay more cash.

The Bank of England’s Financial Policy Committee announced their thoughts on possible macro-prudential measures to quell the UK’s housing market this morning. The Bank of England’s plan to to cap mortgages with a 4.5x multiple on salaries and only allowing banks to take on 15% of their loan book in such risky loans are issues to help the financial security of the sector, not the consumer. In the meantime, house prices will charge higher still.

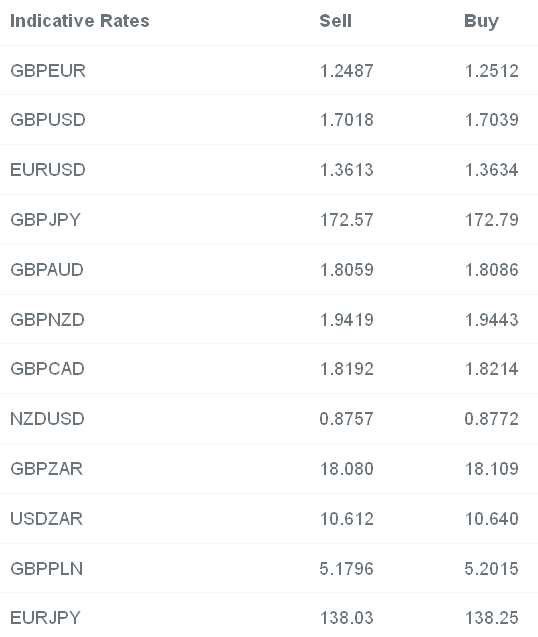

Sterling moved higher on the announcement as the market deemed the measures to be insufficient to help near-term frothiness in housing markets. It naturally follows that the last line of defence in the likely event that these measures fail to help anything, would be an interest rate rise. Overnight GBP/USD has hit 1.7052 and GBP/EUR peaked at 1.2563.

The main news overnight has been a very strong run of Japanese data. CPI, the main inflation measure, has hit the highest level in 32 years with a reading of 3.4%. An increase in utility prices and the recent sales tax rise has boosted inflation dramatically – currently running at 3.4%, highest since 1982 – but should we see limited wage growth it will not last long. The key will be whether companies drive wages higher from cash piles that have been built up in the past few years. Wages were lower in April for the 23rd month in a row.

In the short-term the higher inflation and time needed to see output effects of both fiscal and monetary policy effects will keep the Bank of Japan on the sidelines and the Yen supported as a result. It obviously stands to benefit from negative moves in US data and yields and/or geopolitical risks from the Middle East on a haven basis as well.

Today’s markets will focus on the final iterations of French and UK GDP for Q1 and updated German inflation numbers. French GDP stagnated in Q1 it has been confirmed this morning with household consumption down 0.5% on the quarter and capital investment down 0.8%. Q2 prospects are not looking much better. UK GDP has the very real chance of being revised higher this morning following strong March surveys in construction and services output. We think that GDP will move to 0.9% on the quarter – a far cry from the numbers seen in France, Germany or the US.

German inflation at 13.00 is expected to bounce back from last month’s 0.1% decline on a month-by-month scale. The longer term weakness however is far from a bounce back and next week’s Eurozone wide figure will continue recent trends of disinflation and stagnant pricing.