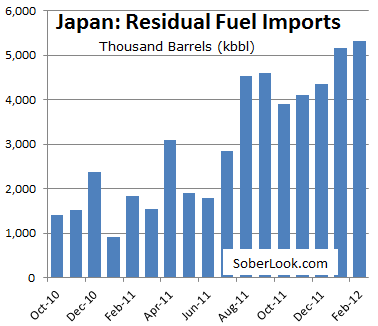

As predicted earlier this year, Japan continues to struggle with its energy needs. The chart below shows the recent trend in Japan's imports of residual fuel oil. Residual fuel is used for electricity generation, industrial process and space heating, as well as fuel for large ships. Japan had always bought some fuel oil for shipping and certain industrial processes, but nuclear generators had in the past been the dominant source of electricity. Now the source of power has been replaced by expensive fuel oil.

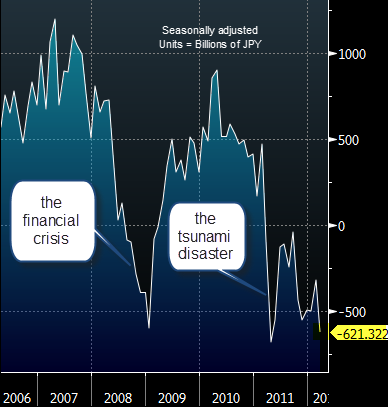

These fuel imports are quickly translating into a rising trade deficit.

AP/WP: Disaster-battered Japan reported its biggest annual trade deficit ever Thursday, a contrast from decades of surpluses, as a nuclear crisis boosted expensive oil and gas imports.

The Finance Ministry’s preliminary trade data showed a 4.41 trillion yen ($54 billion) trade deficit for the fiscal year that ended March 31.

The chart below shows Japan Merchandise Trade Balance (seasonally adjusted) from the Ministry of Finance. This is not the full trade deficit, but is a strong indicator of trade flows.

AP/WP: All but one of Japan’s 54 nuclear power reactors are offline in the aftermath of a nuclear crisis set off in March 2011 by the tsunami in northeastern Japan. That has forced Japan to rely on oil and gas-fired generation to supply electricity.

Although the central government, eager to restart some of the reactors, has been carrying out safety tests on the nuclear plants, local officials have been wary of giving a go-ahead.

The earthquake and tsunami also hurt manufacturing, not only in northeastern Japan but for those companies that had counted on supplies from that area. Exports for the fiscal year dropped 3.7 percent from the previous year, while imports climbed 11.6 percent, according to the Finance Ministry.

The ministry said comparable trade data go back to fiscal 1979, but the latest deficit number was also bigger than those dating back to the Meiji period, starting in 1868.

Japanese companies have also been gradually moving production overseas to curb damage from the strong yen, which erodes the value of export earnings.

Analysts say that if expensive fuel imports continue, Japanese consumers will likely foot higher utility bills, and that could dampen consumer spending, further hurting the economy.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Japan's Fuel Imports Driving Up Trade Deficit To Highest On Record

Published 04/26/2012, 01:51 AM

Updated 07/09/2023, 06:31 AM

Japan's Fuel Imports Driving Up Trade Deficit To Highest On Record

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.