- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Japan Faces The Pressure

Many market watchers were disappointed by today’s result which presents an unmitigated challenge for the government of Shinzo Abe. Manufacturing and Industrial production both produced weaker than expected results. The Manufacturing PMI came in at 49.4 compared to last month's 53.9. It was forecast to be around 53.0 so this will hurt Japanese confidence in the key sector as the contraction was not expected, with the last contraction occuring back in March 2013 for the manufacturing sector.

Source: Bloomberg (Japan Manufacturing PMI m/m)

Industrial production was also much weaker than expected. After last month’s shocking result which was a final reading of -2.3%, markets were hoping to find some composure in the Japanese economy. Today’s reading disappointed many as it came in at 0.3%, missing the forecast of 0.5%. Historically,preliminary data has been more optimistic when it comes to positive rises and more negative when it has come to negative drops. In the case of being localised around 0.3%, we generally don’t see much movement away from this and the band is fairly tight. So final industrial production will likely be very close to the 0.3%, if not coming in at 0.3%

Source: Blackwell Research & Bloomberg ( Last 12 months data: Prelim = Red, Final = Blue)

It’s not alldoom and gloom though, as Industrial production y/y for March came in at 7.0%, a strong result, but now markets are pricing in weaker industrial growth with the months ahead, looking much worse as Japanese manufacturers are expecting -1.4% for April m/m and a May output of only 0.1% m/m.

Source: Bloomberg (Industrial Production y/y)

Many will regard this as rather serious for Japan but it shouldn’t come as a surprise. The Yen’s rapid devaluation and the Japanese earthquakeled to a boom in industrial production. It looks likely that in order to stimulate growth, Japan may need to do more and that is exactly what markets are hoping for in the coming months.

The reality, though, might be a bit hard to stomach. I expect that we may see a change in heart from Japan with regards to further devaluation, but so far Kuroda has said no to further quantitative easing and inflation is close to the current target that the BoJ set. Even so, it's likely that the inflation is artificial when you factor in the rapid devaluation of the Yen relative to fuel prices which have been in high demand since the turning off of nuclear power after the Fukushima disaster.

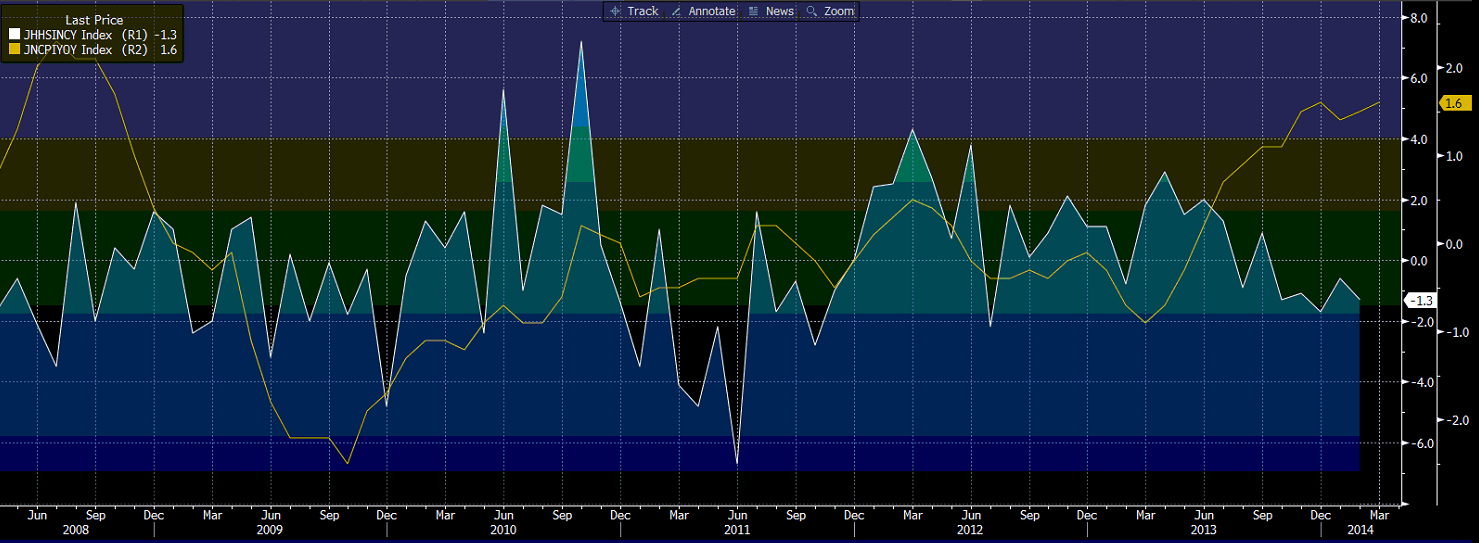

But the problem with higher inflation leads to negative effects when we look at average base wages which have fallen to -0.4% y/y. This is the 22ndstraight drop and one that should paint a worrying picture when you’re trying to stoke inflation, but real wages are falling and things might not be working as planned. The effect in Japan so far has been muted and I imagine the wealth effect from a strong sharemarket might actually make many believe they are better off in the current situation. The graph below certainly paints a different picture over all when we compare household wages to current inflation.

Source: Bloomberg (Japan household wages y/y compared to Japan CPI y/y)

Despite all of this information, people still believe that the Yen is in a stable place but long term-wise, these things add up and will have an impact on the Japanese economy as a whole. The main scapegoat so far seems to be the sales tax put in place in April and it will take some time to measure the impact. Whether Kuroda wants to impart more stimulus on the economy or not will certainly be interesting and I believe he will be left with little choice other than to act. It’s just a matter of time and it’s likely we will see action from the hawkish governor before the year is out, and in the event of that, a USDJPY of 110 might be the future.

Related Articles

The US dollar has come under some pressure on the back of the rerating of the US growth outlook and expectations that the Russia-Ukraine conflict is nearing an end. However, we...

The Swiss franc is down for a second straight trading day. In the European session, USD/CHF is trading at 0.8980, up 0.38% on the day. Switzerland’s GDP Eases to 0.2% The Swiss...

USD/JPY is consolidating near 149.33 on Wednesday, with the yen pausing its rally while holding near four-month highs against the USD. This stabilisation follows renewed support...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.